Biotech Stock Roundup: REGN Up on Approval, APLS, NVAX Gain on Updates & More

It was a busy week for the biotech sector, with quite a few important updates. Among these, Regeneron Pharmaceuticals REGN was in the spotlight as it finally gained the FDA’s nod for a higher dose of its lead drug Eylea.

Recap of the Week’s Most Important Stories:

Updates From Regeneron: Shares of Regeneron gained after the FDA approved an 8mg dose of aflibercept injection for the treatment of patients with wet age-related macular degeneration, diabetic macular edema and diabetic retinopathy under the brand name Eylea HD. A 2 mg dose of aflibercept is already approved under the brand name Eylea for various ophthalmology indications. The approval by the regulatory body was based on the 48-week results of two studies, PULSAR and PHOTON, which compared Eylea HD to aflibercept injection at 2 mg. Data from these studies showed that Eylea HD demonstrated clinically equivalent vision gains to Eylea, which were maintained with fewer injections.

Concurrently, the regulatory body approved pozelimab-bbfg for treating adult and pediatric patients one year of age and older with CHAPLE disease, also known as CD55-deficient protein-losing enteropathy. The candidate has been approved under the brand name Veopoz in the United States. Per Regeneron, Veopoz is the first and only treatment indicated specifically for CHAPLE, an ultra-rare hereditary disease that can cause potentially life-threatening gastrointestinal and cardiovascular symptoms.

Earlier, the European Medicines Agency accepted for review the company’s marketing authorization application (MAA) for pipeline candidate odronextamab. The MAA is seeking approval of the candidate to treat adult patients with relapsed/refractory (R/R) follicular lymphoma or R/R diffuse large B-cell lymphoma who have progressed after at least two prior systemic therapies.

Setback for Gilead: Gilead Sciences, Inc. GILD suffers a setback in developing its oncology candidate, magrolimab. The FDA has placed a partial clinical hold on new patient starts in studies evaluating magrolimab to treat acute myeloid leukemia (AML) in the United States.

As a result of the hold, screening and enrollment of new study participants under the U.S. investigational new drug application (IND 147229) and U.S. Expanded Access Program will be paused. Nevertheless, patients already enrolled in AML studies may continue to receive treatment and be monitored according to the current study protocol. The candidate is a potential first-in-class anti-CD47 immunotherapy and is being evaluated for several potential indications, including ongoing trials in solid tumors. Management stated that studies of magrolimab in solid tumors can continue without any impact from this hold.

Earlier, the late-stage ENHANCE study on magrolimab in higher-risk myelodysplastic syndromes was discontinued. The decision to suspend the ENHANCE study was based on a planned analysis that indicated futility in achieving the study's primary endpoints, which were focused on complete response and overall survival.

Gilead currently has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Novavax Vaccine Updates: Novavax, Inc. NVAX announced that its updated protein-based XBB COVID vaccine candidate induced neutralizing antibody responses in neutralizing antibodies against emerging subvariants the EG.5.1 (also known as ‘Eris’) and XBB.1.16.6 in studies on small animals and non-human primate. XBB sublineage variants currently account for the majority of COVID cases in the United States and the European Union. The vaccine has been designed to target the XBB descendent lineage viruses. NVAX shares gained on the news.

Novavax had earlier announced that it had initiated a filing with the FDA for its updated COVID-19 vaccine and intends to submit one in Europe in the coming weeks. Management stated that it is manufacturing the updated vaccine commercially and planning to launch it in the upcoming fall.

Apellis Gains on Safety Update: Shares of Apellis Pharmaceuticals, Inc. APLS soared after the company provided an update on injection kits and an update on the rare events of retinal vasculitis reported in real-world treatment with Syfovre (pegcetacoplan injection) for geographic atrophy secondary to age-related macular degeneration. The drug was approved for these indications in February 2023.

The company received reports of retinal vasculitis (or inflammation) following treatment with Syfovre (pegcetacoplan injection) in July. The company examined these cases along with the American Society of Retina Specialists' Research and Safety in Therapeutics (ReST). These events occurred between seven and 13 days after the initial administration of the drug, with no specific lots implicated.

Apellis partnered with ReST and has been closely monitoring and investigating the occurrences of retinal vasculitis. The company updated the number of confirmed adverse events to eight (five occlusive and three non-occlusive). Two of these events followed injections in April, three in May and three in June. All these events occurred after the initial administration of Syfovre.

During the comprehensive investigation into real-world safety events, Apellis discovered internal structural variation in 19-gauge x 1½ inch filter needles in some injection kits. These filter needles play a crucial role in withdrawing medication from vials during the preparation of injection procedures. As a precautionary measure, Apellis recommends healthcare practitioners to not use injection kits containing the 19-gauge filter needle and switch to kits equipped with the 18-gauge filter needle, which are already in distribution.

Fulcrum Gains on Hold Removal: Shares of clinical-stage biopharmaceutical company Fulcrum Therapeutics, Inc. FULC surged after the company announced that the FDA has lifted the clinical hold on the investigational new drug (IND) application seeking approval of FTX-6058 for the potential treatment of sickle-cell disease (SCD).

The FDA placed the clinical hold on the IND in February 2023. The regulatory body noted preclinical data previously submitted in April, October and December 2022, and non-clinical and clinical evidence of hematological malignancies observed with other inhibitors of polycomb repressive complex 2 (PRC2). Thereafter, Fulcrum suspended dosing in the phase Ib trial of FTX-6058 and worked diligently with the agency to resolve the hold. Fulcrum plans to resume enrollment for patients with SCD shortly.

Performance

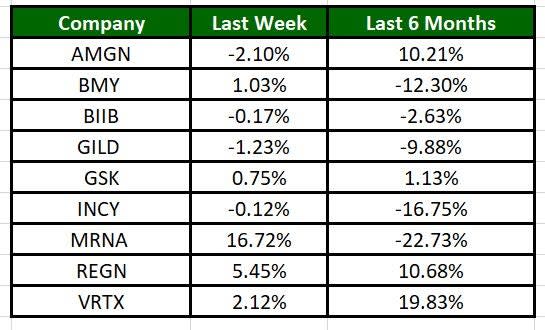

The Nasdaq Biotechnology Index has gained 1.53% in the past five trading sessions. Among the biotech giants, Moderna has gained 16.72% during the period. Over the past six months, shares of Moderna have plunged 22.73%. (See the last biotech stock roundup here: Biotech Stock Roundup: GLTO Plunges on Setback, BLUE Offers Updates & More).

Image Source: Zacks Investment Research

What's Next in Biotech?

Stay tuned for more pipeline updates.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Regeneron Pharmaceuticals, Inc. (REGN) : Free Stock Analysis Report

Gilead Sciences, Inc. (GILD) : Free Stock Analysis Report

Novavax, Inc. (NVAX) : Free Stock Analysis Report

Apellis Pharmaceuticals, Inc. (APLS) : Free Stock Analysis Report

Fulcrum Therapeutics, Inc. (FULC) : Free Stock Analysis Report