BJ's Wholesale (BJ) to Report Q3 Earnings: Factors to Note

BJ's Wholesale Club Holdings, Inc. BJ is likely to register an increase in the top line when it reports third-quarter fiscal 2023 results on Nov 17 before market open. The Zacks Consensus Estimate for revenues is pegged at $4,975 million, indicating growth of 4% from the prior-year reported figure.

The bottom line of this operator of membership warehouse clubs is expected to have declined year over year. In the past seven days, the Zacks Consensus Estimate for third-quarter earnings per share has fallen by a penny to 95 cents. The consensus figure suggests a decrease of 4% from the year-ago quarter.

BJ's Wholesale has a trailing four-quarter earnings surprise of 10.2%, on average. In the last reported quarter, this Westborough, MA-based company’s bottom line surpassed the Zacks Consensus Estimate by a margin of 7.8%.

Factors to Consider

BJ's Wholesale’s focus on simplifying assortments, boosting marketing and merchandising capabilities, expanding into high-demand categories and building an own-brand portfolio is commendable. The company remains committed to enhancing omnichannel capabilities and providing value for customers. These endeavors have been contributing to growth in membership signups and renewals.

The third quarter is anticipated to reflect the positive impact of BJ's Wholesale's emphasis on better pricing, private-label offerings, merchandise initiatives and digital solutions. These factors are expected to have contributed favorably to the company's top-line performance. We expect merchandise comparable club sales to have improved 0.7%.

However, the quarter may also reveal challenges, particularly in the form of potential deleverage in SG&A expenses, which could adversely affect margins. Higher labor and occupancy costs as a result of new club and gas station openings and other continued investments to drive strategic priorities, are likely to have pushed SG&A expenses higher. We expect SG&A expenses to have increased 3.9% during the quarter under review, with the operating margin expected to have contracted 10 basis points.

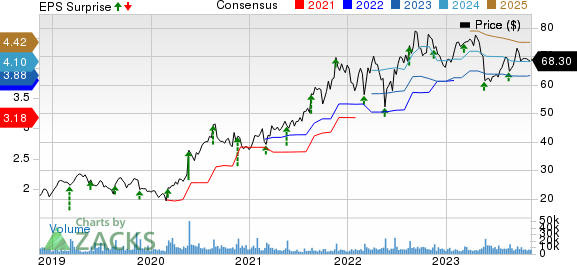

BJ's Wholesale Club Holdings, Inc. Price, Consensus and EPS Surprise

BJ's Wholesale Club Holdings, Inc. price-consensus-eps-surprise-chart | BJ's Wholesale Club Holdings, Inc. Quote

What the Zacks Model Unveils

Our proven model does not conclusively predict an earnings beat for BJ's Wholesale this time. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. However, that’s not the case here.

BJ's Wholesale has a Zacks Rank #3 but an Earnings ESP of -3.79%. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Stocks With the Favorable Combination

Here are companies you may want to consider as our model shows that these have the right combination of elements to post an earnings beat:

Costco COST currently has an Earnings ESP of +4.26% and a Zacks Rank of 2. The company is likely to register an increase in the bottom line when it reports first-quarter fiscal 2024 numbers. The Zacks Consensus Estimate for quarterly earnings per share of $3.43 suggests a rise of 10.7% from the year-ago reported number. You can see the complete list of today’s Zacks #1 Rank stocks here.

Costco’s top line is expected to ascend year over year. The Zacks Consensus Estimate for quarterly revenues is pegged at $57.69 billion, which calls for an increase of 6% from the prior-year quarter. COST has a trailing four-quarter earnings surprise of 2.1%, on average.

Ross Stores ROST currently has an Earnings ESP of +2.08% and a Zacks Rank #2. The company is expected to register a bottom-line increase when it reports third-quarter fiscal 2023 results. The Zacks Consensus Estimate for quarterly earnings per share of $1.21 suggests an increase of 21% from the year-ago quarter.

Ross Stores’ top line is anticipated to rise year over year. The consensus mark for revenues is pegged at $4.83 billion, indicating an increase of 5.8% from the figure reported in the year-ago quarter. ROST has a trailing four-quarter earnings surprise of 11.4%, on average.

Walmart WMT currently has an Earnings ESP of +0.63% and carries a Zacks Rank #2. The company’s bottom line is expected to increase marginally year over year when it reports third-quarter fiscal 2024 numbers. The Zacks Consensus Estimate for quarterly earnings per share of $1.51 suggests an increase of 0.7% from the year-ago quarter.

Walmart’s top line is expected to increase year over year. The Zacks Consensus Estimate for quarterly revenues is pegged at $159.2 billion, which indicates a rise of 4.2% from the figure reported in the prior-year quarter. WMT has a trailing four-quarter earnings surprise of 11.6%, on average.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Walmart Inc. (WMT) : Free Stock Analysis Report

BJ's Wholesale Club Holdings, Inc. (BJ) : Free Stock Analysis Report

Costco Wholesale Corporation (COST) : Free Stock Analysis Report

Ross Stores, Inc. (ROST) : Free Stock Analysis Report