Blackbaud (BLKB) Q2 Earnings Top Estimates, Revenues Up Y/Y

Blackbaud BLKB reported second-quarter 2023 non-GAAP earnings of 98 cents per share, which surpassed the Zacks Consensus Estimate by 5.4%. The bottom line increased 31% year over year.

Total revenues jumped 2.3% year over year to $271 million driven by strength in recurring revenues. Transactional revenues registered growth in the high single digits on a year-over-year basis in the quarter under review. However, revenues missed the Zacks Consensus Estimate by 0.6%.

Total recurring revenues (contributed 96.8% to the top line) in the reported quarter amounted to $262.4 million, up 3.9% year over year. One-time services and other revenues (3.2% of the top line) totaled $8.7 million, down 30.3% year over year.

Non-GAAP organic revenues grew 2.8% on a reported basis and 3.2% at constant currency, year over year. Non-GAAP organic recurring revenues rose 4.4% year over year.

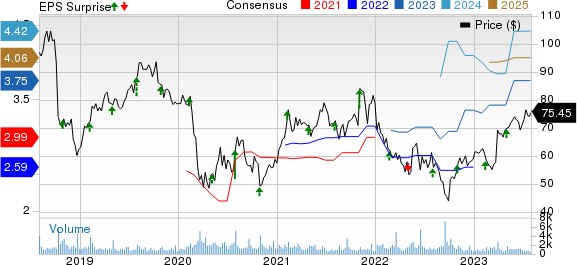

Blackbaud, Inc. Price, Consensus and EPS Surprise

Blackbaud, Inc. price-consensus-eps-surprise-chart | Blackbaud, Inc. Quote

Margin Details

Non-GAAP gross margin was 61.6%, up 280 basis points (bps) from the prior-year quarter’s levels.

Total operating expenses improved 7.2% on a year-over-year basis to $149.3 million. As a percentage of revenues, the figure expanded 250 bps to 55.1%.

Non-GAAP operating margin extended 680 bps from the year-ago quarter’s figure to 27.4%.

Non-GAAP adjusted EBITDA margin was 32.8%, up 620 bps year over year.

Balance Sheet & Cash Flow

As of Jun 30, Blackbaud had total cash, cash equivalents and restricted cash of $790.3 million compared with $388.1 million as of Mar 31, 2023.

Total debt (including the current portion) as of Jun 30, came in at $846.6 million compared with $858.9 million as of Mar 31, 2023.

For the second quarter, cash provided by operating activities was $53.2 million compared with $57.3 million in the prior-year period.

Non-GAAP adjusted free cash flow in the second quarter was $43.6 million compared with $43.9 million in the previous-year quarter.

2023 Guidance Reiterated

BLKB continues to expect non-GAAP revenues to be between $1.095 billion and $1.125 billion. The Zacks Consensus Estimate is pegged at $1.11 billion.

The company projects non-GAAP adjusted EBITDA margin in the range of 30.5-31.5%.

Non-GAAP earnings per share are anticipated to be between $3.63 and $3.94. The Zacks Consensus Estimate is pegged at $3.75 per share.

Non-GAAP adjusted free cash flow for the year is forecast in the $190-$210 million band.

Zacks Rank & Other Key Picks

Blackbaud currently carries a Zacks Rank #2 (Buy).

Some other top-ranked stocks worth consideration in the broader technology space are Badger Meter BMI, Salesforce CRM and Autodesk ADSK. Badger Meter sports a Zacks Rank #1 (Strong Buy) while each of Salesforce and Intuit carries a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Badger Meter’s 2023 earnings has gained 4.8% in the past 60 days to $2.82 per share. BMI’s earnings beat the Zacks Consensus Estimate in the last four quarters, the average surprise being 6.7%. Shares of BMI have surged 66.8% in the past year.

The consensus mark for Salesforce’s fiscal 2024 earnings is pegged at $7.44 per share, up 0.5% in the past 60 days. The long-term earnings growth rate is anticipated to be 19.3%.

CRM’s earnings beat the Zacks Consensus Estimate in the last four quarters, the average surprise being 15.5%. Shares of CRM have grown 18.1% in the past year.

The consensus estimate for Autodesk’s fiscal 2024 earnings of $7.25 per share unchanged in the past 60 days. The long-term earnings growth rate is anticipated to be 24.3%.

ADSK’s earnings beat the Zacks Consensus Estimate in the last four quarters, the average beat being 2.1%. Shares of ADSK have declined 2.7% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Salesforce Inc. (CRM) : Free Stock Analysis Report

Badger Meter, Inc. (BMI) : Free Stock Analysis Report

Autodesk, Inc. (ADSK) : Free Stock Analysis Report

Blackbaud, Inc. (BLKB) : Free Stock Analysis Report