Blue Bird Corp (BLBD) Soars with Record Q1 Earnings, Raises 2024 Outlook

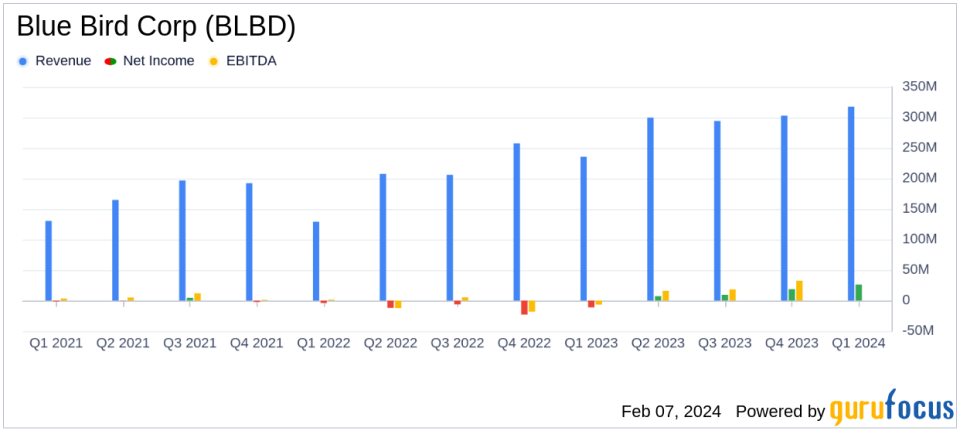

Net Sales: $317.7 million, up 35% year-over-year.

GAAP Net Income: $26.2 million, a significant increase from the prior year.

Adjusted EBITDA: Record $47.6 million, up $51.1 million year-over-year.

Unit Sales: 2,129 buses sold, a 9% increase from the previous year.

Adjusted Net Income: $29.7 million, reflecting strong operational performance.

Adjusted Diluted EPS: $0.91, up from the previous year.

FY2024 Guidance: Adjusted EBITDA forecast raised to $130 million.

On February 7, 2024, Blue Bird Corp (NASDAQ:BLBD), a leader in electric and low-emission school buses, released its 8-K filing, announcing fiscal 2024 first quarter results that set new records for the company. Blue Bird Corp operates primarily in two segments: Bus and Parts, with the majority of its sales in the United States. The company's focus on school buses and extended warranties, along with its parts sales, positions it as a key player in the Vehicles & Parts industry.

Financial Highlights and Operational Achievements

Blue Bird Corp's impressive performance in the first quarter is marked by a 35% increase in net sales, amounting to $317.7 million. The company's GAAP net income saw a remarkable rise to $26.2 million, a $37.4 million improvement from the prior year. This financial success is attributed to a combination of higher unit sales, which grew by 9%, and a significant increase in the average sales price per unit due to strategic pricing actions and favorable product and customer mix changes.

The company's Adjusted EBITDA reached an all-time high of $47.6 million, up $51.1 million from the same quarter last year, reflecting a robust 15% margin. This substantial growth in profitability underscores Blue Bird's effective operational improvements and cost control measures. The company's leadership in alternative-powered school buses is further solidified with a record quarter of electric vehicle (EV) bus deliveries and a backlog of over 400 electric school bus orders.

Management's Perspective

"I am incredibly proud of our teams continued progress in delivering record financial results in the first quarter, said Phil Horlock, CEO of Blue Bird Corporation. The market demand for our school buses remains very strong with approximately 4,600 units in our order backlog."

"We are very pleased with the first quarter results, with an all-time record Adj. EBITDA margin, said Razvan Radulescu, CFO of Blue Bird Corporation. With better line-of-sight into 2024, we are raising our fiscal 2024 full-year guidance to Net Revenue to $1.15-1.25 Billion, Adj. EBITDA of $120-140 million and Adj. Free Cash Flow of $60-70 million."

Challenges and Industry Outlook

Despite the strong results, Blue Bird Corp faces challenges such as ongoing inflationary pressures that have led to increased raw material costs. However, the company has successfully navigated these challenges by implementing price increases and optimizing product and channel mix. The company's proactive approach to market demand, particularly in the EV segment, is expected to drive further growth, supported by funding from the EPAs Clean School Bus Program.

Looking ahead, Blue Bird Corp has increased its FY2024 guidance, reflecting confidence in its business strategy and the anticipated recovery of the global supply chain. The company's focus on sustainable and innovative transportation solutions positions it well for continued success in the evolving Vehicles & Parts industry.

For more detailed information on Blue Bird Corp's financial performance and future prospects, investors and stakeholders are encouraged to review the full earnings report and listen to the earnings call.

Stay tuned to GuruFocus.com for the latest financial news and expert analysis on Blue Bird Corp and other significant market players.

Explore the complete 8-K earnings release (here) from Blue Bird Corp for further details.

This article first appeared on GuruFocus.