BJ's Wholesale Club (BJ) Q3 Earnings Top Estimates, Decline Y/Y

BJ’s Wholesale Club Holdings, Inc. BJ came up with its third-quarter fiscal 2023 results, wherein the top line fell short of the Zacks Consensus Estimate but improved from the year-ago period. Conversely, the company’s bottom line managed to surpass the consensus estimate but experienced a year-over-year decline. BJ’s Wholesale Club’s comparable club sales, excluding gasoline sales, remained roughly flat year over year. The company also revised its full-year expectations for the metric, citing a shift in consumer behavior due to the macroeconomic environment.

Q3 Insights

BJ’s Wholesale Club reported adjusted earnings of 98 cents a share, which surpassed the Zacks Consensus Estimate of 95 cents. However, quarterly earnings declined 1% from 99 cents reported in the year-ago quarter.

This operator of membership warehouse clubs generated total revenues of $4,924.7 million, which grew 2.9% from the year-ago quarter’s levels but fell short of the consensus mark of $4,936 million. Net sales increased 2.8% to $4,818.7 million, while membership fee income jumped 6.6% to $106.1 million.

Total comparable club sales during the quarter under discussion increased 0.3% year over year. Excluding the impact of gasoline sales, comparable club sales marginally slid by 0.1%, falling short of our projected 0.7% growth. Markedly, digitally enabled comparable sales advanced 16% during the quarter.

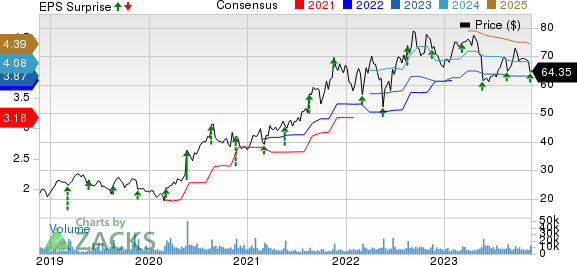

BJ's Wholesale Club Holdings, Inc. Price, Consensus and EPS Surprise

BJ's Wholesale Club Holdings, Inc. price-consensus-eps-surprise-chart | BJ's Wholesale Club Holdings, Inc. Quote

A Look at Margins

In the third quarter, gross profit rose to $902.5 million from $877.1 million in the year-ago period. The merchandise gross margin rate, which excludes gasoline sales and membership fee income, expanded 30 basis points from the year-ago quarter’s level. The metric was favorably impacted by moderated supply chain costs and improved inventory management.

The operating income increased 3.9% to $199.4 million, while the operating margin, as a percentage of total revenues, remained flat at 4%. We note that adjusted EBITDA rose 1% to $274.9 million during the quarter, while the adjusted EBITDA margin shrunk 10 basis points to 5.6%. We had anticipated 10 and 30 basis points of contraction in the operating and EBITDA margins, respectively.

SG&A expenses rose 3.4% from the year-ago quarter to $697.1 million. This reflects higher labor and occupancy costs due to new club and gas station openings as well as other investments to drive strategic priorities. As a percentage of total revenues, SG&A expenses increased 10 basis points to 14.2%. We had projected a year-over-year increase of 3.9% in SG&A expenses.

Other Details

BJ’s Wholesale Club ended the reported quarter with cash and cash equivalents of $33.6 million. The long-term debt amounted to $398.4 million, while stockholders’ equity was $1,353.7 million.

Net cash provided by operating activities during the 39-week period ended on Oct 28, 2023, was $444.5 million. Cash from operating activities and free cash flow were $175 million and $47.6 million, respectively, during the quarter.

As part of its share repurchase program, the company bought back 242,000 shares worth $17.1 million in the third quarter.

Outlook

Management envisions fourth-quarter fiscal 2023 comparable club sales, excluding the impact of gasoline sales, to be down 2% to up 1%. For the fiscal year, it foresees growth of 1% to 1.8% in the metric, down from the prior expectation of approximately 2% increase. The company had registered 6.5% growth in fiscal 2022. BJ’s Wholesale Club continues to expect fiscal 2023 adjusted earnings in the band of $3.80-$3.92 per share.

This Zacks Rank #3 (Hold) stock has declined 7.5% in the past six months against the industry’s rise of 8.9%.

Stocks Hogging the Limelight

Here, we have highlighted three better-ranked stocks, namely Ollie's Bargain OLLI, Ross Stores ROST and Sysco Corporation SYY.

Ollie's Bargain, which operates as a retailer of brand-name merchandise, currently has a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for Ollie's Bargain’s current financial-year sales and earnings suggests growth of 14.2% and 67.9%, respectively, from the year-ago reported numbers. Ollie's Bargain has a trailing four-quarter earnings surprise of 1.3%, on average.

Ross Stores, which operates off-price retail apparel and home fashion stores, currently carries a Zacks Rank #2.

The Zacks Consensus Estimate for Ross Stores’ current financial-year sales and earnings indicates growth of 7.2% and 21.7%, respectively, from the year-ago reported numbers. ROST has a trailing four-quarter earnings surprise of 7.8%, on average.

Sysco, which is engaged in the marketing and distribution of various food and related products to the foodservice or food-away-from-home industry, currently carries a Zacks Rank #2.

The Zacks Consensus Estimate for Sysco’s current financial-year sales and earnings implies growth of 4.4% and 7.7%, respectively, from the year-ago reported numbers.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

BJ's Wholesale Club Holdings, Inc. (BJ) : Free Stock Analysis Report

Ross Stores, Inc. (ROST) : Free Stock Analysis Report

Sysco Corporation (SYY) : Free Stock Analysis Report

Ollie's Bargain Outlet Holdings, Inc. (OLLI) : Free Stock Analysis Report