Black Hills Corp (BKH) Surpasses Earnings Guidance for 2023, Sets Positive Outlook for 2024

Earnings Per Share (EPS): Achieved $3.91, surpassing the guidance range.

Debt to Capitalization Ratio: Improved to 57.3% from 60.8% year-over-year.

Dividend Track Record: Increased quarterly dividend, marking 54 consecutive years of growth.

2024 EPS Guidance: Initiated at $3.80 to $4.00, reflecting a 4% increase from 2023 guidance.

Capital Forecast: Increased five-year capital plan by $800 million to $4.3 billion for 2024-2028.

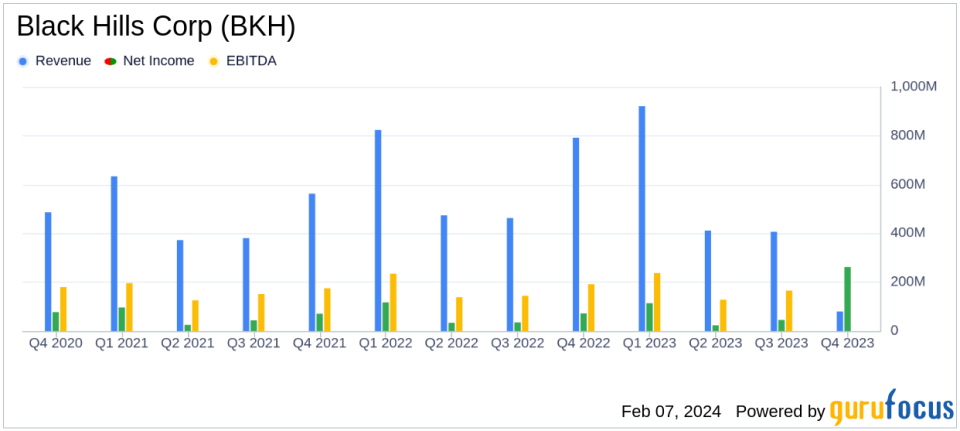

On February 7, 2024, Black Hills Corp (NYSE:BKH) released its 8-K filing, detailing a strong financial performance for the fourth quarter and full year of 2023. The company, a leading energy provider in the Midwest and mountain regions of the U.S., reported a notable earnings per share (EPS) of $3.91, which exceeded the projected guidance range of $3.65 to $3.85. Black Hills Corp's commitment to disciplined capital and expense management, as well as strategic growth initiatives, has contributed to this success.

Financial Performance and Strategic Initiatives

Black Hills Corp's performance in 2023 was primarily driven by new rates and customer growth, contributing an additional $0.63 per share. The company effectively managed the challenges posed by inflation and unfavorable weather conditions, which had a combined negative impact of $0.28 per share. Despite these challenges, the company's strategic execution and regulatory strategy led to the implementation of new rates at Wyoming Electric and Rocky Mountain Natural Gas, among others.

President and CEO Linn Evans highlighted the company's ability to deliver on financial objectives amidst an inflationary environment and expressed confidence in Black Hills Corp's long-term growth target of 4% to 6% in EPS. The company's strategic growth initiatives include the Ready Wyoming electric transmission project and plans to add renewable energy resources in South Dakota and Colorado.

Capital Allocation and Dividend Growth

Black Hills Corp's commitment to shareholder returns is evident in the increase of its quarterly dividend, marking 54 years of consecutive dividend growth. The company's capital allocation strategy includes an increased five-year capital forecast, now totaling $4.3 billion for the period from 2024 to 2028, to support ongoing growth initiatives.

2024 Outlook and Guidance

Looking ahead to 2024, Black Hills Corp has initiated an EPS guidance range of $3.80 to $4.00. This guidance is based on assumptions of normal weather conditions, timely regulatory outcomes, no significant unplanned outages, and equity issuance through the at-the-market equity offering program. The company also anticipates production tax credits of approximately $18 million associated with wind generation assets.

Operational Highlights

Operational achievements for the year included the commencement of the Ready Wyoming project, setting new peak load records, and advancing renewable energy projects. The company also successfully navigated regulatory processes, resulting in approved rate reviews and settlement agreements that will contribute to future revenue growth.

Financial Health and Credit Ratings

Black Hills Corp's financial health remains strong, with improved net debt to capitalization ratios and affirmed credit ratings from all three major credit rating agencies. The company's proactive financial management, including debt offerings and equity issuance, positions it well for continued investment in strategic growth and operational excellence.

For more detailed information on Black Hills Corp's financial results and operational updates, investors are encouraged to review the full 8-K filing.

Black Hills Corp will host a live conference call and webcast to discuss its financial and operating performance, providing an opportunity for investors to gain further insights into the company's strategic direction and financial health.

Value investors and potential GuruFocus.com members interested in the utilities sector may find Black Hills Corp's consistent performance, strategic growth initiatives, and commitment to shareholder returns to be of particular interest. The company's ability to navigate an inflationary environment while maintaining financial discipline and advancing key projects positions it as a noteworthy player in the regulated utilities industry.

Explore the complete 8-K earnings release (here) from Black Hills Corp for further details.

This article first appeared on GuruFocus.