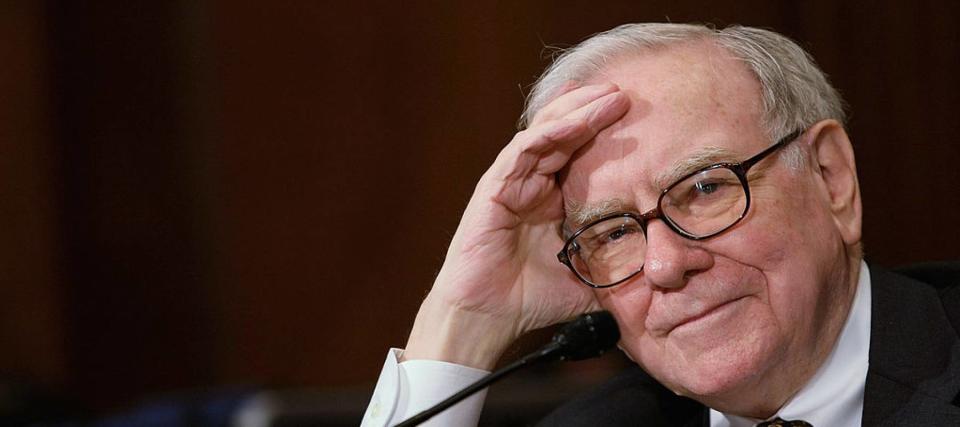

Bitcoin has dropped more than 30% from when Warren Buffett described it as 'rat poison squared': Here are 3 stocks he's invested in that outperformed crypto

Billionaire Warren Buffett memorably described Bitcoin as “rat poison squared” during a shareholder meeting in April 2022. Bitcoin was trading near $40,000 at the time. It’s now trading at around $36,288.

Meanwhile, Berkshire Hathaway’s Class A stock has outperformed the cryptocurrency and recently reached an all-time high, surpassing $560,000. Presently, the Class A stock sits above $545,000.

Don't miss

Commercial real estate has outperformed the S&P 500 over 25 years. Here's how to diversify your portfolio without the headache of being a landlord

Rising prices are throwing off Americans' retirement plans — here's how to get your savings back on track

'A natural way to diversify': Janet Yellen now says Americans should expect a decline in the USD as the world's reserve currency — 3 ways you can prepare

Unsurprisingly, Buffett hasn’t changed his mind about the world’s most persistent digital obsession. “I’ve seen people do stupid things all my life,” Buffett said in an interview with CNBC earlier this year, comparing betting on Bitcoin to playing the slots in Las Vegas.

“We’ve had an explosion of gambling, essentially. And I like to bet on a football game — if I’m sitting and watching, it makes it more interesting. But I don’t think I want to make a living trying to bet against the house.”

Instead of crypto, Buffett has been laser-focused on his preferred asset class: equities. Here are the top three stocks he’s invested in over the past year that have outperformed Bitcoin by a wide margin.

Lennar Corp.

Buffett seems to be focused on American homebuilders right now. He added a stake in Lennar Corporation (LEN) sometime in the second quarter of 2023, according to recent regulatory filings.

The Florida-based company is one of the largest home builders in the country. That puts it in a favorable position given the shortage of homes across America. Between 2012 and 2022, there were 6.5 million more households formed than homes constructed. If this gap continues to widen, demand for homebuilding could skyrocket.

Buffett seems to be betting on this trend, adding two other homebuilders, NVR (NVR) and DR Horton (DHI), to his portfolio during the second quarter.

Read more: Rich young Americans have lost confidence in the stock market — and are betting on these 3 assets instead. Get in now for strong long-term tailwinds

Diageo

In the first quarter of the year, Buffett added a stake in British alcoholic beverage giant Diageo (DEO). But the Oracle of Omaha is no stranger to sin stocks, having acquired a sizable stake in Guinness, the beer brand that would eventually be combined with other brands to form Diageo, back in the 1990s.

At the time, Buffett even compared the investment to his most famous bet. “In the sense of where they earn their profits — continent-by-continent — Coca-Cola and Guinness display strong similarities," he wrote in a letter to investors that year.

Now, Diageo is back in the Berkshire portfolio, and that’s probably a sign that the company is undervalued. The stock trades at just under 19 times earnings per share and offers a 2.57% dividend yield. Meanwhile, Bitcoin's dividend yield is 0% and has a non-existent price-to-earnings ratio.

Occidental Petroleum

Warren Buffett is clearly bullish on energy, at least in the medium term. That’s why he started accumulating a stake in Occidental Petroleum Corp (OXY) last year and now controls over 25% of the company’s outstanding shares.

The price of crude oil has rebounded in recent months. In fact, it hit a 10-month high recently and experts expect demand to keep a price floor on the commodity for the year ahead. That’s a major tailwind for oil producers like Occidental.

Buffett’s bet on energy giants is now a key part of his portfolio. Considering how cheap these companies are (Occidental stock trades at 11 times earnings), retail investors should consider taking a closer look too.

What to read next

Thanks to Jeff Bezos, you can now use $100 to cash in on prime real estate — without the headache of being a landlord. Here's how

Worried about the economy? Here are the best shock-proof assets for your portfolio. (They’re all outside of the stock market.)

Jeff Bezos and Oprah Winfrey invest in this asset to keep their wealth safe — you may want to do the same in 2023

This article provides information only and should not be construed as advice. It is provided without warranty of any kind.