Blackstone Mortgage Trust Inc's Meteoric Rise: Unpacking the 29% Surge in Just 3 Months

Blackstone Mortgage Trust Inc (NYSE:BXMT), a prominent player in the REITs industry, has seen a significant surge in its stock price over the past three months. The company's market cap stands at $4.02 billion, with its stock price currently at $23.32. Over the past week, the stock price has seen a gain of 6.70%, and over the past three months, it has risen by an impressive 29.38%.

GF Value and Valuation

The GF Value, defined by GuruFocus.com, calculates a stock's intrinsic value using historical multiples, past performance adjustments, and future business estimates. The current GF Value of Blackstone Mortgage Trust Inc is $34.06, up from $32.66 three months ago. Despite the increase in stock price, the GF Valuation indicates that the stock is still significantly undervalued, similar to its status three months ago.

Company Overview

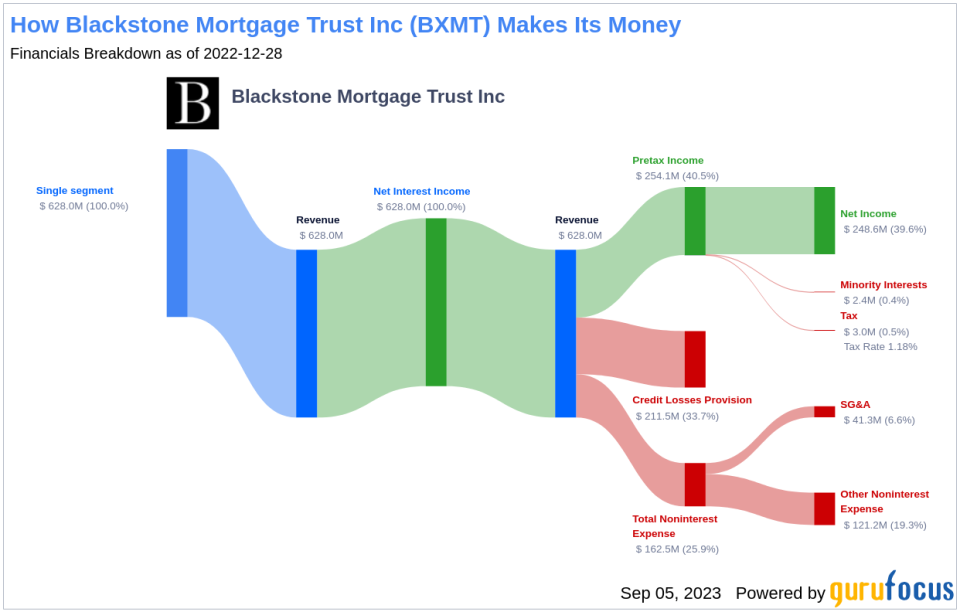

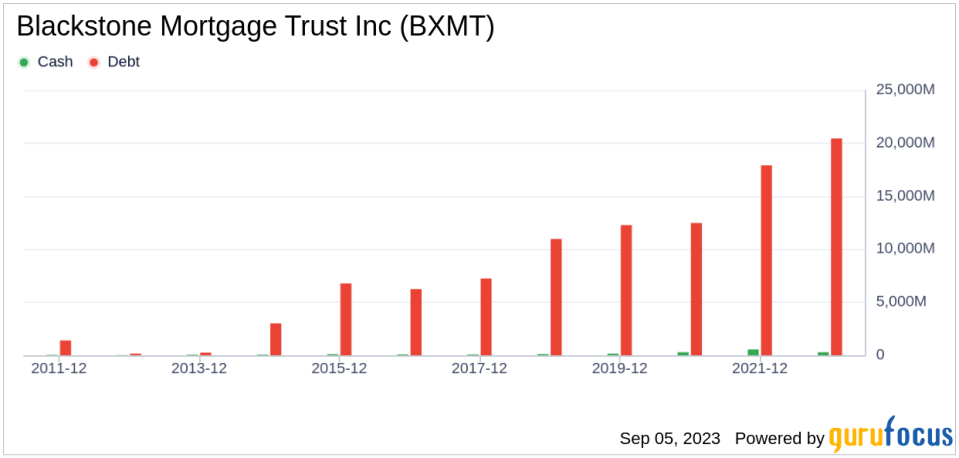

Blackstone Mortgage Trust Inc is a real estate finance company primarily involved in the origination and purchase of senior loans collateralized by commercial properties in North America, Europe, and Australia. The vast majority of the company's asset portfolio is comprised of floating rate loans secured by priority mortgages. These mortgages are mainly derived from office, hotel, and manufactured housing properties. A significant percentage of the collateralized real estate properties are located in New York, California, and the United Kingdom. Blackstone Mortgage Trust is managed by a subsidiary of The Blackstone Group and benefits from the market data provided by its parent company. Nearly all of Blackstone Mortgage Trust's revenue is generated in the form of interest income.

