Blackstone Secured Lending Fund (BXSL) Reports Solid Q4 and Full Year 2023 Results

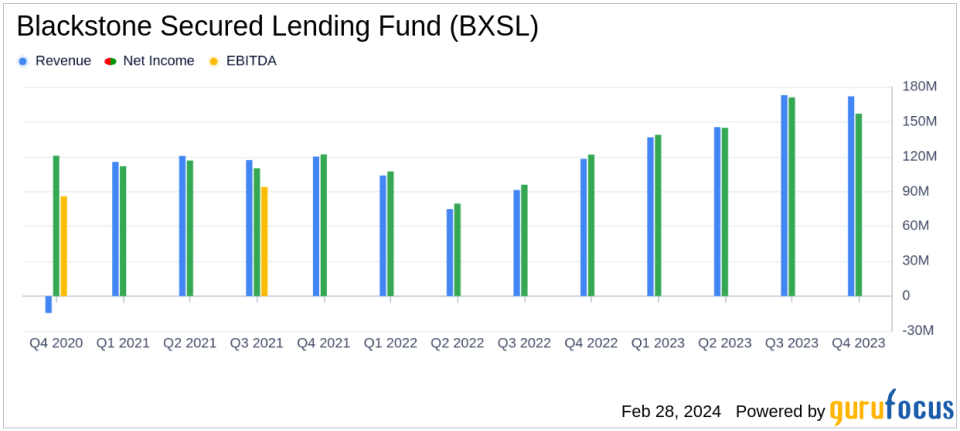

Net Investment Income (NII): $0.96 per share in Q4, up 7% from Q4 2022.

Net Income: $157 million, or $0.88 per share, a 16% increase from Q4 2022.

Dividend: Declared at $0.77 per share for Q1 2024, backed by a dividend coverage ratio of 125%.

Investments at Fair Value: Grew to approximately $9.9 billion, with a portfolio predominantly in first lien debt.

Leverage: Average debt-to-equity ratio at 1.05x, with total debt outstanding at $4.9 billion.

Liquidity: $1.8 billion available, including cash and undrawn debt facilities.

Portfolio Companies: Increased to 196, with less than 0.1% on non-accrual.

On February 28, 2024, Blackstone Secured Lending Fund (NYSE:BXSL) released its fourth quarter and full year 2023 results, showcasing a robust performance in a challenging interest rate environment. The company's 8-K filing details the financials and strategic positioning that have contributed to its success.

Blackstone Secured Lending Fund is a non-diversified, closed-end management investment company with a focus on generating current income and, to a lesser extent, long-term capital appreciation through investments primarily in originated loans and other securities of private U.S. companies.

Performance and Challenges

BXSL reported a net investment income of $0.96 per share for the fourth quarter, marking a 1% increase from the previous quarter and a 7% increase compared to the same quarter in the previous year. The company's net income stood at $157 million, or $0.88 per share, which is a 13% decrease from the previous quarter but a 16% increase year-over-year. This performance underscores the company's ability to navigate the rising interest rate landscape effectively, with a 98.5% first lien, senior secured portfolio providing capital protection.

Despite the strong results, BXSL faces challenges inherent in the asset management industry, such as market volatility and credit risk. The company's focus on senior secured lending and disciplined investment approach are crucial in mitigating these risks.

Financial Achievements

The company's financial achievements are significant in the asset management industry, where consistent income generation and asset growth are key performance indicators. BXSL's increase in net asset value (NAV) to $5.0 billion, or $26.66 per share, reflects the company's effective investment strategy and portfolio management. The declared dividend of $0.77 per share for the first quarter of 2024, supported by a strong dividend coverage ratio of 125%, demonstrates BXSL's commitment to delivering shareholder value.

Key Financial Metrics

Important metrics for BXSL include the weighted average yield on debt investments, which increased to 12.0% at quarter-end, and new investment commitments in the quarter totaling $1.0 billion at par. The company's leverage ratio, a critical measure of financial stability, was well-managed with an average debt-to-equity ratio of 1.05x. The total return of 11.0% annualized since inception and 3.3% for the quarter further illustrates the company's strong performance.

Analysis of Company's Performance

BXSL's strategic focus on first lien, senior secured debt positions it well in the current economic climate, where interest rates are a significant concern for investors. The company's disciplined investment approach and robust credit performance have contributed to its solid earnings capacity. With a diversified portfolio and a strong pipeline of investment opportunities, BXSL is well-positioned for continued growth and capital protection.

For a detailed presentation of BXSL's fourth quarter and full year 2023 results, investors and interested parties can visit the company's website at www.bxsl.com.

Value investors and potential members of GuruFocus.com seeking opportunities in the asset management sector may find BXSL's performance indicative of a company with a strong income-generating capability and a prudent approach to capital protection.

Explore the complete 8-K earnings release (here) from Blackstone Secured Lending Fund for further details.

This article first appeared on GuruFocus.