Blackbaud (BLKB) Working on AI-Enabled Impact Edge Solution

Blackbaud BLKB recently announced that it was working on a new AI-powered, social impact reporting and storytelling solution — Impact Edge.

Citing an independent, anonymous market research report, Blackbaud noted that majority of the leaders, who are in charge of managing social impact initiatives, find it difficult to collect, create and provide data across the various social impact-related endeavors.

In this scenario, Impact Edge, which utilizes generative AI, will aid businesses to gain insights in to their organization's social impact by using data from their various employee engagement programs, educational initiatives, philanthropic programs, and other reliable external data sources, added BLKB.

Impact Edge will be integrating YourCause from Blackbaud and EVERFI from Blackbaud solutions within a single tool to consolidate data gathered from all reliable sources into one centralized location. This will bolster visibility, collaboration and impact storytelling.

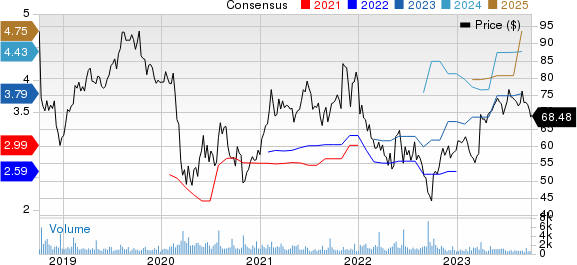

Blackbaud, Inc. Price and Consensus

Blackbaud, Inc. price-consensus-chart | Blackbaud, Inc. Quote

The company is currently working with some of its cohorts for the development of Impact Edge. The solution is designed to offer transparent data definitions, cite sources and robust data hygiene, per management. In addition to monitoring of reporting impact, businesses can track goals and past program performance and use data to formulate more effective future strategies/policies.

BLKB will be displaying a prototype of Impact Edge solution at EVERFI Impact Summit (Oct 4-6) in Miami and at bbcon 2023 (Oct 22-24) in Denver.

Blackbaud is a cloud software company that offers a full spectrum of cloud-based and on-premise software solutions, and related services for organizations of all sizes, especially social good organizations. It continues to invest heavily in cloud-based applications and software, which is expected to bolster long-term growth.

The company’s performance is being driven by momentum in transactional revenue owing to solid demand for the JustGiving platform coupled with rising volumes across other payment solutions. Frequent product launches along with rising customer renewal rates and booking bode well. Going ahead, the company is likely to benefit from cost cutting actions and its new contractual pricing approach. Also, its efforts towards rolling out AI-enabled capabilities across portfolio to help clients to upgrade fundraising are positives.

However, uncertainty prevailing over global macroeconomic conditions and unfavorable foreign currency movement are likely to weigh down on the company’s performance in the near term. Leveraged balance sheet and stiff competition are added concerns.

BLKB currently carries a Zacks Rank #2 (Buy).

In the past year, the stock has gained 31.5% compared with the Zacks sub-industry’s growth of 33.4%.

Image Source: Zacks Investment Research

Other Key Picks

Some other top-ranked stocks in the broader technology space are Asure Software ASUR, Synopsys SNPS, and VMware VMW. Each stock is sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Asure Software’s 2023 EPS has increased 35% in the past 60 days to 54 cents.

Asure Software’s earnings beat the Zacks Consensus Estimate in all the last four quarters, the average surprise being 676.4%. Shares of ASUR have surged 68.4% in the past year.

The Zacks Consensus Estimate for Synopsys’ fiscal 2023 EPS has gained 2.5% in the past 60 days to $11.09. SNPS’ long-term earnings growth rate is 16.4%. Shares of SNPS have climbed 39.8% in the past year.

The Zacks Consensus Estimate for VMware’s fiscal 2024 EPS has improved 5.9% in the past 60 days to $7.23.

VMware’s earnings outpaced the Zacks Consensus Estimate in two of the last four quarters, while missing it in the remaining quarters. The average earnings surprise stands at 1.2%. Shares of VMW have jumped 45.6% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

VMware, Inc. (VMW) : Free Stock Analysis Report

Synopsys, Inc. (SNPS) : Free Stock Analysis Report

Blackbaud, Inc. (BLKB) : Free Stock Analysis Report

Asure Software Inc (ASUR) : Free Stock Analysis Report