Block: Intrinsic Valuation Model reveals an Investment Opportunity

Block (NYSE:SQ) is a leading fintech company that is famed for its widely popular Cash App, and Square SMB ecosystem. The CEOs of SquareAlyssa Henry has recently left after a solid 9 years with the company. This impacted the stock price slightly, although there does not seem to be any animosity. Although there was a temporary outage at Square in September, which may have been related, but that would be speculation at this stage. Either way, the tremendous founder and entrepreneur Jack Dorsey (who also founded Twitter) will take over in the interim. Blocks stock price has been decimated by 84% since its high in August 2021 and now trades close to its pandemic low. In this post im going to break down its financials and valuation, to see if this could be a buying opportunity, lets dive in.

Solid Financials

Block reported solid financial results for the second quarter of 2023. Its revenue was $5.53 billion, which beat analyst forecasts by $433 million and rose by 26% year over year. This a major positive given the pullback in Bitcoin trading.

Total gross profit rose by 27% year over year, to $1.87 billion. This was driven by improved operating leverage. Adjusted EBITDA also rose substantially to $384 million, driven by similar reasons.

Adjusted Operating income (inc stock based compensation) turned from a loss of $103 million in Q2,22 to a positive $25 million in profit for Q3,23.

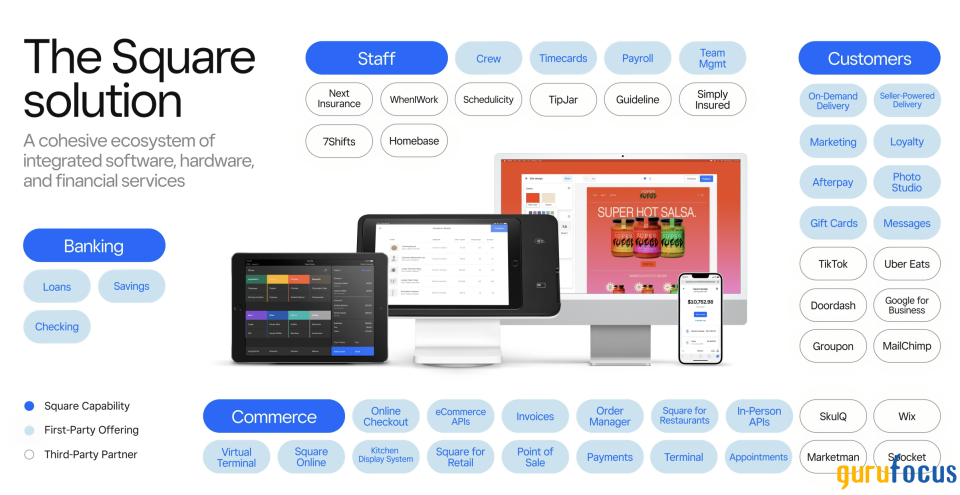

The SMB payment platform Square saw its Gross Payment Volume (GPV) increase by 12% year over year. Churn has also stabilized relative to prior years which was a positive.

Square reported close to half of total gross profit with $888 million reported, up 18% year-over-year.

This was driven mainly by its point of sales (PoS) products across retail, restaurants and appointments.

Its Square Banking product drove gross profit of $167 million, up 24% year over year.

Its Banking products also drove 19% of Square gross profit up from 17% in the prior year.

This was driven by features such as Instant Transfer, Square Savings, Square Debit Card and even Square Loans. The loans are particularly interesting given SMBs are an historically underserved market when it comes to capital. Square is therefore in a strong position due to the data it collects to underwrite the risk on the various loans.

Mid Market sellers have also become more popular on the platform increasing by 20% year over year.

Moving onto Cash App, this drove slightly over 50% of total gross profit, or $968 million, up a rapid 37% year over year.

This was driven by a solid 15% increase in monthly transacting active users to 54 million. Its inflows framework reported an increase in Inflows per Transacting Active and monetization rate.

