BlackBerry (BB) Unveils AI-Driven Cybersecurity Assistant

BlackBerry Limited BB unveiled its latest AI-driven assistant designed for Security Operations Center (SOC) teams, which is backed by Generative AI technology that offers cyber threat analysis and support as well as improves the effectiveness of Chief Information Security Officers (“CISO”) operations.

The system utilizes private, extensive language models to ensure precision and safeguard data privacy. BlackBerry's Cylance AI customers can leverage the system to predict user needs, deliver timely information without manual queries and drastically reduce research time.

The system is integrated into the Cylance Console, which will streamline workflows and elevate the user experience beyond traditional chatbot interactions, added the company. This solution will likely help to modernize SOC operations, empowering organizations to stay ahead of cyber threats and aiding CISOs in overcoming resource constraints amid a constantly evolving threat landscape. The initial release of BlackBerry's Generative AI-powered cybersecurity assistant will be limited to a select group of customers.

BlackBerry Limited Price and Consensus

BlackBerry Limited price-consensus-chart | BlackBerry Limited Quote

Per a report from Allied Market Research, the global generative AI market was valued at $10.5 billion in 2022 and is projected to reach $191.8 billion by 2032 at a CAGR of 34.1% from 2023 to 2032. This will likely boost demand for the company’s AI-driven solutions.

BlackBerry provides intelligent security software and services to enterprises and governments around the world. It offers devices and software platforms for managing security, mobility and communications among hardware, programs, mobile apps and the Internet of Things (IoT).

In October, the company announced significant advancements in Unified Endpoint Management (UEM) — BlackBerry UEM at the edge and BlackBerry UEM for the IoT. It will likely help to enhance productivity and security by bringing workloads closer to end-users.

For fiscal 2024, BlackBerry expects Cybersecurity revenues in the range of $425-$450 million. Cyber business billings growth is expected to be in the range of 7-20% due to increased uptake of security products.

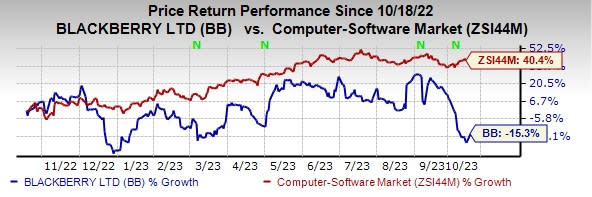

BlackBerry currently has a Zacks Rank #3 (Hold). The stock has lost 15.3% in the past year against the sub-industry’s growth of 40.4%.

Image Source: Zacks Investment Research

Stocks to Consider

Some better-ranked stocks in the broader technology space are Asure Software ASUR, Synopsys SNPS and Watts Water Technologies WTS. Asure Software and Synopsys currently sport a Zacks Rank #1 (Strong Buy), whereas Watts Water Technologies carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Asure Software’s 2023 earnings per share (EPS) has increased 5.9% in the past 60 days to 54 cents.

Asure Software’s earnings beat the Zacks Consensus Estimate in all the last four quarters, the average being 676.4%. Shares of ASUR have surged 78.5% in the past year.

The Zacks Consensus Estimate for Synopsys’ 2023 EPS has gained 2.5% in the past 60 days to $11.09. SNPS’ long-term earnings growth rate is 16.4%. Shares of SNPS have surged 72% in the past year.

The Zacks Consensus Estimate for Watts Water’s 2023 EPS has increased 1% in the past 60 days to $7.78. The company’s long-term earnings growth rate is 7.5%.

Watts Water’s earnings beat estimates in all the trailing four quarters, delivering an average surprise of 12.5%. Shares of WTS have rallied 42.4% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Synopsys, Inc. (SNPS) : Free Stock Analysis Report

Asure Software Inc (ASUR) : Free Stock Analysis Report

Watts Water Technologies, Inc. (WTS) : Free Stock Analysis Report

BlackBerry Limited (BB) : Free Stock Analysis Report