BlackRock Inc. Boosts Stake in VSE Corp

BlackRock Inc. (Trades, Portfolio), a leading global investment management corporation, has recently increased its holdings in VSE Corp. This article provides an in-depth analysis of the transaction, profiles of both BlackRock Inc. (Trades, Portfolio) and VSE Corp, and an overview of the Aerospace & Defense industry. We will also compare VSE Corp's performance with the industry average and other gurus' investments in the company.

Transaction Details

On July 31, 2023, BlackRock Inc. (Trades, Portfolio) added 3,164 shares of VSE Corp to its portfolio at a trade price of $53.75 per share. This transaction increased BlackRock's total holdings in VSE Corp to 743,627 shares, representing 4.80% of the company's outstanding shares. However, the impact on BlackRock's portfolio was negligible, as VSE Corp's shares account for a small fraction of the firm's total equity of $3,388.31 trillion.

Profile of BlackRock Inc. (Trades, Portfolio)

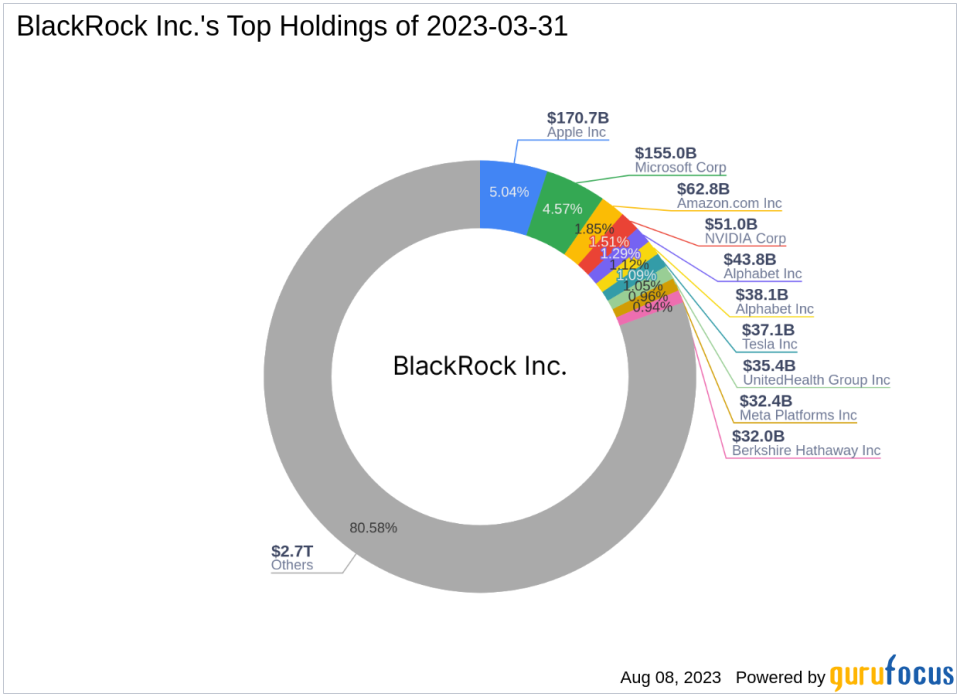

Founded in 1988, BlackRock Inc. (Trades, Portfolio) is a renowned investment management corporation operating through a vast group of subsidiaries. The firm's risk management division, BlackRock Solutions, monitors about 7% of the world's total financial assets. BlackRock has a significant presence in virtually every financial market worldwide, with 21 investment centers, 70 offices in 30 countries, and clients spanning over 100 countries. The firm's top holdings include Apple Inc, Amazon.com Inc, Alphabet Inc, Microsoft Corp, and NVIDIA Corp, primarily in the Technology and Healthcare sectors.

Profile of VSE Corp

VSE Corp is a diversified aftermarket products and services company providing repair services, parts distribution, logistics, supply chain management, and consulting services for land, sea, and air transportation assets to commercial and government markets. The company operates through three segments: Aviation, Federal and Defense, and Fleet. As of August 8, 2023, VSE Corp has a market capitalization of $844.185 million and a stock price of $53.62. The company's PE percentage stands at 21.45, indicating that it is profitable. According to GuruFocus, VSE Corp is fairly valued with a GF Value of $51.24 and a Price to GF Value ratio of 1.05. The company's stock has gained 15.06% year-to-date and a staggering 9649.09% since its IPO in 1995.

