Biotech Stock Roundup: MDGL, PCVX Up on Study Data, MRNA Provides Updates

The biotech sector has been in focus in the past week with key pipeline and regulatory updates. Among these, Madrigal Pharmaceuticals, Inc. MDGL surged on nonalcoholic steatohepatitis (NASH) data.

Recap of the Week’s Most Important Stories:

Madrigal Up on NASH Data: Madrigal stock soared after it announced that the FDA granted Breakthrough Therapy designation to its experimental candidate resmetirom for the treatment of NASH. This designation expedites the development and review of drugs for serious or life-threatening conditions. The breakthrough therapy designation requires preliminary clinical evidence that demonstrates the drug may have substantial improvement on at least one clinically significant endpoint over available therapy or over placebo if there is no available therapy.

Concurrently, Madrigal announced that the outcomes portion of the phase III MAESTRO-NASH biopsy trial has completed enrollment. The company remains on track for its new drug application (NDA) filing by the second quarter. The filing is supported by the positive outcomes on the reduction of liver fibrosis and resolution of NASH from the 52-week serial liver biopsy portion of MAESTRO-NASH. The company is focused on patient recruitment on MAESTRO-NASH-OUTCOMES, a phase III clinical outcome study evaluating resmetirom in patients with well-compensated NASH cirrhosis that provides a second and potentially earlier opportunity to support full approval for both noncirrhotic and cirrhotic NASH.

Madrigal currently has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Updates From Moderna: Moderna MRNA and partner Merck MRK announced detailed results from the phase IIb KEYNOTE-942/mRNA-4157-P201 study. The study is evaluating mRNA-4157 (V940), an investigational individualized neoantigen therapy (INT), in combination with Merck's anti-PD-1 therapy, Keytruda, in patients with resected high-risk melanoma (stage III/IV). Data showed recurrence or death was reported in 22.4% of patients in the combination arm compared with 40% of patients who received Keytruda alone with a median follow-up of 23 and 24 months, respectively.

The study had earlier achieved its primary endpoint of recurrence-free survival (RFS) as data from the study showed that mRNA-4157, when combined with Merck’s blockbuster immuno-oncology drug Keytruda, exhibited a statistically significant and clinically meaningful reduction in the risk of disease recurrence or death by 44%.

Moderna and Merck intend to initiate a phase III study in patients with adjuvant melanoma in 2023. The companies also plan to evaluate the vaccine in other cancer indications, including non-small cell lung cancer.

Vaxcyte Up on Pneumococcal Conjugate Vaccine Data: Shares of Vaxcyte, Inc. PCVX surged after it released positive data from the phase II study of its 24-Valent pneumococcal conjugate vaccine (PCV) candidate, VAX-24, in adults aged 65 and older.

Concurrently, the company announced data from the full six-month safety assessment and prespecified pooled immunogenicity analyses from both the phase II study in adults aged 65 and older and the prior phase 1/II study in adults aged 18-64 (phase 1 portion adults aged 18-49, phase II portion adults aged 50-64). VAX-24, Vaxcyte’s lead broad-spectrum 24-valent PCV candidate, is being studied to prevent invasive pneumococcal disease (IPD).

VAX-24 showed robust immune responses across all 24 serotypes (ST) at all doses (1.1mcg, 2.2mcg and 2.2mcg/4.4mcg), confirming prior phase II results in adults aged 50-64.

At the 2.2mcg dose, which Vaxcyte plans to advance to phase III, VAX-24 achieved opsonophagocytic activity (OPA) response non-inferiority criteria for 18 of the 20 STs common with Prevnar 20 (PCV20) and superiority criteria for the four additional VAX-24 STs. The six-month safety data from both studies showed safety and tolerability results for VAX-24 similar to PCV20 at all doses studied. Based on these positive data, Vaxcyte plans to meet with regulators and advance VAX-24 into a pivotal phase III study (top-line data is expected in 2025).

GSK to Acquire Bellus Health: GSK plc GSK announced that it will acquire Canada-based, late-stage biopharmaceutical company BELLUS Health Inc. for $14.75 per share of common stock in cash, representing an approximate total equity value of $2.0 billion (£1.6 billion). The acquisition will add camlipixant, a potential best-in-class and highly selective P2X3 antagonist currently in phase III development (anticipated regulatory approval and launch in 2026) for the first-line treatment of adult patients with refractory chronic cough (RCC) to GSK’s pipeline. The transaction is expected to close in the third quarter of 2023 or earlier. The acquisition is likely to be accretive to adjusted earnings per share from 2027.

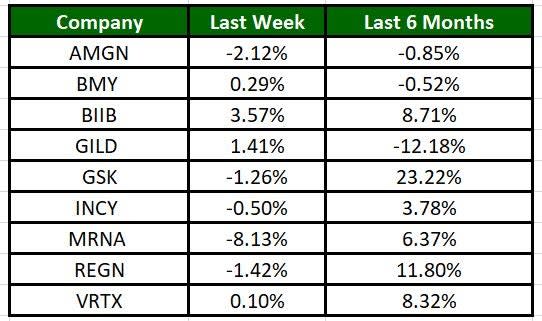

Performance

The Nasdaq Biotechnology Index has gained 1.49% in the past five trading sessions. Among the biotech giants, Biogen has gained 3.57% during the period. Over the past six months, shares of GSK soared 23.22%. (See the last biotech stock roundup here: Biotech Stock Roundup: MRNA Provides Update, KALA, IFRX Surge on Regulatory News)

Image Source: Zacks Investment Research

What's Next in Biotech?

Stay tuned for other updates.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

GSK PLC Sponsored ADR (GSK) : Free Stock Analysis Report

Merck & Co., Inc. (MRK) : Free Stock Analysis Report

Moderna, Inc. (MRNA) : Free Stock Analysis Report

Madrigal Pharmaceuticals, Inc. (MDGL) : Free Stock Analysis Report

Vaxcyte, Inc. (PCVX) : Free Stock Analysis Report