Biotech Stock Roundup: BMY Grabs MRTX, AKRO Down on Study Data, ALNY Faces Setback

It was a busy week for the biotech sector. M&A is back in the spotlight in the sector as Bristol Myers BMY announces that it will acquire Mirati Therapeutics, Inc. MRTX. Pipeline and regulatory updates from Akero Therapeutics AKRO and Alnylam Pharmaceuticals, Inc. ALNY were also in focus.

Recap of the Week’s Most Important Stories:

Bristol Myers to Acquire Mirati: Biotech giant Bristol Myers announced that it will acquire commercial-stage oncology company Mirati Therapeutics for $58.00 per share in cash, amounting to a total equity value of $4.8 billion. In addition to cash, each Mirati stockholder will receive one non-tradeable Contingent Value Right (CVR) for each share held. This, in turn, will entitle its holder to receive a one-time potential payment of $12.00 in cash, for a total value of approximately $1.0 billion. The payment is contingent upon a potential FDA acceptance of a new drug application for MRTX1719 for the treatment of either locally advanced or metastatic non-small cell lung cancer (NSCLC) in patients who have received no more than two prior lines of systemic therapy within seven years after the closing of the merger.

The transaction is expected to dilute Bristol Myers’ bottom line (non-GAAP) by approximately 35 cents per share in the first 12 months after closing.

BMY is looking to offset its declining revenues from the blockbuster multiple myeloma drug Revlimid and blood thinner medicine Eliquis due to generic competition. The acquisition will add Mirati’s lung cancer drug Krazati (adagrasib) to BMY’s strong oncology portfolio. Bristol Myers will also get access to early-stage candidate MRTX1719, a potential first-in-class MTA-cooperative PRMT5 inhibitor which is currently in phase I development.

Other promising pipeline candidates in Mirati’s pipeline include MRTX1133 and MRTX0902. MRTX1133 targets the KRAS mutation, which is implicated in key tumor types such as pancreatic cancer, NSCLC and colorectal cancer. MRTX0902 is a SOS1 inhibitor in phase I development with the potential for combination use with other agents targeting the MAPK/RAS pathway, including Krazati.

Mirati has been in the spotlight of late as a potential acquisition candidate. Its shares fell on the news as investors weren’t most likely impressed by the price offered. Last week, shares of Mirati surged on a rumored takeover interest by Sanofi.

Mirati currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

uniQure to Cut Jobs: uniQure N.V. QURE announced a strategic reorganization to reduce its operating expenses. The company will discontinue investments in more than half of its research and technology projects, which include AMT-210 for the treatment of Parkinson’s disease and multiple undisclosed programs. Consequently, a research lab in Lexington will be closed, and the company plans to sublease this space. All GMP manufacturing will be consolidated into its Lexington, MA, manufacturing facility and processing and analytical development will be consolidated into its Amsterdam, NL, facility. These will, however, not impact the commercial manufacturing of Hemgenix for CSL Behring.

As a result of the restructuring plan, uniQure will eliminate 114 positions. This reduction represents 28% of the workforce not committed to Hemgenix manufacturing obligations and approximately 20% of the total workforce. The restructuring action is expected to result in cost savings of approximately $180 million over the next three years. Shares of uniQure gained last week on the news.

Management expects that the current balance of cash, cash equivalents and investment securities of $628.6 million as of Jun 30, 2023, (excluding the $100 million milestone payment subsequently received from CSL Behring) should fund operations into the second quarter of 2027. uniQure will prioritize the continued development of AMT-130 in Huntington’s disease and the near-term initiation of clinical trials for AMT-260 in refractory mesial temporal lobe epilepsy, AMT-162 in SOD1- amyotrophic lateral sclerosis and AMT-191 in Fabry disease.

The current chief scientific officer, Ricardo Dolmetsch, will leave the company due to the significant reduction in research activities.

Setback for Alnylam: Alnylam Pharmaceuticals received a setback as the FDA issued a Complete Response Letter (CRL) to the company’s supplemental new drug application (sNDA) for label expansion of patisiran. The sNDA was seeking label expansion of the drug to treat the cardiomyopathy of transthyretin-mediated (ATTR) amyloidosis. The FDA cited insufficient evidence of the clinical meaningfulness of patisiran treatment effects for the cardiomyopathy of ATTR amyloidosis. As a result, the regulatory body could not approve the sNDA in its present form. However, the CRL did not identify any issues with respect to clinical safety, study conduct, drug quality or manufacturing. Shares of Alnylam were down on the same.

Owing to this CRL, Alnylam will not pursue the label expansion of patisiran in the United States any further. Patisiran is currently marketed as Onpattro in the United States and Europe for the treatment of the polyneuropathy of hereditary ATTR amyloidosis in adults. ALNY has further clarified that the CRL does not pertain to, nor impact, the commercial availability of Onpattro in its approved indication.

Akero Down on Study Results: Shares of clinical-stage company Akero Therapeutics, Inc. plummeted earlier in the week after the company announced 36-week analysis data from the ongoing phase IIb SYMMETRY study on its lead candidate efruxifermin (EFX) in patients with compensated cirrhosis (F4) due to non-alcoholic steatohepatitis (NASH).

The study evaluated two doses of EFX — one at a lower dose of 28mg and another at a higher dose of 50 mg. One hundred eighty-two have been randomized to receive once-weekly subcutaneous dosing of 28mg EFX, 50mg EFX, or placebo.

Data from the study showed that 22% of patients receiving a lower dose of EFX and 24% of patients receiving a higher EFX dose experienced at least a one-stage improvement in liver fibrosis without any worsening of NASH. However, this improvement was not statistically significant compared to the 14% in the placebo-treated group. Investors were most likely disappointed with the same.

On a positive note, 4% of patients in each of the EFX-treated groups experienced a three- or two-stage fibrosis improvement without worsening of NASH – from compensated cirrhosis (F4) to F1 or F2, compared with 0% for placebo. More than half of the patients receiving EFX – 63% in the lower dose group and 60% in the higher dose group – experienced NASH resolution compared to 26% of patients on placebo. Statistically significant improvements were observed for both EFX groups in non-invasive markers of liver injury and fibrosis, insulin sensitization and lipoproteins.

Performance

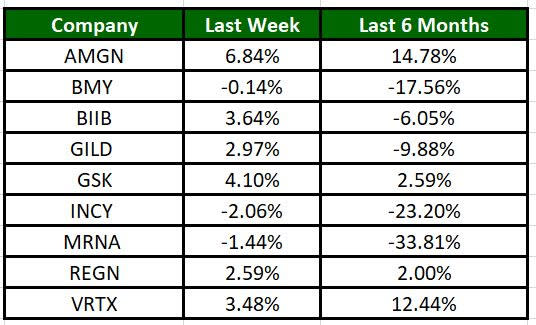

The Nasdaq Biotechnology Index has gained 2.64% in the past five trading sessions. Among the biotech giants, Amgen has gained 6.84% during the period. Over the past six months, shares of Moderna have plunged 33.81%. (See the last biotech stock roundup here: Biotech Stock Roundup: NVAX Up on Updates, ALXO Gains on Study Data & More).

Image Source: Zacks Investment Research

What's Next in Biotech?

Stay tuned for more pipeline updates.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Alnylam Pharmaceuticals, Inc. (ALNY) : Free Stock Analysis Report

Bristol Myers Squibb Company (BMY) : Free Stock Analysis Report

uniQure N.V. (QURE) : Free Stock Analysis Report

Mirati Therapeutics, Inc. (MRTX) : Free Stock Analysis Report

Akero Therapeutics, Inc. (AKRO) : Free Stock Analysis Report