Biotech Stock Roundup: BLUE Announces Q4 Results, ONCT, ASND & RNA Fall on Updates

The biotech sector has been in focus in the past week with key pipeline and regulatory updates. Among these, bluebird’s BLUE downward trend continued after it reported fourth-quarter results and provided pipeline updates.

Recap of the Week’s Most Important Stories:

bluebird Down on Study Updates, Q4 Results: Shares of bluebird bio, Inc. BLUE have been on the downhill after the company provided updates on the biologics license application (BLA) submission for experimental gene therapy lovo-cel for sickle cell disease (SCD) concurrent with the fourth-quarter results on Mar 29, 2023.

In early March, BLUE responded to feedback from the FDA on vector and drug product analytical comparability evaluations completed in December 2022 and submitted additional information related to CMC comparability analyses. The company now states that it expects a response from the FDA within a matter of weeks and will expedite its BLA submission, pending alignment with the FDA on product comparability. The company earlier stated that it will submit the BLA in the first quarter. The delay in BLA submission disappointed investors and shares declined.

Concurrently, bluebird reported fourth-quarter revenues of $0.06 million compared with $1.6 million in the year-ago quarter. Revenues missed the Zacks Consensus Estimate of $102 million. bluebird anticipates reporting commercial revenues in the first quarter of 2023. The company reported earnings of 38 cents per share against a loss of $1.83 in the year-ago quarter.

bluebird currently has a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Oncternal Down on Strategic Reprioritization Update: Shares of clinical-stage biopharmaceutical company Oncternal Therapeutics, Inc. ONCT plunged after it announced a strategic reorganization to extend its cash runway. The reprioritization was undertaken on account of the rapidly changing commercial landscape for Bruton’s tyrosine kinase inhibitors (BTK inhibitors). Consequently, the company shelved the phase III and phase I/II study of zilovertamab in combination with Imbruvica.

This includes closing two studies of zilovertamab in combination with Imbruvica, the ongoing phase I/II study CIRM-0001 and the phase III study ZILO-301, a global registrational study in patients with relapsed/refractory mantle cell lymphoma (MCL). In addition, the company is looking for partnerships and collaborations for executing future late-stage clinical trials of zilovertamab. Other projects and indirect expenses will also be reduced, which is estimated to extend the expected cash runway into 2025. The projected cash runway will support the advancement of two pipeline candidates, ONCT-808 and ONCT-534.

Management estimates that its cash, cash equivalents and short-term investments balance was $54.3 million at the end of the first quarter. It had 58.7 million shares of common stock outstanding as of Mar 31, 2023, and expects the cash balance to support planned operations into 2025.

Avidity Down on Study Update: Shares of Avidity Biosciences, Inc. RNA crashed after the company provided an update on phase I/II MARINA study of AOC 1001 in adults with myotonic dystrophy type 1 (DM1). In September 2022, the FDA placed a partial clinical hold on new participant enrollment in the MARINA study after reviewing the information provided by Avidity related to a serious adverse event reported in a single participant in the 4 mg/kg cohort of the MARINA study. A thorough analysis was conducted by the company in consultation with multiple independent experts. Avidity concluded that the participant most likely experienced an extremely rare neurological event comprising bilateral ischemia in the region of the lateral geniculate nuclei in the thalamus with subsequent hemorrhagic transformation. Avidity could not identify a plausible biological link to any component of AOC 1001, the AOC platform, the transferrin receptor delivery mechanism or the reduction of DMPK.

Management stated that discussions are ongoing with FDA regarding the partial clinical hold on new participant enrolment as Avidity continues to provide new AOC 1001 data as it emerges from the MARINA trial. Data from the preliminary assessment of AOC 1001 supports that the targeted dose range is between 2 mg/kg and 4 mg/kg. Hence, Avidity is concluding the MARINA trial with the 38 participants enrolled at 1mg/kg, 2mg/kg and 4mg/kg of AOC 1001 and will not move forward with the 8 mg/kg dose of AOC 1001.

Ascendis Down on Regulatory Update: Shares of Ascendis Pharma A/S ASND were down after the company announced that FDA identified deficiencies in the company’s new drug application (NDA) filing seeking approval for TransCon PTH (palopegteriparatide) in hypoparathyroidism. The deficiencies were not disclosed in the letter but the FDA stated that it cannot hold further discussions about labeling and post-marketing requirements/commitments. The FDA also stated that this does not reflect their final regulatory decision on the company’s application. However, this has delayed the potential approval of the candidate just a month before the action date and a subsequent launch. Management also confirmed that no safety signals had been identified in the ongoing clinical studies or the expanded access program (EAP) evaluating TransCon PTH in hypoparathyroidism patients.

Updates From Vertex: Vertex Pharmaceuticals Incorporated VRTX and partner CRISPR Therapeutics completed the submission of the rolling BLAs to the FDA for the investigational treatment exagamglogene autotemcel (exa-cel) for SCD and transfusion-dependent beta thalassemia (TDT). The BLAs include requests for Priority Review, which would shorten the FDA’s review of the application to eight months from the time of submission compared to a standard review timeline of 12 months.

Both companies also entered into a new non-exclusive licensing agreement for the use of CRISPR Therapeutics’ gene editing technology, known as CRISPR/Cas9, to accelerate the development of Vertex’s hypoimmune cell therapies for type 1 diabetes (T1D).

Performance

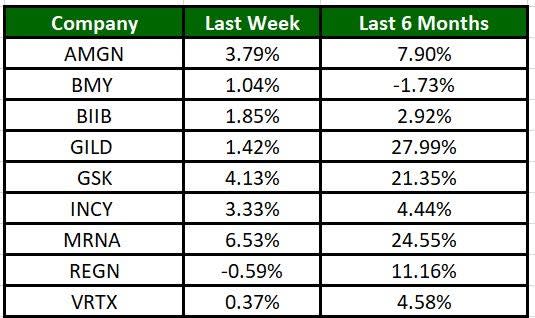

The Nasdaq Biotechnology Index has gained 1.78% in the past five trading sessions. Among the biotech giants, Moderna has jumped 6.53% during the period. Over the past six months, shares of Gilead have soared 27.99%. (See the last biotech stock roundup here: Biotech Stock Roundup: VKTX, BMEA, ITCI Soar on Study Data, INCY Faces Setback)

Image Source: Zacks Investment Research

What's Next in Biotech?

Stay tuned for other updates.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Vertex Pharmaceuticals Incorporated (VRTX) : Free Stock Analysis Report

Avidity Biosciences, Inc. (RNA) : Free Stock Analysis Report

bluebird bio, Inc. (BLUE) : Free Stock Analysis Report

Ascendis Pharma A/S (ASND) : Free Stock Analysis Report

Oncternal Therapeutics, Inc. (ONCT) : Free Stock Analysis Report