BlackRock Inc. Boosts Stake in Southern First Bancshares Inc.

BlackRock Inc. (Trades, Portfolio), a leading global investment management corporation, recently added a substantial number of shares in Southern First Bancshares Inc. (NASDAQ:SFST) to its portfolio. This article provides an in-depth analysis of the transaction, the profiles of both companies, and the potential implications of this significant move.

Details of the Transaction

On July 31, 2023, BlackRock Inc. (Trades, Portfolio) purchased 138,168 shares of Southern First Bancshares Inc. at a traded price of $30.18 per share. This transaction resulted in a 20.66% increase in BlackRock's holdings of the bank's stock, bringing its total shares to 806,965. However, the impact of this transaction on BlackRock's portfolio is currently not applicable. The firm now holds a 10.00% stake in Southern First Bancshares Inc.

Profile of BlackRock Inc. (Trades, Portfolio)

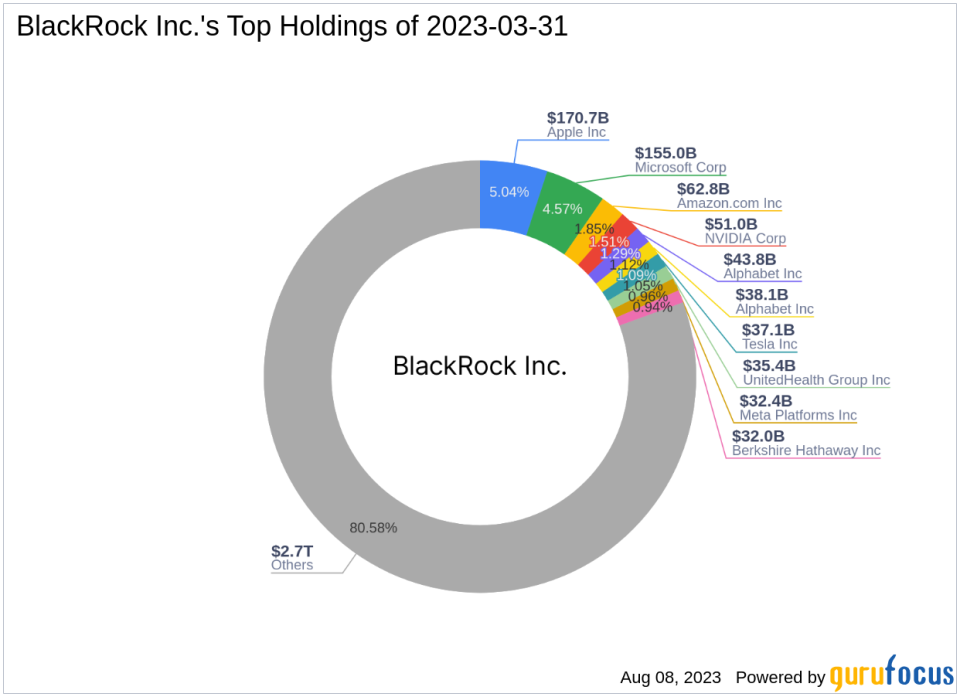

Founded in 1988, BlackRock Inc. (Trades, Portfolio) is a renowned investment management corporation that operates through a vast network of subsidiaries. The firm's investment philosophy is rooted in risk management, with its platform monitoring about 7% of the world's total financial assets. BlackRock has a significant presence in virtually every financial market globally, with 21 investment centers and 70 offices in 30 countries. The firm's top holdings include Apple Inc., Amazon.com Inc., Alphabet Inc., Microsoft Corp., and NVIDIA Corp. As of the date of this article, BlackRock's equity stands at a staggering $3,388.31 trillion, with Technology and Healthcare being its top sectors.

Profile of Southern First Bancshares Inc.

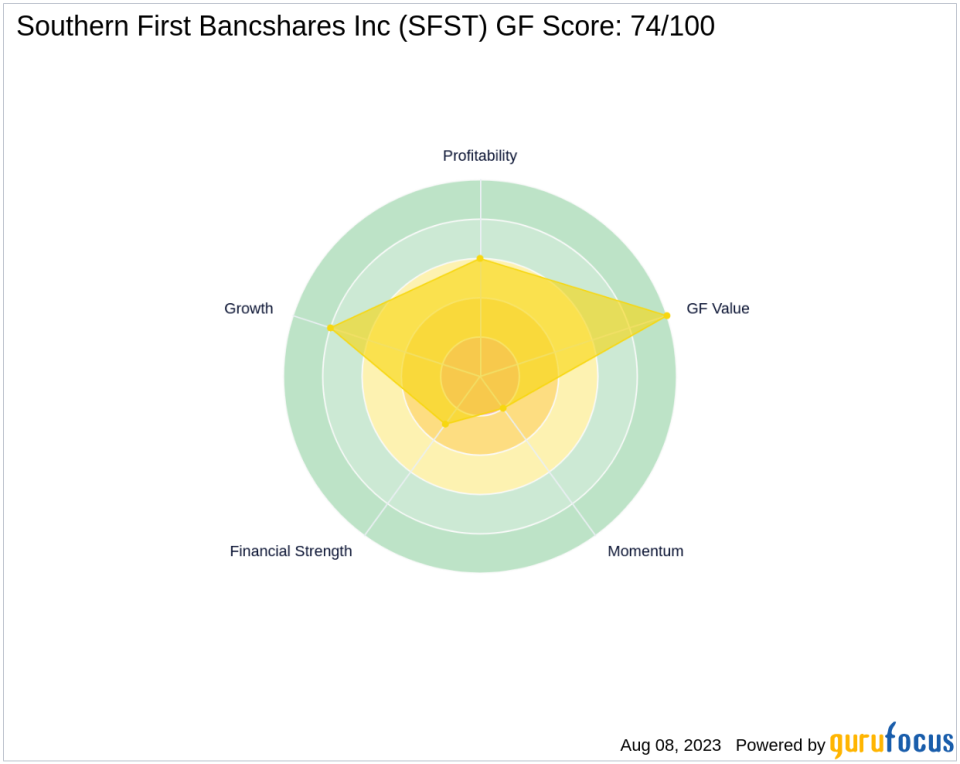

Southern First Bancshares Inc., a bank holding company based in the USA, primarily serves as the holding company for Southern First Bank. The bank provides a range of commercial, consumer, and mortgage loans to the general public. As of the date of this article, the company's market capitalization stands at $241.081 million, with a current stock price of $29.85. The company's Profitability Rank is 6/10, its Growth Rank is 8/10, and its GF Value Rank is 10/10. The company's GF Score is 74/100, indicating future potential that is average.

Analysis of the Stock's Performance

Since its Initial Public Offering (IPO) on October 28, 1999, Southern First Bancshares Inc.'s stock has seen a significant price change ratio of 524.48%. However, the year-to-date price change ratio stands at -33.74%. Since the transaction, the stock's price has decreased by 1.09%. The stock is currently modestly undervalued, with a GF Value of $42.01 and a Price to GF Value ratio of 0.71.

Comparison with Other Gurus

Hotchkis & Wiley Capital Management LLC is the guru with the most shares of Southern First Bancshares Inc. Other notable gurus who also hold the traded stock include Mario Gabelli (Trades, Portfolio).

Conclusion

In conclusion, BlackRock Inc. (Trades, Portfolio)'s recent acquisition of a significant stake in Southern First Bancshares Inc. is a noteworthy move that could potentially influence both the stock's performance and the firm's portfolio. As always, investors are advised to conduct their own comprehensive research before making investment decisions.

This article first appeared on GuruFocus.