Biotech Stock Roundup: BMY's KRTX and RYZB Acquisition, CYTK Surges on Study Data

It has been an unexpectedly busy week for the biotech sector, despite the holiday season, as the mergers and acquisitions activities heat up. Study read-outs and other news were also in the spotlight. Biotech bigwig Bristol Myers BMY announced two multi-billion buyouts in a week, leading to a massive surge of the companies on the radar.

Recap of the Week’s Most Important Stories:

BMY on Acquisition Spree: Bristol Myers has announced two back-to-back acquisitions in a week as the company looks to expand and strengthen its portfolio in light of generic competition for its two largest drugs.

Earlier in the week, it entered into a definitive merger agreement to acquire clinical-stage radiopharmaceutical therapeutics (RPT) company RayzeBio RYZB for $62.50 per share in cash, amounting to a total equity value of approximately $4.1 billion.

The acquisition will add RayzeBio’s proprietary radiopharmaceutical platform, along with its innovative pipeline of potentially first-in-class actinium-based RPTs, to Bristol Myers’ oncology portfolio.

RayzeBio’s clinical-stage pipeline comprises its lead candidate, RYZ101, targeting somatostatin receptor 2 (SSTR2), which is over-expressed in GEP-NETs and extensive-stage small cell lung cancer (ES-SCLC). RYZ101 is currently being evaluated in a phase III study in patients with SSTR-positive GEP-NETs who have previously been treated with lutetium-177-based somatostatin therapies. Enrollment in the late-stage study is ongoing. A phase Ib clinical trial is also currently enrolling patients to evaluate RYZ101 as a first-line treatment of ES-SCLC in combination with standard-of-care therapy. The addition of these candidates will further diversify Bristol Myers’ oncology pipeline.

Last week, Bristol Myers announced that it will acquire the biopharmaceutical company Karuna Therapeutics, Inc. KRTX for $330.00 per share in cash for a total equity value of $14 billion to strengthen its neuroscience portfolio. The acquisition is expected to close in the first half of 2024, subject to customary closing conditions.

Karuna is focused on developing drugs for psychiatric and neurological conditions. Its lead asset, KarXT (xanomeline-trospium), is an antipsychotic with a novel mechanism of action and differentiated efficacy and safety. The new drug application for KarXT for the treatment of schizophrenia in adults is under review in the United States.

The FDA has set a target action date of Sep 26, 2024. The candidate is expected to be launched in late 2024 upon tentative approval. A registrational clinical trial is currently underway, evaluating KarXT as adjunctive treatment, with the current standard of care agents for the treatment of schizophrenia, with data expected in 2025.

The candidate is also in a registrational trial for the treatment of psychosis in patients with Alzheimer’s disease. Data for the same is expected in 2026. The acquisition will diversify its broad portfolio and enable it to establish a presence in the schizophrenia space, which is challenging but has enormous potential given the lack of treatments.

Shares of RayzeBio and Karuna surged on the acquisition announcements.

Bristol Myers currently has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Cytokinetics Soars on Study Data: Shares of Cytokinetics, Incorporated CYTK skyrocketed after the company announced that the late-stage study on its cardiovascular candidate aficamten showed statistically significant and clinically meaningful increase in primary efficacy endpoint. Aficamten was evaluated in SEQUOIA-HCM (Safety, Efficacy, and Quantitative Understanding of Obstruction Impact of Aficamten in HCM), a phase III clinical trial in patients with symptomatic obstructive hypertrophic cardiomyopathy.

Results showed treatment with aficamten significantly improved exercise capacity compared to placebo, increasing peak oxygen uptake measured by cardiopulmonary exercise testing by a least square mean difference of 1.74 mL/kg/min. Statistically significant and clinically meaningful improvements were also observed in all 10 prespecified secondary endpoints. Aficamten was well-tolerated in SEQUOIA-HCM with an adverse event profile comparable to placebo.

Cytokinetics plans to submit regulatory applications for aficamten in the second half of 2024.

Setback for Amgen: Amgen AMGN announced that the FDA issued a complete response letter (CRL) to its new drug application (NDA) seeking full approval for Lumakras (sotorasib) for adult patients with previously treated KRAS-mutated non-small cell lung cancer (NSCLC).

Per the CRL, the FDA issued a new post-marketing requirement (PMR) for an additional confirmatory study to support the drug’s full approval. This study needs to be completed by February 2028.

This decision is in line with the issues raised by an FDA advisory committee on the Lumakras NDA in October. The committee members voted 10-to-2, expressing skepticism on relying on the primary endpoint of progression-free survival in Amgen's previously-conducted confirmatory study (CodeBreak 200) to assess Lumakras’ benefits.

Amgen obtained accelerated approval for the drug in May 2021. The FDA concluded that the dose comparison PMR issued at the time of accelerated approval to compare the safety and efficacy of Lumakras 960 mg daily dose versus a lower daily dose has been fulfilled. The company said Lumakras at 960 mg once daily will remain the dose for patients with KRAS G12C-mutated NSCLC under accelerated approval.

Performance

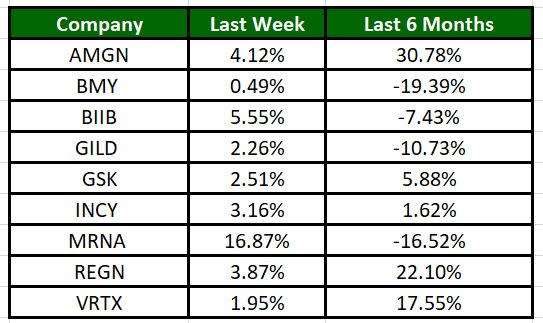

The Nasdaq Biotechnology Index has gained 6.89% in the past four trading sessions. Among the biotech giants, Moderna has gained 16.87% during the period. Over the past six months, shares of Moderna have plunged 16.52%. (See the last biotech stock roundup here: Biotech Stock Roundup: CGEN Up on GILD Deal, MRNA Gains on Study Data & More).

Image Source: Zacks Investment Research

What's Next in Biotech?

Stay tuned for more pipeline updates.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Bristol Myers Squibb Company (BMY) : Free Stock Analysis Report

Amgen Inc. (AMGN) : Free Stock Analysis Report

Cytokinetics, Incorporated (CYTK) : Free Stock Analysis Report

Karuna Therapeutics, Inc. (KRTX) : Free Stock Analysis Report

RayzeBio, Inc. (RYZB) : Free Stock Analysis Report