BlackBerry (BB) Strengthens Canadian Government Partnership

BlackBerry Limited BB revealed an extended collaboration with the Government of Canada through a multi-year agreement. The collaboration aligns with the Government of Canada's focus on achieving net-zero emissions by 2050 and aligns with BlackBerry's commitment to being carbon neutral since 2021.

The deal was signed by the Shared Services Canada department, which is responsible for delivering secure digital IT services for the Government of Canada. The collaboration will provide federal employees with a tailored BlackBerry Cloud and expand the use of BlackBerry UEM, BlackBerry UEM Dark Site, and BlackBerry SecuSUITE for secure daily operations.

These BlackBerry solutions will play a vital role in safeguarding information within Canadian government systems. Notably, BlackBerry SecuSUITE is NATO-certified for classified secure communications, which emphasizes the company's trusted relationships with various governments globally.

BlackBerry Limited Price and Consensus

BlackBerry Limited price-consensus-chart | BlackBerry Limited Quote

The increasing demand for cybersecurity solutions bodes well for BlackBerry. Per a report from Fortune Business Insights, the global cybersecurity market is projected to grow from $172.32 billion in 2023 to $424.97 billion by 2030, at a CAGR of 13.8%.

BlackBerry provides intelligent security software and services to enterprises and governments around the world. It offers devices and software platforms for managing security, mobility and communications among hardware, programs, mobile apps and IoT.

In October, the company announced that the U.S. Department of Homeland Security had granted it a seven-year Indefinite Delivery, Indefinite Quantity contract. The contract aims to create and maintain the Super Enterprise for Personnel Emergency Notification System. BlackBerry is partnering with American Systems and 4 Points Technology to fulfill the software and services aspects of the contract.

For fiscal 2024, BlackBerry expects Cybersecurity revenues in the range of $425-$450 million. Cyber business billings growth is expected to be in the range of 7-20% due to increased uptake of security products.

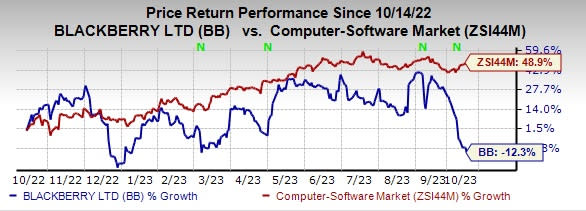

BlackBerry currently has a Zacks Rank #3 (Hold). The stock has lost 12.3% in the past year against the sub-industry’s growth of 48.9%.

Image Source: Zacks Investment Research

Stocks to Consider

Some better-ranked stocks in the broader technology space are Asure Software ASUR, Synopsys SNPS and Watts Water Technologies WTS. Asure Software and Synopsys currently sport a Zacks Rank #1 (Strong Buy), whereas Watts Water Technologies carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Asure Software’s 2023 earnings per share (EPS) has increased 5.9% in the past 60 days to 54 cents.

Asure Software’s earnings beat the Zacks Consensus Estimate in all the last four quarters, the average being 676.4%. Shares of ASUR have surged 78.5% in the past year.

The Zacks Consensus Estimate for Synopsys’ 2023 EPS has gained 2.5% in the past 60 days to $11.09. SNPS’ long-term earnings growth rate is 16.4%. Shares of SNPS have surged 72% in the past year.

The Zacks Consensus Estimate for Watts Water’s 2023 EPS has increased 1% in the past 60 days to $7.78. The company’s long-term earnings growth rate is 7.5%.

Watts Water’s earnings beat estimates in all the trailing four quarters, delivering an average surprise of 12.5%. Shares of WTS have rallied 42.4% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Synopsys, Inc. (SNPS) : Free Stock Analysis Report

Asure Software Inc (ASUR) : Free Stock Analysis Report

Watts Water Technologies, Inc. (WTS) : Free Stock Analysis Report

BlackBerry Limited (BB) : Free Stock Analysis Report