BlackRock Inc. Reduces Stake in Seneca Foods Corp

BlackRock Inc. (Trades, Portfolio), a leading investment management corporation, has recently reduced its stake in Seneca Foods Corp. This article will provide an in-depth analysis of the transaction, the profiles of both BlackRock Inc. (Trades, Portfolio) and Seneca Foods Corp, and the implications of the transaction for both entities.

Transaction Details

On July 31, 2023, BlackRock Inc. (Trades, Portfolio) reduced its holdings in Seneca Foods Corp by 58.91%, selling 566,937 shares at a price of $38.565 per share. This left BlackRock Inc. (Trades, Portfolio) with a total of 395,516 shares in Seneca Foods Corp, representing 6.70% of their holdings in the company. Despite the significant reduction, the transaction had no impact on BlackRock Inc. (Trades, Portfolio)'s portfolio.

Profile of BlackRock Inc. (Trades, Portfolio)

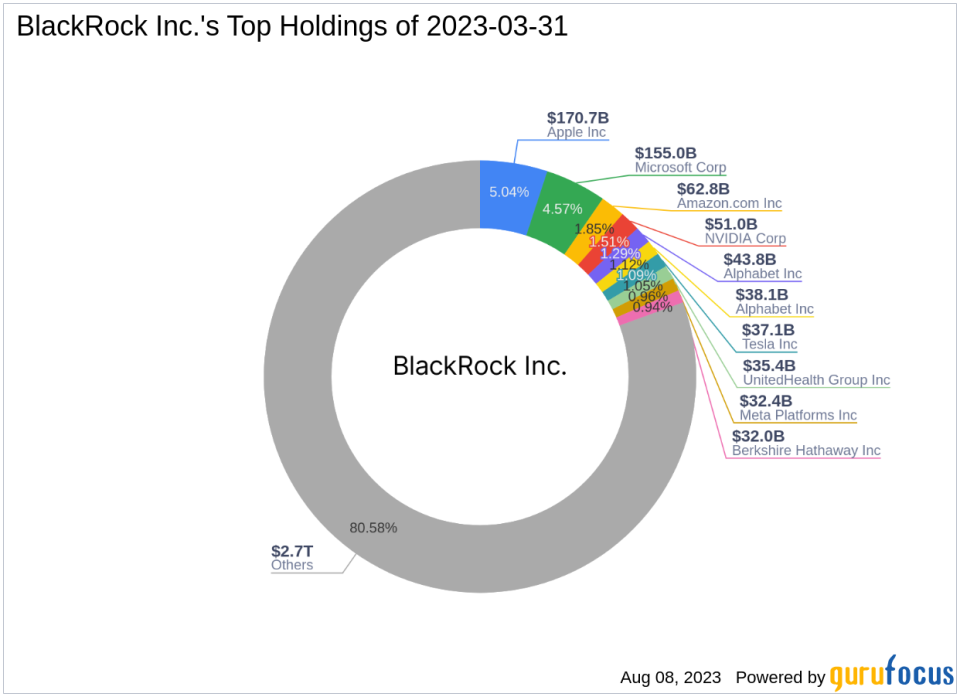

Founded in 1988, BlackRock Inc. (Trades, Portfolio) is a global investment management corporation that operates through a large group of subsidiaries. The firm's investment philosophy is rooted in risk management, with its platform monitoring about 7% of the world's total financial assets. As of the date of this article, BlackRock Inc. (Trades, Portfolio) holds 5334 stocks in its portfolio, with a total equity of $3,388.31 trillion. The firm's top holdings include Apple Inc., Amazon.com Inc., Alphabet Inc., Microsoft Corp., and NVIDIA Corp. The technology and healthcare sectors dominate BlackRock Inc. (Trades, Portfolio)'s portfolio.

Profile of Seneca Foods Corp

Seneca Foods Corp is a US-based provider of packaged fruits and vegetables. The company's product offerings include canned, frozen, and bottled produce, as well as snack chips. As of the date of this article, Seneca Foods Corp has a market capitalization of $304.505 million and a stock price of $40.1. The company's PE percentage stands at 32.87, indicating a profitable operation. According to GuruFocus, Seneca Foods Corp is significantly undervalued, with a GF Value of 62.18.

