Bloom Energy Corp (BE) Reports Mixed Results Amid Record Annual Revenue

Annual Revenue: Bloom Energy Corp (NYSE:BE) achieved record full-year revenue of $1.3 billion, marking an 11.2% increase from the previous year.

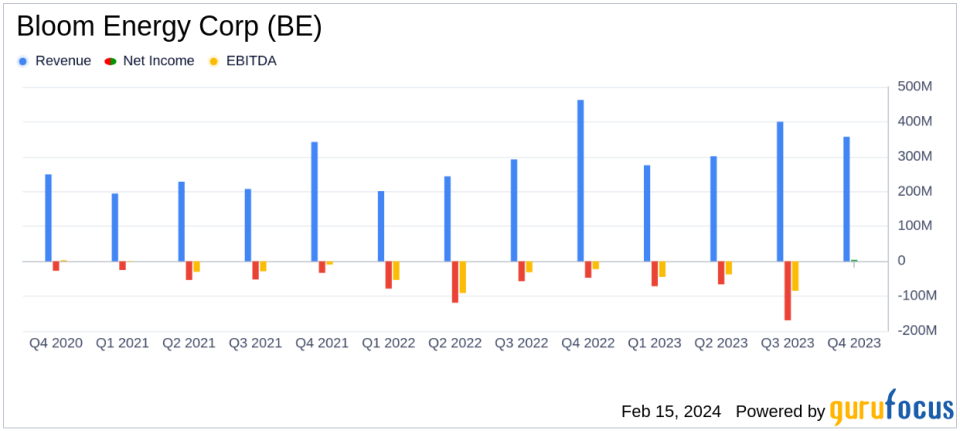

Quarterly Performance: Q4 revenue saw a 22.8% decrease year-over-year, with a notable improvement in GAAP operating profit.

Gross Margin: Full-year gross margin improved to 14.8%, while Q4 gross margin increased significantly to 25.9%.

Operating Profit/Loss: Operating loss for the full year improved, while Q4 operating profit showed a substantial turnaround from the prior year's loss.

Leadership Transition: President and CFO Greg Cameron announced his departure, with a search for a new CFO underway.

2024 Outlook: Bloom Energy provides a positive outlook for 2024, expecting revenue between $1.4 - $1.6 billion and non-GAAP operating income of $75 - $100 million.

Bloom Energy Corp (NYSE:BE) released its 8-K filing on February 15, 2024, disclosing its financial results for the fourth quarter and full year ended December 31, 2023. Despite a decrease in Q4 revenue, the company celebrated a record full-year revenue, driven by growth in product and service revenue.

Bloom Energy, known for its solid-oxide fuel cell systems, has been expanding its product offerings, including a Combined Heat and Power system and the Be Flexible load following product. These innovations are part of Bloom's strategy to meet the increasing demand for clean, efficient energy solutions.

Financial Performance and Challenges

The company's Q4 revenue of $356.9 million represented a 22.8% decrease compared to the same period in the previous year. However, the full-year revenue of $1.3 billion indicated an 11.2% increase from 2022. The gross margin for the year improved to 14.8%, reflecting a 2.4 percentage point increase, while Q4 gross margin saw a significant rise to 25.9%. Operating profit for Q4 was $12.9 million, a remarkable improvement from the $40.6 million operating loss in Q4 of the previous year. Despite these gains, the company faced a non-GAAP operating profit decrease in Q4, highlighting the challenges of maintaining profitability amidst growth.

Financial Achievements and Importance

Bloom Energy's record revenue and improved gross margins are critical achievements for the company and the broader Industrial Products industry. These metrics demonstrate Bloom's ability to scale its operations and improve cost efficiency, which is vital for sustaining growth in the competitive clean energy sector.

Key Financial Metrics

Important metrics from Bloom Energy's financial statements include:

Full-year non-GAAP gross margin increased to 25.8%, up from 23.0% in 2022.

Non-GAAP operating profit for the year was $19.2 million, compared to a non-GAAP operating loss of $33.5 million in 2022.

GAAP EPS for Q4 was $0.02, an improvement from a loss of $0.23 in the same quarter of the previous year.

These metrics are crucial as they provide insights into the company's operational efficiency, profitability, and earnings potential.

Executive Commentary

"At Bloom Energy, our relentless focus on operational excellence and innovation helped us achieve a year of record revenue in 2023," said KR Sridhar, Founder, Chairman, and CEO of Bloom Energy. Greg Cameron, President and CFO, added, "This year we reached critical milestones by delivering record revenues and positive Non-GAAP Operating Income."

Analysis of Company Performance

Bloom Energy's performance in 2023 reflects a company in transition, balancing growth with profitability challenges. The record annual revenue underscores the company's expanding market presence and successful product innovation. However, the quarterly declines and the CFO's departure signal potential volatility and leadership changes that could impact future performance.

The company's outlook for 2024 is optimistic, with expected revenue growth and a focus on achieving positive non-GAAP operating income. This forward-looking approach, combined with strategic product development, positions Bloom Energy to capitalize on the growing demand for clean energy solutions.

For a detailed analysis of Bloom Energy Corp's financial results and future prospects, investors and interested parties are encouraged to visit GuruFocus.com for comprehensive reports and investment tools.

Explore the complete 8-K earnings release (here) from Bloom Energy Corp for further details.

This article first appeared on GuruFocus.