Blade Air Mobility Inc CEO Robert Wiesenthal Sells 96,255 Shares

In a significant insider transaction, CEO and 10% Owner Robert Wiesenthal sold 96,255 shares of Blade Air Mobility Inc (NASDAQ:BLDE) on December 15, 2023. This move has caught the attention of investors and market analysts, as insider transactions can often provide valuable insights into a company's prospects and the confidence level of its top executives.

Who is Robert Wiesenthal?

Robert Wiesenthal is a prominent figure in the aviation industry, serving as the CEO of Blade Air Mobility Inc. His career spans various leadership roles, including executive positions at Sony Corporation of America and Warner Music Group. At Blade Air Mobility, Wiesenthal has been instrumental in steering the company's strategic direction and expansion in the urban air mobility market.

About Blade Air Mobility Inc

Blade Air Mobility Inc is a technology-powered air mobility company committed to reducing travel friction by providing cost-effective air transportation alternatives to some of the most congested ground routes in the U.S. and abroad. The company's mission is to democratize aviation by making it more accessible to the masses. Blade's asset-light model, which leverages partnerships with existing operators, allows it to offer scheduled and on-demand flights without the capital risk associated with owning aircraft.

Analysis of Insider Buy/Sell and Stock Price Relationship

Insider transactions, particularly those involving a company's CEO, can be a strong indicator of the management's view on the stock's valuation. In the case of Blade Air Mobility Inc, the insider, Robert Wiesenthal, has not made any purchases over the past year but has sold a total of 522,709 shares. This pattern of behavior could suggest that the insider believes the stock may be fully valued or that he is taking profits off the table.

On the day of the insider's recent sale, shares of Blade Air Mobility Inc were trading at $3.11, giving the company a market cap of $239.574 million. The sale of 96,255 shares by the insider represents a significant divestment and could be interpreted in several ways. Some investors might view this as a lack of confidence in the company's short-term growth prospects, while others might see it as a routine liquidity event for the insider.

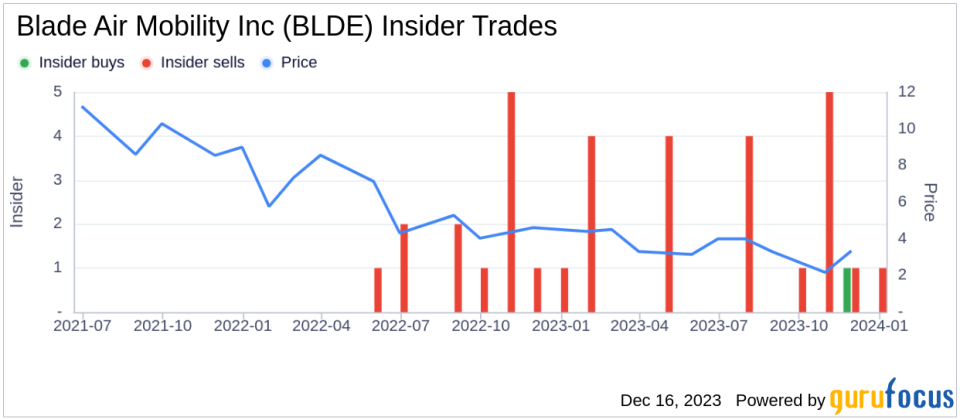

It is also important to consider the broader insider transaction history for Blade Air Mobility Inc. Over the past year, there has been only 1 insider buy compared to 21 insider sells. This trend suggests that insiders, on balance, have been more inclined to sell their shares than to purchase additional ones. While this does not necessarily indicate a bearish outlook for the company, it does warrant attention from investors who look to insider activity as a component of their investment thesis.

When analyzing insider transactions, it is crucial to consider the context and potential motivations behind the trades. Insiders may sell shares for various reasons unrelated to their view on the company's future, such as diversifying their personal portfolio, tax planning, or meeting liquidity needs. Therefore, while insider sales can provide valuable clues, they should not be the sole basis for investment decisions.

The insider trend image above provides a visual representation of the buying and selling patterns of Blade Air Mobility Inc's insiders. The predominance of sell transactions over the past year is evident, and this could be a factor for potential investors to consider when evaluating the company's stock.

Conclusion

Robert Wiesenthal's recent sale of 96,255 shares of Blade Air Mobility Inc is a transaction that merits attention from the investment community. While the insider's actions may raise questions about his outlook on the company's valuation, it is essential to view this event within the broader context of the company's performance, market conditions, and the insider's personal circumstances.

Investors should also consider the company's business model, growth strategy, and competitive landscape when assessing the implications of insider transactions. Blade Air Mobility Inc's focus on urban air mobility and its asset-light approach position it in a unique niche within the aviation industry, which could present both opportunities and challenges in the years ahead.

Ultimately, insider transactions are just one piece of the puzzle. A comprehensive analysis that includes financial performance, industry trends, and broader market dynamics is crucial for making informed investment decisions. As Blade Air Mobility Inc continues to navigate the evolving air mobility space, investors will be watching closely to see how the company's strategy and insider activity align with its long-term growth prospects.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.