Profitability Analysis

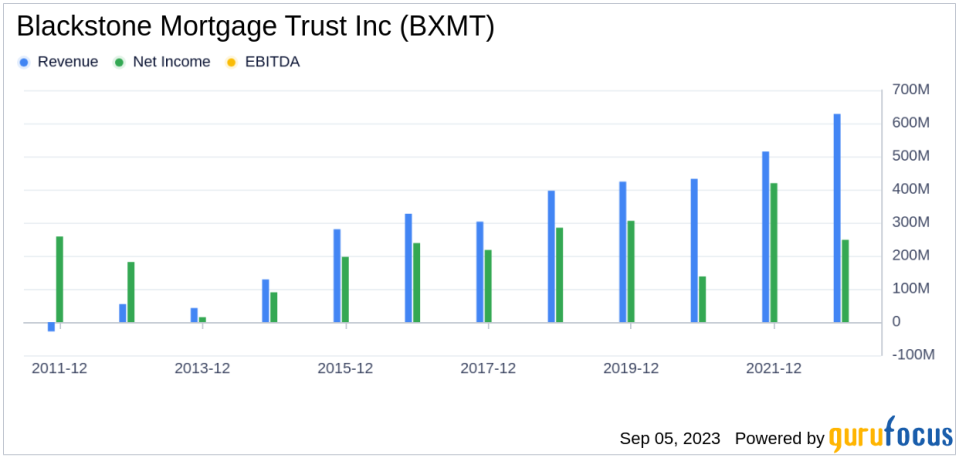

Blackstone Mortgage Trust Inc's Profitability Rank stands at 5/10, indicating a moderate level of profitability. The company's ROE (Return on Equity) is 6.01%, which is better than 62.06% of the companies in the industry. The ROA (Return on Assets) is 1.09%, outperforming 41.18% of the companies in the industry. Impressively, the company has maintained profitability for the past 10 years, a feat achieved by only 0.13% of the companies in the industry.

Growth Prospects

The company's Growth Rank is 2/10, indicating a relatively low growth rate. However, the 3-Year Revenue Growth Rate per Share is 4.10%, better than 63.61% of the companies in the industry. The 5-Year Revenue Growth Rate per Share is 1.80%, outperforming 58.79% of the companies in the industry. The future total revenue growth rate is estimated to be 9.06%, which is better than 82.07% of the companies in the industry. However, the 3-Year and 5-Year EPS without NRI Growth Rates are -14.70% and -7.70% respectively, indicating a decline in earnings per share.

Major Stock Holders

Paul Tudor Jones (Trades, Portfolio) is the largest holder of Blackstone Mortgage Trust Inc's stock, holding 195,580 shares, which accounts for 0.11% of the total shares. Murray Stahl (Trades, Portfolio) holds the second-largest number of shares, with 25,050 shares, accounting for 0.01% of the total shares. Mario Gabelli (Trades, Portfolio) holds the third-largest number of shares, with 20,980 shares, accounting for 0.01% of the total shares.

Competitors Overview

Blackstone Mortgage Trust Inc faces competition from Arbor Realty Trust Inc (NYSE:ABR) with a stock market cap of $2.98 billion, Rithm Capital Corp (NYSE:RITM) with a stock market cap of $4.95 billion, and Ready Capital Corp (NYSE:RC) with a stock market cap of $1.86 billion.

Conclusion

In conclusion, Blackstone Mortgage Trust Inc has shown impressive stock performance over the past three months, with a significant surge in its stock price. The company's profitability and growth prospects are moderate, with a profitability rank of 5/10 and a growth rank of 2/10. The company's major stockholders include Paul Tudor Jones (Trades, Portfolio), Murray Stahl (Trades, Portfolio), and Mario Gabelli (Trades, Portfolio). Despite facing competition from Arbor Realty Trust Inc, Rithm Capital Corp, and Ready Capital Corp, the company's future prospects look promising, with a GF Valuation indicating that the stock is significantly undervalued.

This article first appeared on GuruFocus.