Blend Labs Inc (BLND) Reports Notable Operating Loss Improvement and Revenue Growth Amid Market ...

Revenue: Q4 total revenue reached $36.1 million, with the Blend Platform segment contributing $25.9 million.

Gross Margin: GAAP and non-GAAP gross profit margins improved significantly to approximately 55% in Q4 from 34% and 35% in the prior year, respectively.

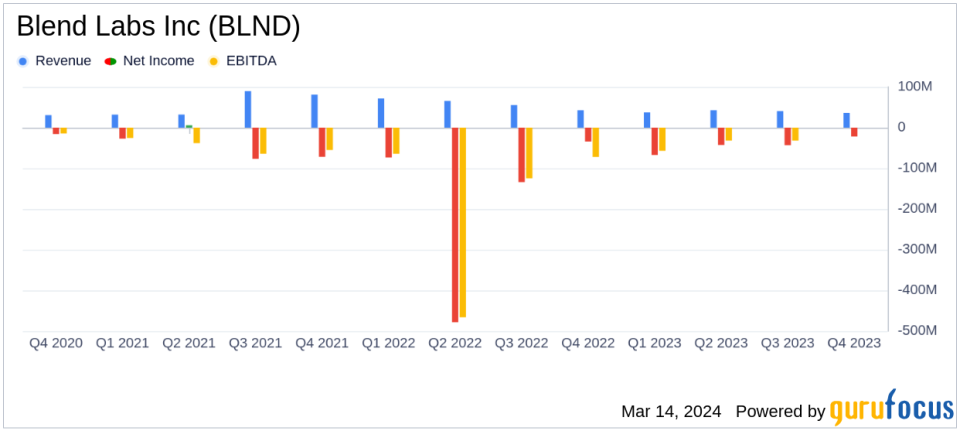

Operating Loss: GAAP loss from operations decreased to $21.9 million in Q4, a substantial improvement from $75.2 million in the same period last year.

Net Loss Per Share: GAAP net loss per share improved to $0.13 in Q4, compared to $0.35 in Q4 of the previous year.

Liquidity: As of December 31, 2023, Blend has a total of $144.2 million in cash, cash equivalents, and marketable securities.

Debt Management: Blend prepaid $85.0 million of its term loan and amended the maturity date to June 30, 2027, under certain conditions.

On March 14, 2024, Blend Labs Inc (NYSE:BLND), a leading provider of cloud banking software, released its 8-K filing, disclosing its financial results for the fourth quarter and full year of 2023. Despite facing a challenging market environment, Blend Labs Inc has demonstrated resilience by meeting its fourth-quarter revenue guidance and significantly reducing its operating loss throughout the year.

Blend Labs Inc operates a cloud-based software platform that enhances the digital interaction between financial services firms and their customers. The company's offerings facilitate applications for mortgages, consumer loans, and deposit accounts. Blend Labs Inc operates through two segments: the Blend Platform, which includes a suite of products for the entire origination process, and Title365, which streamlines title, settlement, and closing processes. The majority of the company's revenue is derived from the Blend Platform segment.

Financial Performance and Strategic Progress

Despite a 20-25% industry mortgage market volume decline, Blend Labs Inc's Mortgage Suite revenue within the Blend Platform segment decreased by only 3% year-over-year to $17.2 million in Q4. The Consumer Banking Suite revenue saw a 15% increase compared to the prior-year period, totaling $6.4 million in Q4. Professional services revenue also rose by 11% year-over-year to $2.3 million.

Blend Labs Inc's commitment to its strategic priorities is evident in its expansion of the consumer banking footprint, maintenance of a leading market share in mortgage relationships, and cost structure streamlining. These efforts have led to a significant reduction in the GAAP net operating loss, which decreased to $21.9 million in Q4 from $75.2 million in the same period last year. The non-GAAP net operating loss in Q4 outperformed the top end of guidance due to the execution of efficiency initiatives, placing the company on a path toward non-GAAP profitability within the year.

Year-Over-Year Financial Highlights

For the full year of 2023, Blend Labs Inc reported a total revenue of $156.8 million, with the Blend Platform segment contributing $109.5 million and the Title segment $47.3 million. The company's GAAP and non-GAAP gross profit margins improved to approximately 52%, up from 38% and 39% in 2022, respectively. The GAAP loss from operations for the year was $156.2 million, a notable decrease from $746.2 million in 2022. The GAAP net loss per share attributable to common stockholders improved to $0.76, compared to $3.28 in the previous year.

Blend Labs Inc's liquidity position remains strong, with cash, cash equivalents, and marketable securities totaling $144.2 million as of December 31, 2023. The company's cash used in operating activities was $127.6 million in 2023, an improvement from $190.4 million in 2022. Free cash flow also showed improvement, at $(128.2) million in 2023 compared to $(192.5) million in 2022.

Looking Forward

For the first quarter of 2024, Blend Labs Inc has provided guidance with expected Blend Platform Segment Revenue between $22.0 million and $24.0 million, Title Revenue between $10.5 million and $11.5 million, and a non-GAAP Net Operating Loss between ($14.0) million and ($12.0) million. The company's guidance reflects an internally estimated 800,000 - 875,000 U.S. aggregate industry mortgage originations in Q1 2024.

Blend Labs Inc's CEO, Nima Ghamsari, expressed optimism about the company's strong pipeline and the intention to accelerate growth while working towards the mission of building simple, proactive, and instant experiences for any banking product.

"Despite a challenging market environment, Blend has achieved substantial progress on our three strategic priorities over the course of 2023," said Nima Ghamsari, Head of Blend. "First, weve expanded our consumer banking footprint by achieving double-digit year-on-year revenue growth in every quarter. Second, we continued to deepen our mortgage relationships and maintain our leading market share. And third, weve succeeded in streamlining our cost structure, which resulted in a significant reduction in loss from operations."

Investors and analysts interested in further details can access the webcast discussing the Q4 and full year 2023 financial results on Blend's investor relations website.

Blend Labs Inc's performance in the face of industry headwinds demonstrates the company's resilience and strategic focus. With improvements in key financial metrics and a clear path toward profitability, Blend Labs Inc is positioning itself for sustainable growth in the evolving digital banking landscape.

Explore the complete 8-K earnings release (here) from Blend Labs Inc for further details.

This article first appeared on GuruFocus.