BIOTECHNOLOGY VALUE FUND L P Adds to Its Stake in Kymera Therapeutics Inc

On November 3, 2023, BIOTECHNOLOGY VALUE FUND L P (Trades, Portfolio), a prominent investment firm, increased its holdings in Kymera Therapeutics Inc (NASDAQ:KYMR), a leading biotechnology company based in the USA. This article provides an in-depth analysis of the transaction, the profiles of the guru and the traded company, and the potential implications for value investors.

Details of the Transaction

The firm added 414,105 shares of Kymera Therapeutics Inc to its portfolio at a traded price of $14.27 per share. This transaction increased the firm's total holdings in the company to 5,054,898 shares, representing 9.09% of the guru's holdings in the traded stock. However, the impact of this transaction on the guru's portfolio is currently not applicable.

Profile of the Guru

BIOTECHNOLOGY VALUE FUND L P (Trades, Portfolio) is a renowned investment firm with a focus on the biotechnology sector. The firm's investment philosophy is centered on identifying and investing in biotechnology companies with high growth potential. The firm's equity is currently not applicable, and it does not have any top holdings at the moment.

Overview of Kymera Therapeutics Inc

Kymera Therapeutics Inc is a pioneering biotechnology company that is advancing the field of targeted protein degradation. The company's Pegasus targeted protein degradation platform harnesses the body's natural protein recycling machinery to degrade disease-causing proteins. The company operates in a single segment and has a market capitalization of $799.573 million. Since its IPO on August 21, 2020, the company's stock price has decreased by 58.84%, and its year-to-date price change ratio stands at -41.99%.

Analysis of Kymera Therapeutics Inc's Stock

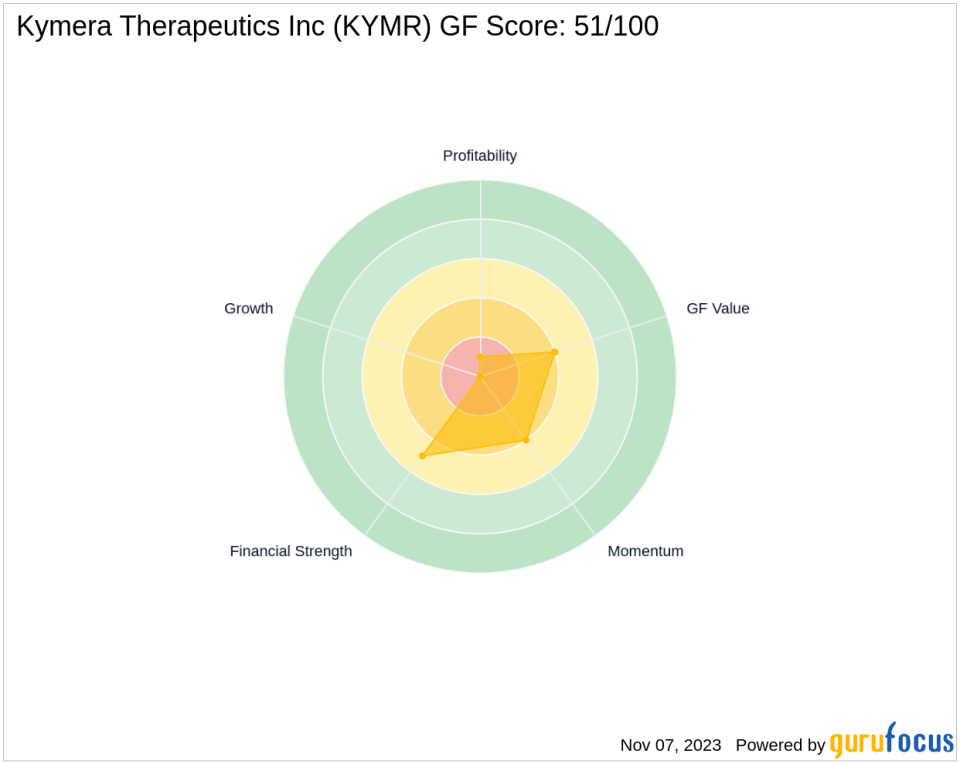

According to GuruFocus, Kymera Therapeutics Inc's stock is potentially a value trap, with a GF Value of 30.03 and a price to GF Value ratio of 0.48. The company's GF Score is 51/100, indicating poor future performance potential. The company's Financial Strength is ranked 5/10, its Profitability Rank is 1/10, and its Growth Rank is 0/10. The company's GF Value Rank and Momentum Rank are both 4/10.

Comparison with the Largest Guru

The largest guru holding shares in Kymera Therapeutics Inc is Vanguard Health Care Fund (Trades, Portfolio). However, the exact share percentage held by Vanguard Health Care Fund (Trades, Portfolio) is currently not applicable. A comparison of the share percentages held by BIOTECHNOLOGY VALUE FUND L P (Trades, Portfolio) and Vanguard Health Care Fund (Trades, Portfolio) would provide a clearer picture of the guru's confidence in the traded stock.

Conclusion

In conclusion, BIOTECHNOLOGY VALUE FUND L P (Trades, Portfolio)'s recent addition to its stake in Kymera Therapeutics Inc is a significant transaction that could have potential implications for value investors. Despite the company's poor performance since its IPO and its low GF Score, the guru's decision to increase its holdings in the company could indicate a belief in the company's long-term growth potential. However, investors should exercise caution and conduct thorough research before making investment decisions.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.