Blow for Biden as giant microchip factory delayed by lack of skilled workers

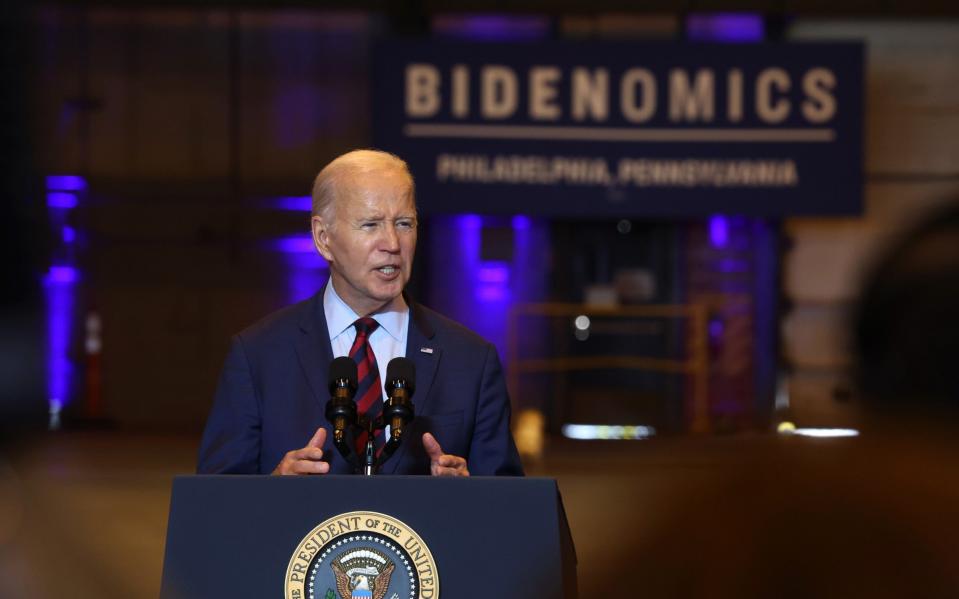

Joe Biden’s plans to boost the US microchip industry have been dealt a setback after the opening of a key factory in Arizona was delayed until at least 2025.

Taiwan Semiconductor Manufacturing Company (TSMC), which has been building the plant since 2021, said the start of production would be pushed back from 2024 to 2025.

TSMC chairman Dr Mark Liu blamed the delay on a shortage of qualified US workers, saying there was “an insufficient amount of skilled workers with the specialised expertise required for equipment installation in a semiconductor-grade facility.”

The year-long delay means the new microchip plant will not open until after next year’s US presidential election, potentially undermining part of the Democrat incumbent’s economic record.

Mr Biden has made reshoring chip production a key part of his $280bn (£217bn) CHIPS Act, a strategy for building up America’s semiconductor manufacturing industry.

The President has invested in bolstering domestic production amid growing nervousness about the US’s reliance on Taiwan for crucial parts.

TSMC is the world’s largest dedicated semiconductor foundry and is a key supplier for major US businesses including Apple.

Mr Biden is keen to diversify sources of chips amid mounting fears that China will invade Taiwan, disrupting exports.

Speaking on Thursday, Dr Liu said TSMC would send “experienced technicians from Taiwan to train the local skilled workers for a short period of time”.

The delay comes amid global upheaval in the semiconductor industry, whose products play a vital part in everything from computers to mobile phones to household appliances and cars.

Production delays caused by the pandemic triggered shutdowns in many industries amid a desperate scramble for any available chips.

Two years ago carmakers including Volvo and Ford were forced to suspend production as they awaited deliveries of crucial microchips for controlling their vehicles’ systems.

Tech industry analysts IDC predicted in September 2021 that an overreaction by chipmakers to tackle supply shortages would lead to overcapacity by this year.

TSMC’s sales dropped 6.2pc in the three months to the end of June, with profits dropping by a quarter.

Bosses blamed “the overall global economic conditions”, with rival chipmaker Intel posting a 36pc drop in sales in April as that company’s chiefs struggle to set up new foundries.

As well as TSMC’s new factory, Intel, the US semiconductor giant, is building two new $20bn factories in Arizona. Another 19 new chip fabrication plants, or fabs, are expected to open across the US over the next ten years.

Rishi Sunak’s government has pledged £1bn to the UK chip industry over the next decade. However, no new fabs are expected to open in Britain as ministers focus government support on design companies instead of manufacturing.

British chip companies have been tempted towards the US by the multi-billion subsidies offered by the Biden administration.

Paragraf, a Cambridge-based semiconductor manufacturer, applied for some of those subsidies after describing Prime Minister Sunak’s semiconductor strategy as “flaccid”.

Similarly, neighbouring company Pragmatic Semiconductor launched a US operation in February as its founder Scott White said: “From a purely logical perspective, there is no reason for us to be a UK company.”