Black Diamond Group Limited's (TSE:BDI) 36% Share Price Surge Not Quite Adding Up

Black Diamond Group Limited (TSE:BDI) shares have had a really impressive month, gaining 36% after a shaky period beforehand. But the gains over the last month weren't enough to make shareholders whole, as the share price is still down 2.5% in the last twelve months.

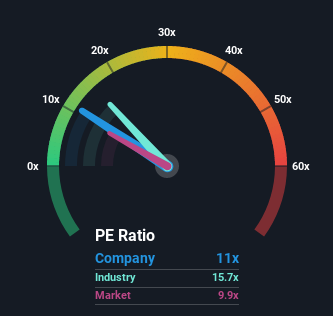

Although its price has surged higher, it's still not a stretch to say that Black Diamond Group's price-to-earnings (or "P/E") ratio of 11x right now seems quite "middle-of-the-road" compared to the market in Canada, where the median P/E ratio is around 10x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

With earnings growth that's superior to most other companies of late, Black Diamond Group has been doing relatively well. One possibility is that the P/E is moderate because investors think this strong earnings performance might be about to tail off. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Check out our latest analysis for Black Diamond Group

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Black Diamond Group.

What Are Growth Metrics Telling Us About The P/E?

In order to justify its P/E ratio, Black Diamond Group would need to produce growth that's similar to the market.

Taking a look back first, we see that the company grew earnings per share by an impressive 262% last year. Still, EPS has barely risen at all from three years ago in total, which is not ideal. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Shifting to the future, estimates from the six analysts covering the company suggest earnings growth is heading into negative territory, declining 15% over the next year. With the market predicted to deliver 11% growth , that's a disappointing outcome.

With this information, we find it concerning that Black Diamond Group is trading at a fairly similar P/E to the market. Apparently many investors in the company reject the analyst cohort's pessimism and aren't willing to let go of their stock right now. Only the boldest would assume these prices are sustainable as these declining earnings are likely to weigh on the share price eventually.

The Final Word

Black Diamond Group's stock has a lot of momentum behind it lately, which has brought its P/E level with the market. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of Black Diamond Group's analyst forecasts revealed that its outlook for shrinking earnings isn't impacting its P/E as much as we would have predicted. When we see a poor outlook with earnings heading backwards, we suspect share price is at risk of declining, sending the moderate P/E lower. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

Don't forget that there may be other risks. For instance, we've identified 2 warning signs for Black Diamond Group that you should be aware of.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a P/E below 20x.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here