BlackRock Inc. Increases Stake in Artisan Partners Asset Management Inc.

BlackRock Inc. (Trades, Portfolio), a leading global investment management corporation, has recently increased its stake in Artisan Partners Asset Management Inc. (NYSE:APAM). This article provides an in-depth analysis of the transaction, the profiles of both companies, and the potential implications for value investors.

Transaction Details

On July 31, 2023, BlackRock Inc. (Trades, Portfolio) added 2,254,196 shares of Artisan Partners Asset Management Inc. to its portfolio at a trade price of $41.49 per share. This transaction increased BlackRock's total holdings in APAM to 7,244,312 shares, representing 10.60% of the company's outstanding shares. Despite the significant share change, the impact on BlackRock's portfolio was minimal, with APAM accounting for just 0.01% of its total holdings.

Profile of BlackRock Inc. (Trades, Portfolio)

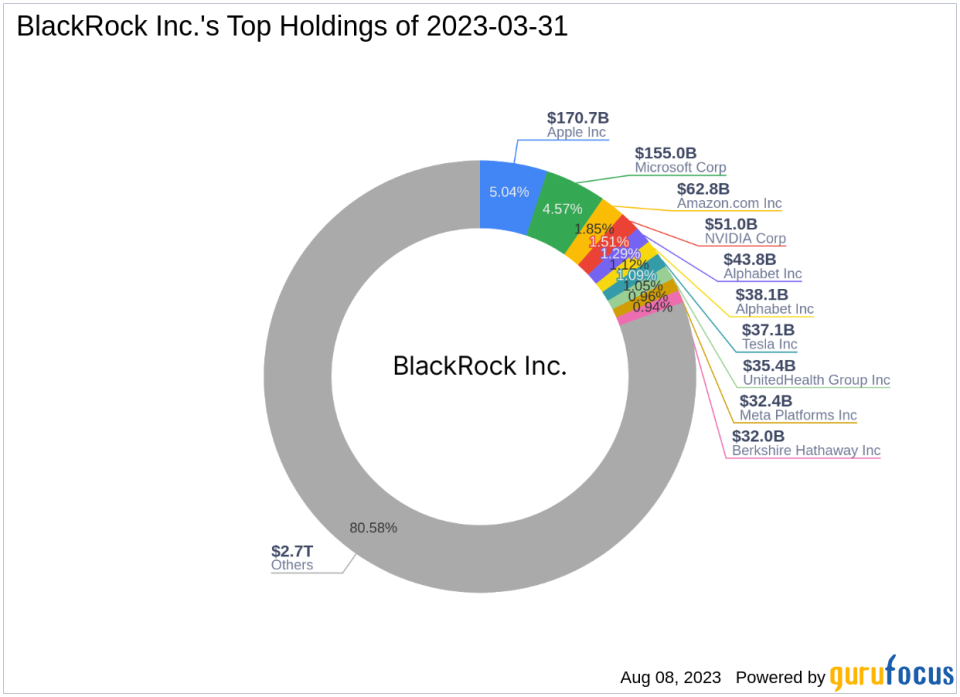

Founded in 1988, BlackRock Inc. (Trades, Portfolio) is a renowned investment management corporation that operates through a large group of subsidiaries. The firm's investment philosophy is rooted in risk management, with its platform monitoring about 7% of the world's total financial assets. As of the date of this article, BlackRock holds 5,334 stocks in its portfolio, with a total equity of $3,388.31 trillion. The firm's top holdings include Apple Inc., Amazon.com Inc., Alphabet Inc., Microsoft Corp., and NVIDIA Corp. The technology and healthcare sectors dominate BlackRock's portfolio.

Profile of Artisan Partners Asset Management Inc.

Artisan Partners Asset Management Inc. is a global investment management firm that offers a range of investment strategies to clients around the world. The company's business is primarily divided into two segments: management fees and performance fees. As of the date of this article, APAM has a market capitalization of $2.62 billion and a stock price of $38.29. The company's PE percentage stands at 13.25, indicating that it is currently profitable. According to GuruFocus, APAM is fairly valued with a GF Value of 35.61 and a price to GF Value of 1.08.

