BlackBerry's (BB) H2M IS to Aid in Hazardous Material Tracking

BlackBerry Limited BB unveiled a new series of BlackBerry Radar devices, H2M IS, which is designed specifically for hazardous materials carriers. It is an asset monitoring solution which provides real-time information through a user-friendly dashboard.

These devices have an 'Intrinsically Safe' certification, which makes them suitable for transportation and logistics companies dealing with hazardous materials like fuel transporters, tank carriers, ocean shipping lines, and railroads.

The 'Intrinsically Safe' certification, specifically at the C1/D1 level, represents the highest safety standard for transporting hazardous goods. BlackBerry Radar is also compliant with the IECEx/ATEX Zone 0/UL913 safety class that allows for safe operation in hazardous and explosive environments.

BlackBerry Limited Price and Consensus

BlackBerry Limited price-consensus-chart | BlackBerry Limited Quote

The H2M IS may assist the U.S. rail industry in addressing the increased regulatory scrutiny due to safety incidents. The Association of American Railroads has mandated that all telematics device installations on Class 1 railroads after Jan 1, 2024, must meet the safety recommendations of the American National Standard Institute.

The H2M IS builds upon the existing capabilities of BlackBerry's Radar H2 device, offering additional features such as sensor readings that provide valuable cargo status information, railcar brake status, and impact event data. Also, early access versions of these devices are currently available to select customers and general availability is expected in Fall 2023.

Headquartered in Waterloo, Canada, BB provides intelligent security software and services to enterprises and governments worldwide. It offers devices and software platforms for managing security, mobility and communications among hardware, mobile apps and the Internet of Things.

In April, the company announced a new integration between its CylanceGUARD Managed Detection and Response and Critical Event Management system, which is powered by BlackBerry AtHoc. The integration with CylanceGUARD will allow users to swiftly initiate incident reaction plans and transmit secure “out-of-band” communications for critical situations.

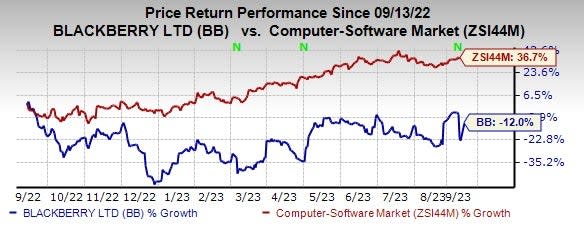

BlackBerry currently has a Zacks Rank #3 (Hold). Shares of the company have lost 12.1% in the past year against the sub-industry’s growth of 36.7%.

Image Source: Zacks Investment Research

Stocks to Consider

Some better-ranked stocks in the broader technology space are Woodward WWD, Aspen Technology AZPN and Badger Meter BMI. Woodward presently sports a Zacks Rank #1 (Strong Buy), whereas Badger Meter and Aspen Technology currently carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Woodward’s fiscal 2023 earnings per share (EPS) has increased 15.9% in the past 60 days to $4.15.

WWD’s long-term earnings growth rate is 13.5%. Shares of WWD have gained 37.6% in the past year.

The Zacks Consensus Estimate for Aspen Technology’s fiscal 2024 EPS has increased 5.8% in the past 60 days to $6.58.

Aspen Technology’s long-term earnings growth rate is 17.1%. Shares of AZPN have declined 12.6% in the past year.

The Zacks Consensus Estimate for Badger Meter’s 2023 EPS has increased 6.3% in the past 60 days to $2.86.

Badger Meter’s earnings beat the Zacks Consensus Estimate in all the last four quarters, the average being 6.7%. Shares of BMI have surged 69.5% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Badger Meter, Inc. (BMI) : Free Stock Analysis Report

Woodward, Inc. (WWD) : Free Stock Analysis Report

Aspen Technology, Inc. (AZPN) : Free Stock Analysis Report

BlackBerry Limited (BB) : Free Stock Analysis Report