BlackBerry (BB) Scraps IPO Plan for IoT Unit, Appoints New CEO

BlackBerry Limited BB recently announced the appointment of John J. Giamatteo as its new chief executive officer ("CEO”) and as a member of its board of directors with immediate effect. Since October 2021, Giamatteo has served as the president of BlackBerry's Cybersecurity business division.

Interim CEO Richard Lynch will continue as the board chairman. Lynch has served as the interim CEO since Nov 4, 2023.

The company added that it will separate the IoT and Cybersecurity businesses into standalone entities but will no longer pursue IPO of the IoT business.

Spinning off businesses into separate entities will aid shareholders to analyze the performance and future potential of each business on a standalone basis. Per management, this move will also provide each entity more freedom to pursue its own growth strategy and capital allocation policy.

BlackBerry is also in the final stages of selecting a consulting firm to bring expertise and additional resources to assist in an independent assessment of the separation and right-sizing process.

BlackBerry Limited Price and Consensus

BlackBerry Limited price-consensus-chart | BlackBerry Limited Quote

The firm provides intelligent security software and services to enterprises and governments around the world. It offers devices and software platforms for managing security, mobility and communications among hardware, programs, mobile applications and IoT.

BlackBerry’s performance is being affected by softness in the Cybersecurity unit due to prolonged sales cycles, particularly within the government sector. It expects the IoT segment to be affected by delays in pre-production software development programs/production schedules at automakers in the current fiscal year. Stiff competition and weak macroeconomic conditions remain additional concerns.

The company lowered its IoT revenue guidance to the band of $225-$240 million for fiscal 2024 compared with earlier guidance of $240-$250 million.

However, management expects a stronger second-half of fiscal 2024 performance for the Cybersecurity business due to a solid pipeline of significant deals. As a result, the company has reiterated its revenue outlook for the Cybersecurity segment. Segmental revenues are estimated in the range of $425-$450 million for fiscal 2024.

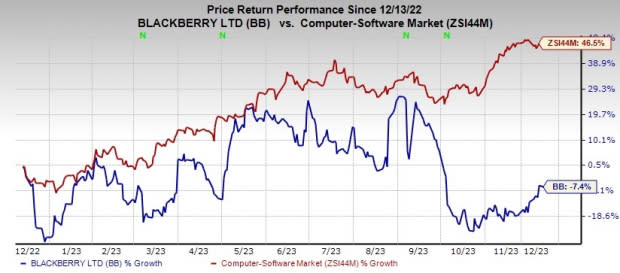

BlackBerry currently has a Zacks Rank #2 (Buy). The stock has lost 7.4% in the past year against the sub-industry’s growth of 46.5%.

Image Source: Zacks Investment Research

Other Stocks to Consider

Some other top-ranked stocks worth consideration in the broader technology space are Blackbaud BLKB, Watts Water Technologies WTS and Woodward WWD, each carrying a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for Blackbaud’s 2023 EPS improved 1.8% in the past 60 days to $3.86. BLKB’s long-term earnings growth rate is 23.4%.

Blackbaud’s earnings beat the Zacks Consensus Estimate in each of the last four quarters, the average surprise being 10.6%. Shares of BLKB have surged 49.3% in the past year.

The Zacks Consensus Estimate for Watts Water Technologies’ 2023 EPS has improved 1% in the past 30 days to $8.00. WTS’ long-term earnings growth rate is 7.8%. Shares of WTS have gained 28.4% in the past year.

The Zacks Consensus Estimate for Woodward’s fiscal 2024 EPS has improved 6.9% in the past 60 days to $4.92.

WWD’s earnings outpaced the Zacks Consensus Estimate in each of the last four quarters, the average surprise being 14.7%. Shares of WWD have jumped 39.2% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Blackbaud, Inc. (BLKB) : Free Stock Analysis Report

Watts Water Technologies, Inc. (WTS) : Free Stock Analysis Report

Woodward, Inc. (WWD) : Free Stock Analysis Report

BlackBerry Limited (BB) : Free Stock Analysis Report