The business reported $53 million in peer to peer volume, across its Cash app up 18% year over year.

Inflows (per active user) were an average of $1,134, up a solid 8% year over year.

An interesting trend management pointed out in the Q2 earnings call was the trend of tax refunds. One third of Cash App Taxes Actives received a tax refund directly into the Cash App, which shows the trust in the platform as a primary bank facility.

Its Buy Now Pay Later (BNPL) platform reported $84 million in gross profit. This was driven by $6.4 billion in gross merchandise volume (GMV), up 22% year over year. This is an interesting trend as it shows the consumer is still spending.

Block has a strong balance sheet with $5.8 billion in cash and short term investments. In addition, the business reported total debt of $5.3 billion, which the majority is long term by nature.

Advanced Valuation

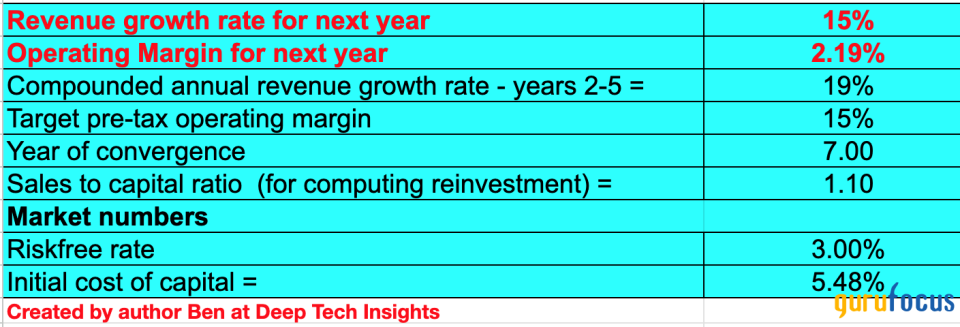

I have inputted the financials of Block into my valuation model which uses the discounted cash flow method of valuation. I have forecast 15% revenue growth for next year , the next four quarters. In addition, to 19% growth per year for the next 2 to 5 years. Given Blocks latest earnings report indicates revenue growth of over 20%, I believe this is achievable and even prudent.

I have forecasted the company will expand its operating margin to 15% over the next 7 years. I expect this to be driven by increased operating leverage as it scales. In addition, to ecosystem benefits across its different products. This is not including a rebound in the popularity of Crypto trading (specifically Bitcoin), although that would be a bonus.

