BlackRock TCP (TCPC), BlackRock Capital (BKCC) Sign Merger Deal

BlackRock TCP Capital Corp. TCPC has entered into an agreement with BlackRock Capital Investment Corporation BKCC, wherein BKCC will merge with and into a wholly-owned indirect subsidiary of TCPC. The completion of the deal, subject to the approval of TCPC and BKCC shareholders, HSR Act approval and satisfaction of other customary closing conditions, is expected in the first quarter of 2024.

Following the merger, BlackRock TCP Capital will continue to trade under the ticker TCPC and the surviving entity will continue as a subsidiary of TCPC.

Deal Details

Per the terms of the deal, BKCC shareholders will receive newly issued shares of TCPC common stock based on the ratio of the BKCC net asset value (“NAV”) per share divided by the TCPC NAV per share, each determined shortly before closing.

Thus, the merger will result in an ownership split of the combined company proportional to each of TCPC’s and BKCC’s respective NAVs.

In relation to the merger, TCPC’s advisor, a wholly-owned indirect subsidiary of BlackRock, Inc. BLK, agreed to some shareholder-friendly actions, which include a reduction in the base management fee rate from 1.50% to 1.25% on assets equal to or below 200% of the NAV of TCPC, with no change to the basis of the calculation.

It includes a waiver of all or a portion of its advisory fees to the extent the adjusted net investment income of TCPC on a per-share basis is less than 32 cents per share in any of the first four fiscal quarters ending after the closing of the transaction, to the extent there are sufficient advisory fees to cover such deficit; and coverage of 50% of merger transaction costs for both TCPC and BKCC, up to a combined cap of $6 million.

Before the closing of the deal, TCPC and BKCC intend to maintain usual course of declaring and paying quarterly dividends and, to the extent necessary, will declare any special distributions required to distribute sufficient taxable income to continue to comply with each of its regulated investment company statuses.

Following the merger, the combined company is expected to have enhanced scale and a large asset base, including total assets of $2.4 billion and net assets of $1.1 billion.

Moreover, the combined company will likely have better access to capital, including the potential to access debt financing on more favorable terms.

The merger is expected to drive meaningful operating synergies via the elimination or reduction of redundant expenses.

The merger is expected to drive accretion of net investment income over time through reduced management fees, lower combined operating expenses and opportunities to grow the portfolio through combined leverage capacity.

Management Comments

Rajneesh Vig, the co-head of US private capital for BLK and chairman and CEO of BlackRock TCP Capital, stated, “We are very excited to announce the transaction between BlackRock TCP Capital Corp. and BlackRock Capital Investment Corporation. This is an opportune time to combine our companies. With BCIC having successfully transformed its portfolio, our investment portfolios are now closely aligned. We believe this transaction positions the combined companies for sustained growth and will create meaningful value for the shareholders of both companies.”

James Keenan, the interim CEO of BlackRock Capital Investment, said, “This transaction continues our commitment to build a best-in-class platform that offers clients products and solutions to capitalize on the expanding opportunities in private debt. Over the past 20 years, BlackRock has built leading private debt capabilities to help our clients achieve their investment objectives by aligning our proven investment excellence with long-term market opportunities. This merger is a strategic next step in the growth and evolution of our business development company platform, which is an important part of our Global Private Debt business.”

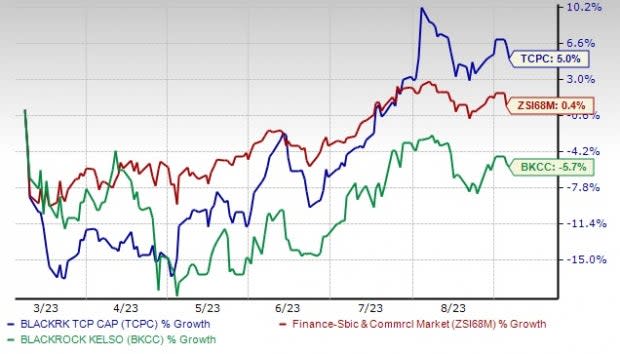

Over the past six months, shares of TCPC have gained 5% whereas the BKCC stock has lost 5.7% compared with the industry’s 0.4% growth.

Image Source: Zacks Investment Research

Currently, TCPC and BKCC, each carry a Zacks Rank #2 (Buy) and BLK carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

BlackRock, Inc. (BLK) : Free Stock Analysis Report

BLACKROCK TCP CAPITAL CORP. (TCPC) : Free Stock Analysis Report

BlackRock Capital Investment Corporation (BKCC) : Free Stock Analysis Report