BlackRock Inc. Acquires Significant Stake in Codexis Inc.

BlackRock Inc. (Trades, Portfolio), a leading global investment management corporation, has recently increased its stake in Codexis Inc., a prominent player in the biotechnology industry. This article provides an in-depth analysis of the transaction, profiles of both BlackRock Inc. (Trades, Portfolio) and Codexis Inc., and an examination of Codexis Inc.'s financial health and stock performance.

Details of the Transaction

On July 31, 2023, BlackRock Inc. (Trades, Portfolio) added 882,588 shares of Codexis Inc. to its portfolio at a trade price of $3.6 per share. This transaction increased BlackRock's total holdings in Codexis to 6,932,344 shares, representing 10.40% of the company's stock. Despite the significant share change, the impact on BlackRock's portfolio was not substantial due to the size and diversity of its holdings.

Profile of BlackRock Inc. (Trades, Portfolio)

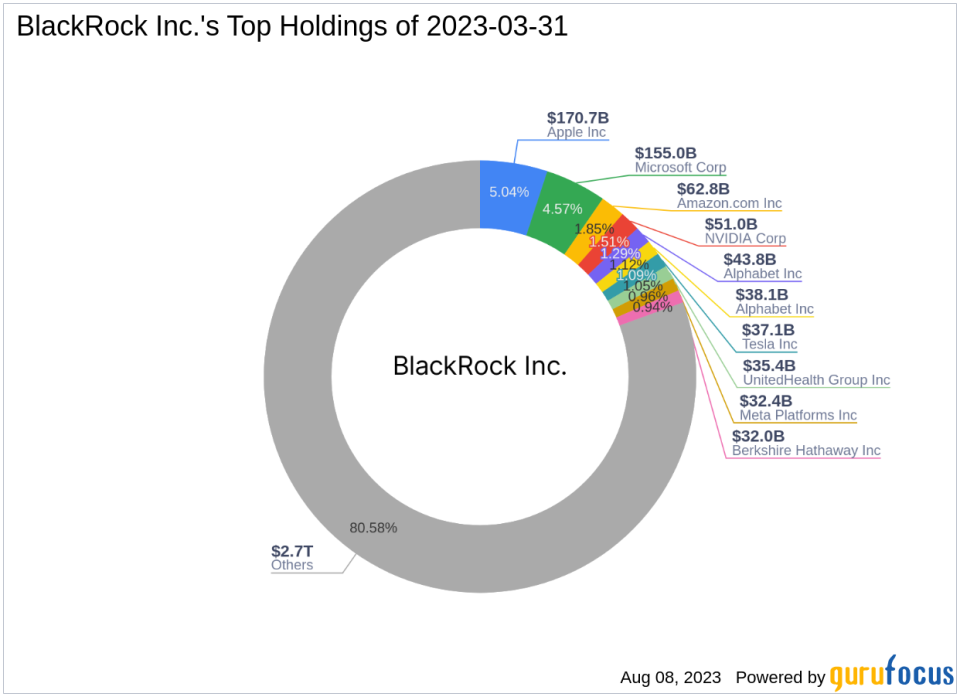

Founded in 1988, BlackRock Inc. (Trades, Portfolio) is a renowned investment management corporation operating through a vast group of subsidiaries. The firm's risk management division, BlackRock Solutions, monitors about 7% of the world's total financial assets. With 21 investment centers and 70 offices in 30 countries, BlackRock has a significant presence in virtually every financial market globally. The firm's top holdings include Apple Inc., Amazon.com Inc., Alphabet Inc., Microsoft Corp., and NVIDIA Corp., primarily in the technology and healthcare sectors. BlackRock's equity stands at a staggering $3,388.31 trillion.

Profile of Codexis Inc.

Codexis Inc., a U.S.-based biotechnology company, specializes in providing enzyme optimization services, commercializing proteins, and developing biocatalyst products. Since its IPO on April 22, 2010, the company has grown to a market capitalization of $159.852 million. However, the company's stock performance has been less than stellar, with a year-to-date price change ratio of -50.96% and a price change ratio of -82.38% since its IPO. The company's GF Score stands at 65/100, indicating a moderate future performance potential.

Financial Health of Codexis Inc.

Examining Codexis Inc.'s financial health, the company's Financial Strength rank stands at 5/10, while its Profitability Rank is at 3/10. The company's Growth Rank is relatively higher at 7/10. Codexis Inc.'s cash to debt ratio is 2.25, ranking 1080th in the industry. However, the company's GF Value Rank is low at 2/10, indicating that the stock may be overvalued.

Stock Performance of Codexis Inc.

Despite the company's growth, Codexis Inc.'s stock performance has been underwhelming. The stock's gain percent since the transaction stands at -36.39%. The company's Momentum Rank is 4/10, indicating a lack of positive momentum in the stock's price. The company's RSI 14 Day Rank is 329, suggesting that the stock is currently oversold.

Conclusion

In conclusion, BlackRock Inc. (Trades, Portfolio)'s acquisition of additional shares in Codexis Inc. represents a significant investment in the biotechnology sector. Despite Codexis Inc.'s lackluster stock performance and financial health, BlackRock's investment could potentially stimulate growth and stability in the company. However, investors should exercise caution due to Codexis Inc.'s low GF Value Rank and Momentum Rank. As always, it is crucial to conduct thorough research and consider various factors before making investment decisions.

This article first appeared on GuruFocus.