Blink Charging Co. Reports Record Growth with 89% Revenue Increase in Q4 and 130% for Full Year 2023

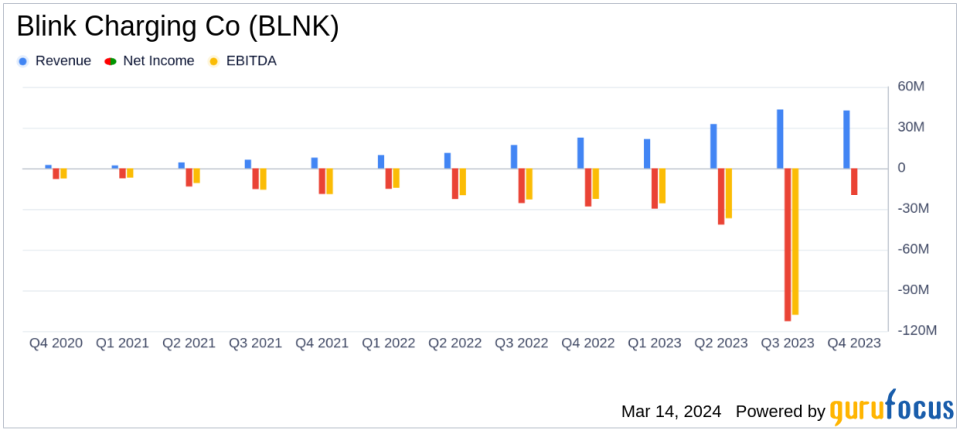

Revenue Growth: Q4 revenue soared by 89% to $42.7 million; full-year revenue jumped 130% to $140.6 million.

Product and Service Sales: Product sales in Q4 increased by 112% and service revenues by 40%; full-year product sales up by 138% and service revenues by 111%.

Gross Profit: Q4 gross profit reached $10.6 million, marking a full-year gross profit of $40.2 million or 29% of revenues.

Balance Sheet Strengthening: BLNK raised $113 million in gross proceeds and paid off $45.5 million in promissory notes and accrued interest.

Operational Milestones: Over 5,100 charging stations contracted, deployed, or sold in Q4; over 23,347 for the full year.

Adjusted EBITDA: Targeting a positive adjusted EBITDA run rate by December 2024, with a full-year 2024 revenue projection of $165 million to $175 million.

Blink Charging Co (NASDAQ:BLNK), a leading provider of electric vehicle (EV) charging services, released its 8-K filing on March 14, 2024, announcing a record-breaking fourth quarter in 2023 with an 89% increase in revenue to $42.7 million and a 130% surge in full-year revenues to $140.6 million. The company's strategic initiatives have led to significant growth in both product and service sales, with a 112% increase in Q4 product revenues to $33.4 million and a 138% rise in full-year product revenues to $109.4 million. Service revenues also saw a substantial increase, with a 40% rise in Q4 and a 111% increase for the full year.

Financial Performance and Challenges

Blink Charging's impressive revenue growth is a testament to the strong demand for EV charging solutions and the company's ability to deliver operational excellence. The company's gross profit for Q4 stood at $10.6 million, or 25% of revenues, with a record full-year gross profit of $40.2 million, or 29% of revenues. This growth is significant for the industry, as it reflects the increasing adoption of EVs and the expansion of charging infrastructure. However, the company also faced challenges, including increased warranty and maintenance expenditures and adjustments related to discontinued components, which led to a decrease in gross margin for Q4.

Strengthening the Balance Sheet

Blink Charging has taken proactive steps to strengthen its balance sheet and improve liquidity. The company raised $113 million in gross proceeds via ATM and paid off $45.5 million in promissory notes and accrued interest. This financial maneuvering enhances the company's trajectory toward reaching a positive adjusted EBITDA run rate and positions it well for future growth.

Operational Highlights and Future Outlook

Operationally, Blink Charging achieved significant milestones, including the opening of a state-of-the-art manufacturing facility and the establishment of a corporate global headquarters. The company has also developed a diverse product portfolio, attracting clients like the United States Postal Service and Mack Trucks. Looking ahead, Blink Charging is optimistic about its future, targeting $165 million to $175 million in revenues for the full year 2024 and aiming for a positive adjusted EBITDA run rate by December 2024.

Key Financial Metrics

Key financial metrics from the income statement, balance sheet, and cash flow statement highlight the company's robust financial position. As of December 31, 2023, cash and cash equivalents totaled $121.7 million, an increase from the previous year. The company's net loss for Q4 was $19.7 million, or $(0.28) per share, an improvement from a net loss of $28.1 million, or $(0.55) per share in Q4 of the previous year. The full-year net loss was $203.7 million, or $(3.21) per share, primarily attributable to non-cash goodwill and intangible assets impairment charges.

"2023 was a historic year for Blink marked by significant achievements and remarkable growth. Total revenue grew 130% compared to 2022, and represents a 671% increase over 2021, fueled by strong demand and our ability to deliver operational excellence," commented Brendan S. Jones, President and Chief Executive Officer of Blink Charging.

Blink Charging's performance demonstrates the company's ability to navigate a rapidly evolving market and capitalize on the growing demand for EV charging infrastructure. With a strengthened balance sheet, operational advancements, and strategic growth initiatives, Blink Charging is well-positioned to continue its trajectory of expansion and profitability.

For more detailed information on Blink Charging Co's financial results, please refer to the full 8-K filing.

Explore the complete 8-K earnings release (here) from Blink Charging Co for further details.

This article first appeared on GuruFocus.