Stock Analysis

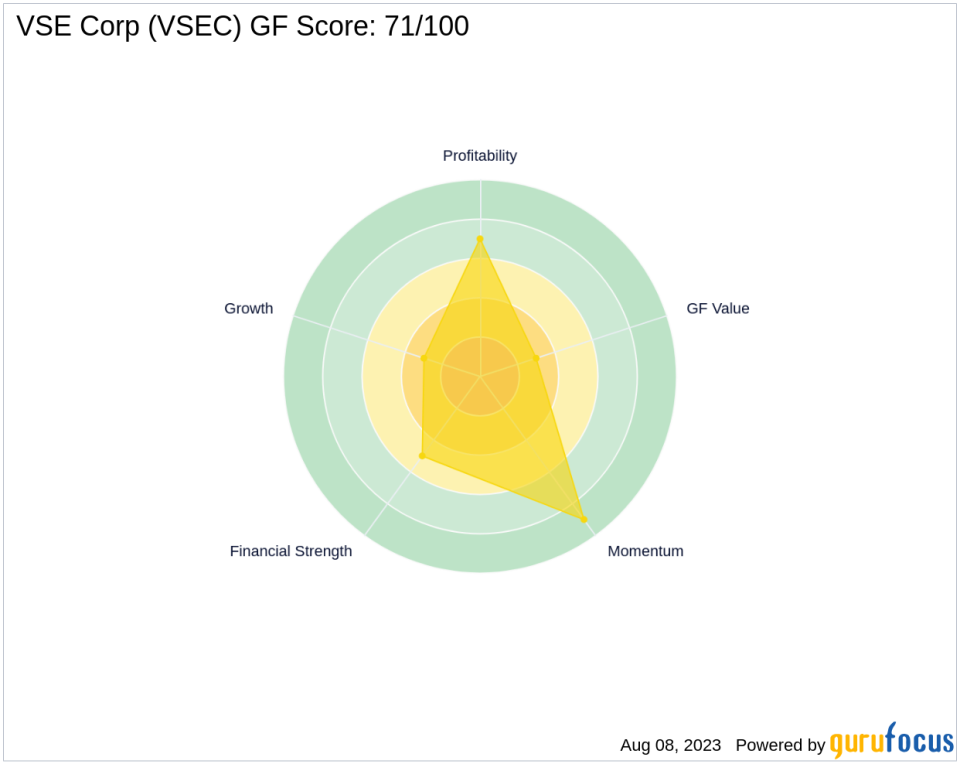

VSE Corp's stock has a GF Score of 71/100, indicating good outperformance potential. The company's Financial Strength is ranked 5/10, while its Profitability Rank is 7/10. The company's Growth Rank is 3/10, and its GF Value Rank is 3/10. VSE Corp's Momentum Rank is 9/10, indicating strong momentum in its stock price.

The company's financial health is reflected in its Piotroski F-Score of 4 and Altman Z score of 2.91. VSE Corp's interest coverage ratio is 2.85, and its cash to debt ratio is 0.01. The company's ROE and ROA are 7.16% and 3.21%, respectively.

Industry Analysis

VSE Corp operates in the Aerospace & Defense industry, a sector known for its high barriers to entry and steady demand. Despite the company's negative gross margin growth and operating margin growth, its 3-year revenue growth stands at 2.80%, indicating potential for future profitability.

Other Gurus' Investments

BlackRock Inc. (Trades, Portfolio) is not the only guru investing in VSE Corp. Other notable investors include First Eagle Investment (Trades, Portfolio) Management, LLC, Keeley-Teton Advisors, LLC (Trades, Portfolio), Steven Scruggs (Trades, Portfolio), and Ken Fisher (Trades, Portfolio). Their investments in VSE Corp further validate the company's potential for growth and profitability.

Conclusion

In conclusion, BlackRock Inc. (Trades, Portfolio)'s recent acquisition of VSE Corp shares is a strategic move that could potentially enhance the firm's portfolio performance. Despite VSE Corp's mixed financial indicators, the company's strong momentum and growth potential make it an attractive investment. However, investors should always conduct their own due diligence before making investment decisions.

This article first appeared on GuruFocus.