BJ's (NYSE:BJ) Posts Q3 Sales In Line With Estimates

Membership-only discount retailer BJ’s Wholesale Club (NYSE:BJ) reported results in line with analysts' expectations in Q3 FY2023, with revenue up 2.9% year on year to $4.92 billion. Turning to EPS, BJ's made a non-GAAP profit of $0.98 per share, down from its profit of $0.99 per share in the same quarter last year.

Is now the time to buy BJ's? Find out by accessing our full research report, it's free.

BJ's (BJ) Q3 FY2023 Highlights:

Revenue: $4.92 billion vs analyst estimates of $4.91 billion (small beat)

Adjusted EBITDA: $274.9 million beat expectations of $268.1 million

EPS (non-GAAP): $0.98 vs analyst estimates of $0.94 (3.9% beat)

Maintained guidance for full year EPS (non-GAAP): $3.86 at the midpoint vs analyst estimates of $3.85 (small beat)

Free Cash Flow of $47.64 million, down 28.9% from the same quarter last year

Gross Margin (GAAP): 18.3%, in line with the same quarter last year

Same-Store Sales were up 0.3% year on year

Store Locations: 408 at quarter end, increasing by 12 over the last 12 months

“Our advantaged model and strong value proposition continue to resonate with our members. During the third quarter, we posted accelerating membership growth, robust traffic gains and continued increases in market share. These gains continue to reinforce the underlying strength of our business and we remain confident in the long-term growth prospects of our Company,” said Bob Eddy, Chairman and Chief Executive Officer, BJ’s Wholesale Club.

Appealing to the budget-conscious individual shopping for a household, BJ’s Wholesale Club (NYSE:BJ) is a membership-only retail chain that sells groceries, appliances, electronics, and household items, often in bulk quantities.

Large-format Grocery & General Merchandise Retailer

Big-box retailers operate large stores that sell groceries and general merchandise at highly competitive prices. Because of their scale and resulting purchasing power, these big-box retailers–with annual sales in the tens to hundreds of billions of dollars–are able to get attractive volume discounts and sell at often the lowest prices. While e-commerce is a threat, these retailers have been able to weather the storm by either providing a unique in-store shopping experience or by reinvesting their hefty profits into omnichannel investments.

Sales Growth

BJ's is one of the larger companies in the consumer retail industry and benefits from economies of scale, enabling it to gain more leverage on fixed costs and offer consumers lower prices.

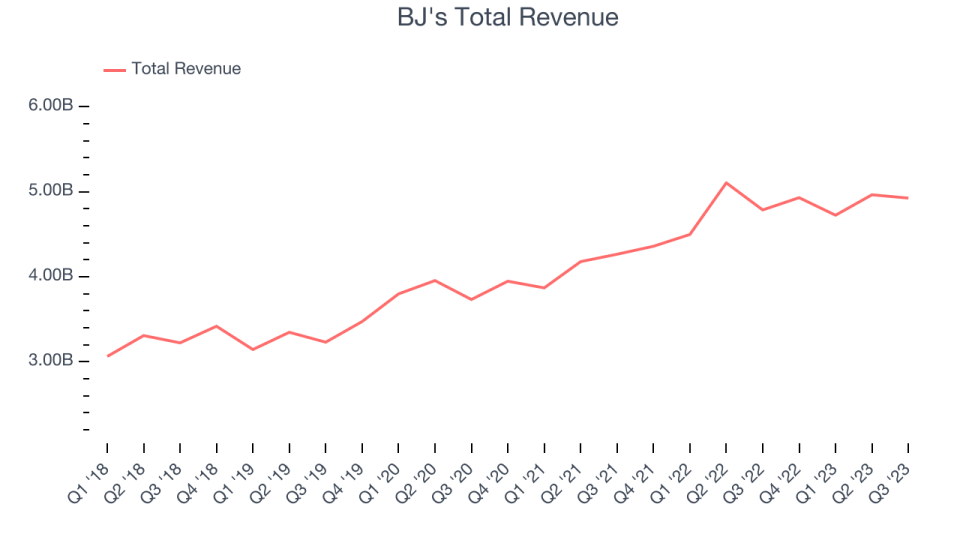

As you can see below, the company's annualized revenue growth rate of 10.4% over the last four years (we compare to 2019 to normalize for COVID-19 impacts) was impressive as it opened new stores and grew sales at existing, established stores.

This quarter, BJ's grew its revenue by 2.9% year on year, in line with Wall Street's estimates. in line with Wall Street's estimates.Looking ahead, analysts expect sales to grow 7.3% over the next 12 months.

The pandemic fundamentally changed several consumer habits. There is a founder-led company that is massively benefiting from this shift. The business has grown astonishingly fast, with 40%+ free cash flow margins. Its fundamentals are undoubtedly best-in-class. Still, the total addressable market is so big that the company has room to grow many times in size. You can find it on our platform for free.

Same-Store Sales

BJ's demand within its existing stores has generally risen over the last two years but lagged behind the broader consumer retail sector. On average, the company's same-store sales have grown by 4.2% year on year. With positive same-store sales growth amid an increasing physical footprint of stores, BJ's is reaching more customers and growing sales.

In the latest quarter, BJ's year on year same-store sales were flat. By the company's standards, this growth was a meaningful deceleration from the 5.3% year-on-year increase it posted 12 months ago. We'll be watching BJ's closely to see if it can reaccelerate growth.

Key Takeaways from BJ's Q3 Results

Sporting a market capitalization of $9.04 billion, BJ's is among smaller companies, but its more than $33.55 million in cash on hand and positive free cash flow over the last 12 months puts it in an attractive position to invest in growth.

It was encouraging to see BJ's slightly top analysts' EPS expectations this quarter despite in-line same-store sales and only a small revenue beat. The company maintained its full year EPS guidance, which was very slightly ahead of current Consensus. Zooming out, we think this quarter featured very few surprises and shows that the company is staying on target. The stock is flat after reporting and currently trades at $67.43 per share.

So should you invest in BJ's right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.

One way to find opportunities in the market is to watch for generational shifts in the economy. Almost every company is slowly finding itself becoming a technology company and facing cybersecurity risks and as a result, the demand for cloud-native cybersecurity is skyrocketing. This company is leading a massive technological shift in the industry and with revenue growth of 50% year on year and best-in-class SaaS metrics it should definitely be on your radar.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

The author has no position in any of the stocks mentioned in this report.