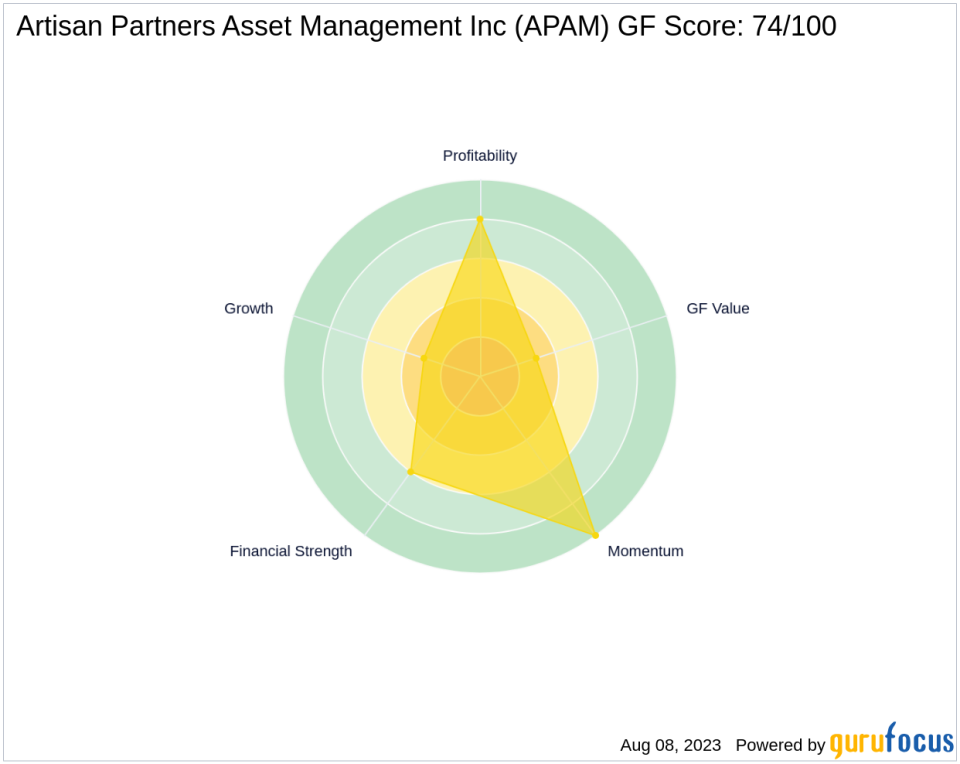

Artisan Partners Asset Management Inc.'s Financial Health

Artisan Partners Asset Management Inc. has a balance sheet rank of 6/10, a profitability rank of 8/10, and a growth rank of 3/10. The company's GF Value Rank and momentum rank are 3/10 and 10/10, respectively. APAM's Piotroski F-Score is 5, and its Altman Z score is 3.23, indicating a low risk of bankruptcy. The company's cash to debt ratio is 0.63, and its interest coverage is 33.72, suggesting that it can comfortably meet its interest payments.

Overview of the Asset Management Industry

The asset management industry is a critical component of the global financial system, providing a range of investment strategies to diverse clients. Artisan Partners Asset Management Inc. has established a strong position within this industry, offering both long-only equity investment strategies and a fixed-income strategy.

Other Gurus' Involvement

Other notable gurus, such as Fisher Asset Management, LLC and HOTCHKIS & WILEY, also hold shares in Artisan Partners Asset Management Inc. Their involvement could potentially influence the stock's performance and BlackRock's investment strategy.

Conclusion

In conclusion, BlackRock Inc. (Trades, Portfolio)'s recent acquisition of shares in Artisan Partners Asset Management Inc. is a significant move that could potentially impact both the stock and the guru's portfolio. With APAM's strong financial health and position within the asset management industry, this transaction could offer promising returns for BlackRock. However, as with any investment, it is crucial for investors to conduct their own due diligence and consider the potential risks involved.

This article first appeared on GuruFocus.