Analysis of Seneca Foods Corp's Stock Performance

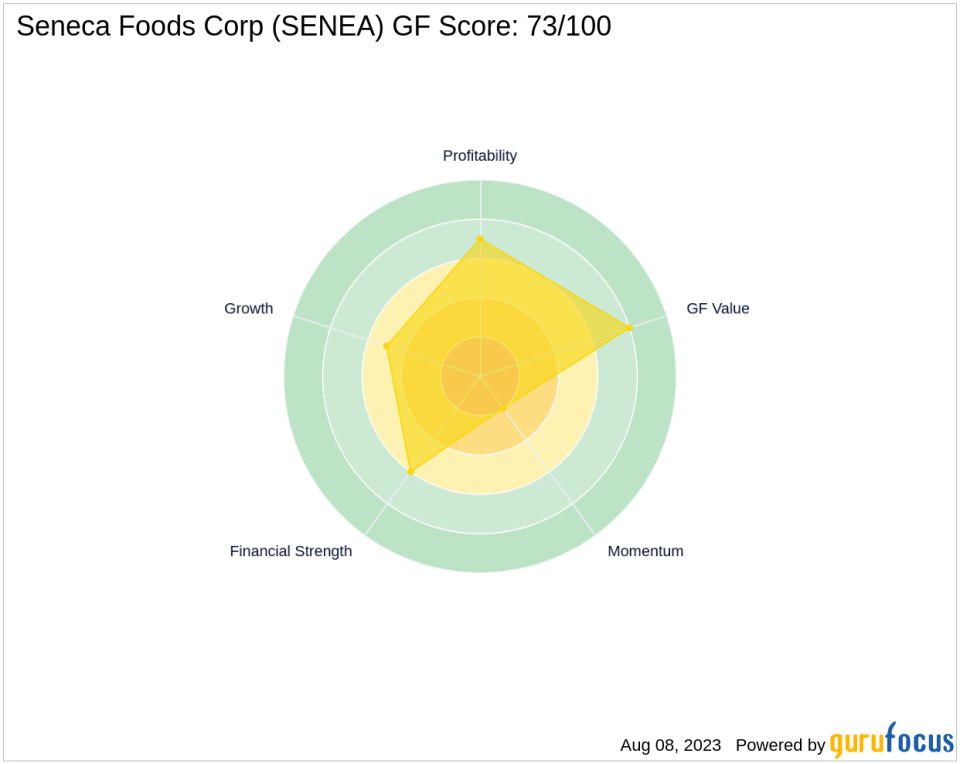

Seneca Foods Corp's stock performance shows a gain of 3.98% since the transaction and a 100.5% increase since its Initial Public Offering (IPO) in 1995. However, the stock has seen a year-to-date decrease of 36.15%. The company's GF Score is 73/100, indicating a likely average performance. The company's Financial Strength is ranked 6/10, its Profitability Rank is 7/10, and its Growth Rank is 5/10. The GF Value Rank is 8/10, while the Momentum Rank is 2/10.

Analysis of Seneca Foods Corp's Financial Health

Seneca Foods Corp's financial health is characterized by a Piotroski F-Score of 4 and an Altman Z score of 3.04. The company's cash to debt ratio is 0.03, and its interest coverage is 1.67. The company's ROE is 5.73, and its ROA is 2.79. Seneca Foods Corp has seen a gross margin growth of 16.10, but its operating margin growth is 0.00. The company's revenue growth over the past three years is 10.00, while its EBITDA growth over the same period is 3.20. However, the company's earnings growth over the past three years is -8.40.

Conclusion

In conclusion, BlackRock Inc. (Trades, Portfolio)'s recent reduction in its stake in Seneca Foods Corp is a significant transaction that has implications for both entities. Despite the reduction, Seneca Foods Corp remains a part of BlackRock Inc. (Trades, Portfolio)'s portfolio, and the transaction does not significantly impact the firm's overall holdings. Seneca Foods Corp's financial health and stock performance indicate a company with potential for growth, despite some challenges. As always, investors are advised to conduct their own thorough research before making investment decisions.

This article first appeared on GuruFocus.