BioVie (BIVI) Falls 61% Despite Upbeat Alzheimer's Study Data

BioVie Inc. BIVI announced a positive analysis of top-line efficacy data from its phase III study of its investigational candidate, NE3107, for the treatment of mild-to-moderate Alzheimer’s disease (AD).

Despite the encouraging results, BioVie’s stock plunged 60.7% in the last trading session, primarily due to investors’ skepticism regarding the results. Per the company, there were significant study conduct violations and protocol deviations.

NE3107 is an oral, small molecule, blood-brain permeable anti-inflammatory insulin sensitizer with a novel mechanism of action.

Per the data readout, the advantage of treating AD patients with NE3107 compared with placebo in the late-stage study demonstrated a benefit equal to or greater than that offered by currently approved monoclonal antibodies in the treatment of AD, without the associated safety concerns.

Furthermore, BioVie reported that NE3107-treated patients experienced an age deceleration advantage by 4.66 months to a year compared with placebo, as measured by epigenetics/DNA methylation Skin Blood Clock. Age deceleration is the difference between the patient’s biological age as measured by the Horvath DNA methylation Skin Blood clock and the actual chronological age.

Management believes NE3107 to be the first drug candidate to demonstrate this impact on DNA methylation and the aging process in a clinical study.

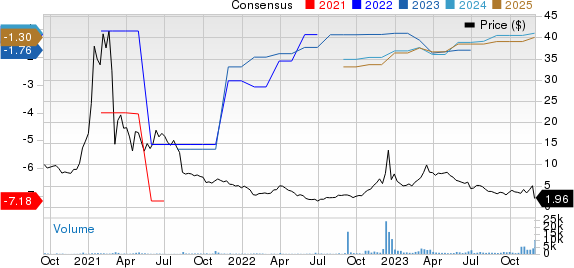

Year to date, shares of BioVie have nosedived 74.8% compared with the industry’s 12.8% fall.

Image Source: Zacks Investment Research

The phase III study of NE3107, initiated during the COVID-19 pandemic, enrolled a total of 439 AD patients. After completion of the study, BIVI observed significant deviation from protocol and good clinical practice violations in several study sites.

Based on this development, the company decided to exclude all patients treated with the candidate in these study sites from the analysis of study efficacy data. The excluded patients were then referred to an investigative body of the FDA for further action.

After accounting for the exclusions, 81 patients remained in the company’s modified intent to treat population, 57 of whom received treatment according to protocol. These 57 patients in the per-protocol population included those who went on to complete the study and were verified to take the study drug from pharmacokinetic data. The top-line efficacy results were upon analysis of data observed from these 57 per-protocol patients.

BioVie also reported that due to the exclusions made from the initial patient population, the primary efficacy endpoint of the study missed achieving statistical significance. This is expected to have contributed to the massive drop in the stock price.

The company intends to utilize the adaptive feature of the phase III study design to continue enrolling patients to reach statistical significance for registrational purposes.

Currently, BioVie is gearing up to discuss its findings regarding the magnitude of NE3107’s therapeutic impact with its potential partners.

BioVie Inc. Price and Consensus

BioVie Inc. price-consensus-chart | BioVie Inc. Quote

Zacks Rank and Other Stocks to Consider

BioVie currently carries a Zacks Rank #2 (Buy).

Some other top-ranked stocks worth mentioning are Puma Biotechnology, Inc. PBYI, ADMA Biologics ADMA and Agenus AGEN. While PBYI sports a Zacks Rank #1 (Strong Buy), ADMA and AGEN carry a Zacks Rank #2 each at present.

You can see the complete list of today’s Zacks #1 Rank stocks here.

In the past 30 days, the Zacks Consensus Estimate for Puma Biotech’s 2023 earnings per share has increased from 67 cents to 73 cents. During the same time frame, the estimate for Puma Biotech’s 2024 earnings per share has increased from 56 cents to 62 cents. Year to date, shares of PBYI have lost 8.3%.

PBYI’s earnings beat estimates in three of the last four quarters while missing on one occasion, delivering a four-quarter average earnings surprise of 76.55%.

In the past 30 days, the Zacks Consensus Estimate for ADMA Biologics’ 2023 loss per share has narrowed from 6 cents to 3 cents. The estimate for ADMA Biologics’ 2024 earnings per share is pegged at 16 cents. Year to date, shares of ADMA have lost 3.9%.

ADMA beat estimates in three of the trailing four quarters and matched in one, delivering an average earnings surprise of 63.57%.

In the past 30 days, the Zacks Consensus Estimate for Agenus’ 2023 loss per share has narrowed from 77 cents to 63 cents. During the same time frame, the estimate for Agenus’ 2024 loss per share has narrowed from 70 cents to 45 cents. Year to date, shares of AGEN have plunged 70.8%.

AGEN beat estimates in one of the trailing four quarters, matching in one and missing the mark on the other two occasions, delivering an average earnings surprise of 0.49%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Agenus Inc. (AGEN) : Free Stock Analysis Report

Puma Biotechnology, Inc. (PBYI) : Free Stock Analysis Report

ADMA Biologics Inc (ADMA) : Free Stock Analysis Report

BioVie Inc. (BIVI) : Free Stock Analysis Report