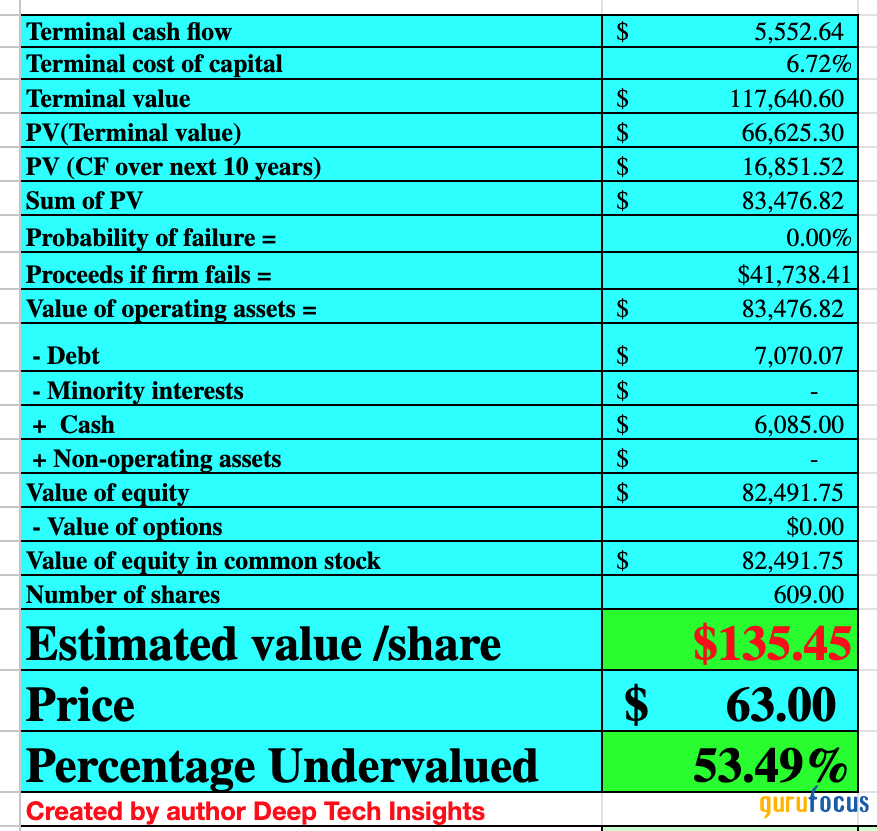

My discounted cash flow model indicates a fair value of $128 per share, and thus the stock is over 50% undervalued at the time of writing.

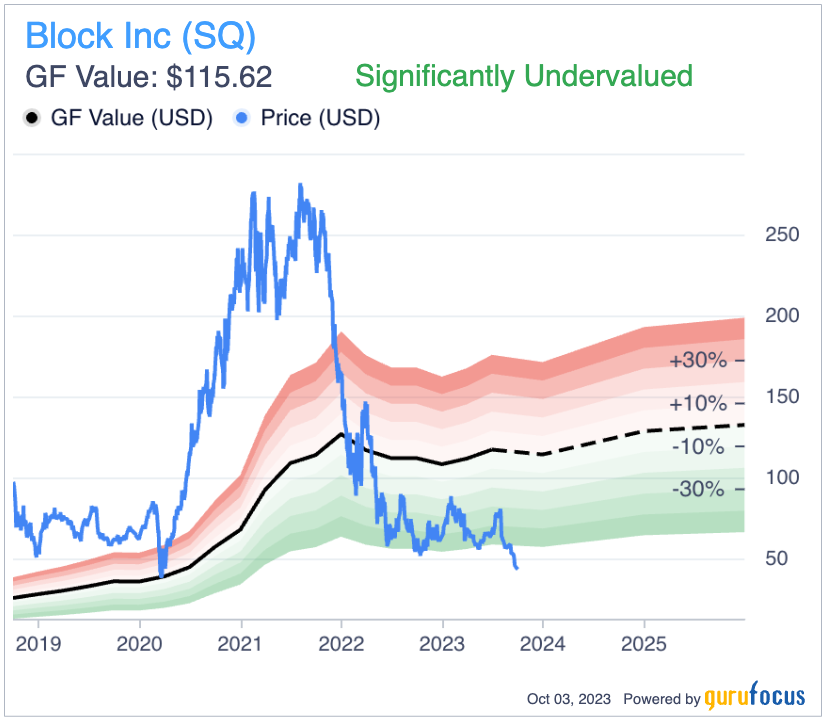

The GF value calculator indicates a fair value of $115 per share, and thus the stock is significantly undervalued.

Block trades at a price to sales (P/S) ratio = 1.35, which is 78% cheaper than its 5 year average.

Analyst ratings and risks

UBS did change its rating to neutral and slash its price target to $102 per share to $65. Although this is still higher than the approximate $45 per share, at the time of writing.

JPMorgan Chase & Co. reduced their target price from $96 to $75 per share.

Although Berenberg initiated a Buy rating on the stock with an average one-year price target of $86.61.

Final Thoughts

Block is a tremendous company managed by an incredible entrepreneur Jack Dorsey. The CEO of Square leaving is not a great sign but I dont believe this will materially impact the long term business. Block has still been growing at a solid clip and given the stock is deeply undervalued intrinsically it looks to be a great long-term investment.

This article first appeared on GuruFocus.