Biotech Stock Roundup: DICE Up on Study Data, GILD, BIIB's Updates & More

It was a busy week for the volatile biotech sector, with important regulatory and pipeline updates from quite a few companies.

Recap of the Week’s Most Important Stories:

DICE Up on Study Results: Shares of DICE Therapeutics, Inc. DICE surged 62.2% after the company announced positive top-line data from phase I study of lead oral IL-17 antagonist, DC-806, for psoriasis. The trial is a first-in-human, randomized, double-blind, placebo-controlled study designed to generate safety and pharmacokinetic (PK) data in healthy volunteers and provide early clinical proof-of-concept in psoriasis patients.

The clinical proof-of-concept in psoriasis patients achieved a mean percentage reduction in PASI from baseline at four weeks of 43.7% in the high-dose group compared to 13.3% in the placebo group, with an exploratory p-value of 0.0008. DC-806 was well tolerated with an excellent safety profile across all dose groups in healthy volunteers and psoriasis patients, with a robust PK profile and clear pharmacodynamic effects on two distinct biomarkers at both high and low doses of DC-806.

The positive data support further development of DC-806 for psoriasis. The candidate is expected to advance into a phase IIb study in the first half of 2023.

Rigel Down on Study Update: Shares of Rigel Pharmaceuticals, Inc. RIGL declined after the company announced an update on fostamatinib for treating patients with warm autoimmune hemolytic anemia (wAIHA).

Rigel does not expect to file a supplemental new drug application (sNDA) for this indication at this time following guidance from the FDA review of data from the phase III FORWARD trial of fostamatinib for wAIHA. Rigel announced dismal top-line efficacy and safety data from the FORWARD study of fostamatinib in patients with wAIHA in June. The trial did not demonstrate statistical significance in the primary efficacy endpoint of durable hemoglobin response in the overall study population. The safety profile was consistent with prior clinical experience, and no new safety issues were identified. Rigel then stated that it will discuss these findings with the FDA to determine the path forward in wAIHA.

Rigel also announced that it will cut its workforce by 16% to reduce operating expenses ranging from $7-$8 million annually, starting in 2023. The move will eliminate 30 positions, primarily in development and administration. Consequently, Rigel expects to recognize a one-time cash severance-related charge of approximately $1.5 million in the fourth quarter of 2022.

Rigel currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Gilead’s Application Gets Priority Review: Gilead Sciences, Inc. GILD announced that the FDA has accepted the supplemental biologics license application (sBLA) for Trodelvy (sacituzumab govitecan-hziy). The sBLA is seeking label expansion of Trodelvy (sacituzumab govitecan-hziy) for the treatment of adult patients with unresectable locally advanced or metastatic hormone receptor (HR) positive, human epidermal growth factor receptor 2 (HER2) negative (IHC 0, IHC 1+ or IHC 2+/ISH–) breast cancer who have received endocrine-based therapy and at least two additional systemic therapies in the metastatic setting.

The sBLA granted Priority Review to the application, and the FDA has currently set a target action date for February 2023. The sBLA is based on statistically significant and clinically meaningful overall survival and progression-free survival results from the phase III TROPiCS-02 Study. A potential label expansion will boost the sales potential of the drug and enable Gilead to diversify in the oncology space.

Pipeline Update From Biogen: Biogen BIIB announced that the first patient has been dosed in the phase II/III AMETHYST study, which will evaluate the efficacy and safety of litifilimab (BIIB059) compared to placebo in cutaneous lupus erythematosus (CLE). The candidate is a first-in-class, humanized IgG1 monoclonal antibody (mAb) targeting blood dendritic cell antigen 2 (BDCA2). The study is expected to enroll 474 adults with CLE. The phase II and phase III parts of the study will each be 52 weeks in duration. Participants will be randomized to receive subcutaneous treatment with litifilimab or placebo every four weeks for 20 weeks with an additional loading dose at week two. The primary endpoint will assess the effect of litifilimab on skin disease activity compared to placebo. The initiation of the AMETHYST study is supported by positive results from the phase II LILAC study.

Vertex Advances AATD Program: Vertex Pharmaceuticals Incorporated VRTX announced that It will now advance its investigational program targeting alpha-1 antitrypsin deficiency (AATD). The FDA has cleared the Investigational New Drug (IND) Application for VX-634, enabling the company to initiate a first-in-human clinical trial for this small molecule AAT corrector in healthy volunteers. Vertex will also initiate a 48-week phase II study of VX-864, a first-generation AAT corrector. This study is being conducted to assess the impact of longer-term treatment on polymer clearance from the liver, as well as the resultant levels of functional AAT (fAAT) in the plasma, as the magnitude of treatment effect was observed in the previous phase II study was insufficient to advance it to development. Vertex is also focusing on additional next-wave AAT correctors, with the next molecules expected to enter the clinic starting in 2023.

Performance

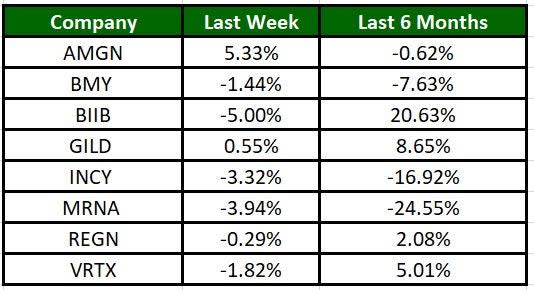

The Nasdaq Biotechnology Index lost 3.12% in the past five trading sessions. Among the biotech giants, Amgen has gained 5.33% during the period. Over the past six months, shares of Biogen have soared 20.63%. (See the last biotech stock roundup here: Biotech Stock Roundup: ICPT, KALV Down on Study Data, VIR Up on Contract Win & More)

Image Source: Zacks Investment Research

What's Next in Biotech?

Stay tuned for other updates.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Biogen Inc. (BIIB) : Free Stock Analysis Report

Gilead Sciences, Inc. (GILD) : Free Stock Analysis Report

Vertex Pharmaceuticals Incorporated (VRTX) : Free Stock Analysis Report

Rigel Pharmaceuticals, Inc. (RIGL) : Free Stock Analysis Report

DICE Therapeutics, Inc. (DICE) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research