Biotech Stock Roundup: GLTO Plunges on Setback, BLUE Offers Updates & More

It was a low-key week for the biotech sector as the earnings season ended and nothing much came from the bigwigs. However, the smaller biotechs came out with key updates. Among these, Galecto, Inc, GLTO was in the spotlight as it suffered a pipeline setback.

Recap of the Week’s Most Important Stories:

Galecto Down on Study Failure: Shares of Galecto plummeted earlier in the week after the company announced that the phase IIb study, GALACTIC-1, failed. The study evaluated the safety and efficacy of inhaled GB0139 for the treatment of idiopathic pulmonary fibrosis (IPF). The trial compared treatment with the inhaled 3 mg dose of GB0139 to placebo (randomized 2:1) over 52 weeks. The GALACTIC-1 trial failed to meet its primary endpoint of change from baseline in the rate of decline in forced vital capacity (FVC) at week 52. Levels of galectin-3 increased from day 0 to week 52 in both the placebo and active GB0139 3 mg arms. Consequently, Galecto plans to discontinue the development of GB0139 and will instead focus on other candidates for severe liver diseases.

Galecto had approximately $49.0 million in cash, cash equivalents and investments at the end of July and is evaluating resource allocation to extend cash runway into 2025 given the failure of the GALACTIC-1 study. The company had earlier conducted a type C meeting with the FDA focused on the continued development of GB1211, Galecto’s oral galectin-3 inhibitor product candidate for treating compensated and decompensated cirrhosis. Galecto now plans to initiate a long-term, randomized, placebo-controlled, phase IIa trial in patients with decompensated NASH cirrhosis, which will evaluate efficacy and tolerability at additional dose levels.

Sonnet Gains on Regulatory Update: Shares of clinical-stage company Sonnet BioTherapeutics Holdings, Inc. SONN gained after the company announced that the FDA accepted the investigational new drug (IND) application for the phase Ib/IIa clinical study of SB221 has been accepted. An IND was required to conduct the SB221 study of Sonnet's SON-1010 in combination with Roche's atezolizumab (Tecentriq) for platinum-resistant ovarian cancer (PROC) in the United States.

The study will be conducted in two parts. Part I of the study, consisting of a modified 3+3 dose-escalation design, will establish the maximum tolerated dose of SON-1010 with a fixed dose of atezolizumab. Clinical benefit in PROC will be confirmed in an expansion group to establish the recommended phase II dose. Thereafter, Part 2 of the study will investigate SON-1010 monotherapy, its use in combination with atezolizumab, or the standard of care for PROC in a randomized comparison to show proof-of-concept.

Update From BLUE: bluebird bio, Inc. BLUE announced that the FDA has communicated that an advisory committee meeting will not be scheduled for its experimental gene therapy lovotibeglogene autotemcel (lovo-cel). The company is evaluating a potentially transformative one-time gene therapy, lovo-cel, for individuals living with sickle cell disease (SCD) with a proposed indication for patients ages 12 and older who have a history of vaso-occlusive events (VOEs).

The regulatory body has previously accepted the biologics licensing application (BLA) seeking approval of the candidate for the abovementioned disease for Priority Review and set a target action date of Dec 20, 2023. The BLA for lovo-cel is based on efficacy results from 36 patients in the HGB-206 study Group C cohort with a median 32 months of follow-up and two patients in the HGB-210 study with 18 months of follow-up each. The BLA submission also includes safety data from 50 patients treated across the entire lovo-cel program, including six patients with six or more years of follow-up, which is the longest follow-up of any gene therapy program for SCD.

Gilead Collaborates With Tentarix: Gilead Sciences, Inc. GILD announced a collaboration with Tentarix Biotherapeutics to discover and develop novel therapies for cancer and inflammation. Both companies established three multi-year partnerships leveraging Tentarix’s proprietary Tentacles platform to discover and develop multi-functional, conditional protein therapeutics for oncology and inflammatory diseases. Per the terms, Tentarix will get upfront payments and an equity investment from Gilead, totaling $66 million across the three collaborations.

Gilead will have the option to acquire up to three select Tentarix subsidiaries containing the programs developed under the collaborations for $80 million per subsidiary. Gilead expects Tentarix to complement its ongoing efforts, build upon its growing strength in protein therapeutics and provide access to next-generation, multi-specific biologics. Gilead expects this transaction to reduce its bottom line in 2023 (both on a GAAP and a non-GAAP basis) by approximately 3-4 cents.

Gilead currently has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance

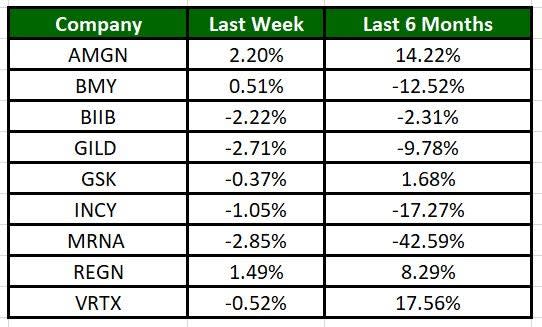

The Nasdaq Biotechnology Index has lost 1.06% in the past five trading sessions. Among the biotech giants, Moderna has lost 2.85% during the period. Over the past six months, shares of Moderna have lost 42.59%. (See the last biotech stock roundup here: Biotech Stock Roundup: SAGE, GRTX Plunge on Setback, REGN to Buy DBTX & More News).

Image Source: Zacks Investment Research

What's Next in Biotech?

Stay tuned for more pipeline updates.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Gilead Sciences, Inc. (GILD) : Free Stock Analysis Report

bluebird bio, Inc. (BLUE) : Free Stock Analysis Report

Sonnet BioTherapeutics Holdings, Inc. (SONN) : Free Stock Analysis Report

Galecto, Inc. (GLTO) : Free Stock Analysis Report