Block (SQ) Q4 Earnings Surpass Estimates, Revenues Rise Y/Y

Block Inc. SQ reported fourth-quarter 2021 adjusted earnings of 27 cents per share, which beat the Zacks Consensus Estimate by 42.1%. Yet, the figure declined 15.6% year over year and 27% sequentially.

Net revenues of $4.08 billion surpassed the Zacks Consensus Estimate of $3.98 billion. Further, the figure increased 29% from the prior-year quarter. The figure also improved 6.1% from the third quarter.

The year-over-year revenue growth was driven by strong momentum across the Cash App ecosystem, which led to the contribution of $2.55 billion to net revenues for the reported quarter, up 18% year over year.

Solid momentum across bitcoin also contributed to the top-line growth. Further, strong growth in transaction, subscription and hardware revenues contributed generously to the results.

Block witnessed solid traction across the Square ecosystem (formerly known as seller ecosystem), generating $1.47 billion of revenues, up 49% year over year.

Further, the company’s Corporate & Other — comprising the global music and entertainment platform TIDAL — generated $56 million of net revenues for the fourth quarter.

Additionally, accelerating gross payment volume (GPV) drove the results.

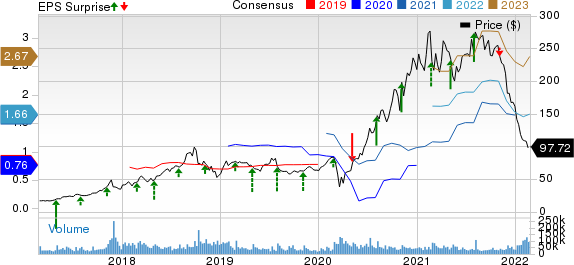

Block Inc. Price, Consensus and EPS Surprise

Block Inc. price-consensus-eps-surprise-chart | Block Inc. Quote

Gross Payment Volume

GPV for the fourth quarter amounted to $46.3 billion, up 45% from the year-ago period. This was driven by strength across the Square ecosystem. Seller GPV accounted for 92% of the total GPV for the reported quarter. Square GPV was up 45% year over year.

Strong performance of the Cash App, which accounted for $3.8 billion of the overall GPV (8%), remained a positive. The figure increased 45% year over year.

Block continued to experience an improvement in card-present volumes in the reported quarter. Card-present GPV was up 56% from the year-ago quarter.

Card-not-present GPV witnessed year-over-year growth of 27% for the fourth quarter. Robust online channels — including Square Online, Invoices, Virtual Terminal and eCommerce API — contributed to the upside.

Top-Line Details

Transaction (32% of net revenues): The company generated transaction revenues of $1.31 billion, up 41% year over year. Strong seller ecosystem accounted for $1.21 billion of transaction revenues, up 41% year over year. Robust performance of the Cash App contributed $104 million to transaction revenues, up 45% year over year owing to the rising number of transactions as well as business accounts.

Subscription and Services (19% of revenues): SQ generated $772 million in revenues from the category, jumping 72% from the year-ago quarter. The improvement can be attributed to a strong performance by the Cash App, which contributed $487 million to the top line. The figure was up 41% from the year-ago quarter. Seller ecosystem contributed $230 million to subscription and services revenues, up 118% year over year.

Hardware (1% of revenues): Square generated revenues of $36 million from the business, up 47% year over year. This was driven by strong unit sales of hardware devices like SquareRegister and Square Terminal.

Bitcoin (48% of revenues): The company generated revenues of $1.96 billion from the category, up 12% year over year. Square continued to benefit from the bitcoin space, driven by the increasing adoption of the Cash App.

Operating Results

Per management, gross profit grew 47% from the year-ago quarter to $1.18 billion. Further, gross margin expanded 354 basis points (bps) year over year to 28.98%.

Adjusted EBITDA was $184 million for the reported quarter, down 1% year over year.

Operating expenses were $1.24 billion, rising 63% from the prior-year quarter.

Product development expenses were $396 million, up 56% year over year, primarily due to rising headcount and personnel costs in engineering, data science, and design teams.

General and administrative expenses were $299 million, up 88% from the prior-year quarter. This was primarily caused by finance, legal, compliance and support personnel costs along with expenses associated with the Afterpay buyout.

Sales and marketing costs were $485 million, up 48% year over year due to an increase in Cash App marketing expenses and a hike in advertising, personnel, and other costs.

Block incurred an operating loss of $54.6 million for the fourth quarter. It reported an operating income of $45.2 million in the prior-year quarter.

Balance Sheet

As of Dec 31, 2021, the cash and cash equivalent balance was $4.44 billion, down from $4.51 billion on Sep 30, 2021.

Short-term investments were $869.3 million for the reported quarter, up from $868.8 million in the previous quarter.

Long-term debt was $4.56 billion compared with $4.74 billion in the third quarter.

Zacks Rank & Stocks to Consider

Currently, Block has a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader technology sector include Allied Motion Technologies AMOT, Broadcom AVGO and inTest INTT. While Allied Motion sports a Zacks Rank #1 (Strong Buy), Broadcom and inTest carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Allied Motion is slated to report fourth-quarter 2021 results on Mar 9. It has gained 6.5% over a year. The long-term earnings growth rate for AMOT is currently projected at 10%.

Broadcom is scheduled to release first-quarter fiscal 2022 results on Mar 3. It has gained 23.4% over a year. The long-term earnings growth rate for AVGO is currently projected at 14.5%.

inTest is slated to report fourth-quarter 2021 results on Mar 4. It has gained 21.8% over a year. The long-term earnings growth rate for INTT is currently projected at 10%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

inTest Corporation (INTT) : Free Stock Analysis Report

Broadcom Inc. (AVGO) : Free Stock Analysis Report

Block Inc. (SQ) : Free Stock Analysis Report

Allied Motion Technologies, Inc. (AMOT) : Free Stock Analysis Report

To read this article on Zacks.com click here.