bluebird (BLUE) Gets $175 Million Loan From Hercules, Shares Up

bluebird bio, Inc. BLUE announced that it has received a $175 million five-year, term loan facility from Hercules Capital, Inc. HTGC. The funding will extend bluebird’s cash runaway by two years. The company’s shares rose 1.4% on the news.

Per the terms of the agreement, bluebird will get the term loans in four tranches. The first tranche of $75 million was drawn upon the closing of the transaction. BLUE will be eligible to draw two additional tranches of $25 million each, subject to the achievement of commercial milestones.

If all three tranches totaling $125 million are executed, the transaction is expected to extend bluebird’s cash runway through the first quarter of 2026. It will be based on current plans and the launch trajectory of its three gene therapies — Lyfgenia for sickle cell disease, Zynteglo for beta-thalassemia and Skysona for cerebral adrenoleukodystrophy.

The agreement states that a fourth tranche of up to $50 million may be available at the sole discretion of Hercules.

BLUE will be responsible for paying only the interest on any amount borrowed during the first three years of the five-year term. Any outstanding balance as of Apr 1, 2027, will be amortized over the remaining life of the loan.

The funding gives bluebird the much-needed funds as it looks to commercialize its three gene therapies.

We remind investors that the FDA approved Zynteglo for the treatment of beta-thalassemia in adult and pediatric patients requiring regular red blood cell transfusions on Aug 17, 2022, and Skysona for treating early, active cerebral adrenoleukodystrophy on Sep 16, 2022. The company received PRVs with the FDA approval of these two gene therapies.

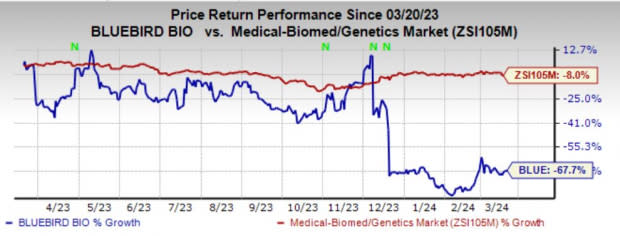

Shares of bluebird have plunged 67.7% in the past year compared with the industry’s decline of 8%.

Image Source: Zacks Investment Research

Shares of the company tanked in December after it raised additional equity. The company offered 83.3 million shares of its common stock at an offer price of $1.50 per share.

The stock has been under pressure, particularly after the FDA recently approved its third gene therapy, lovotibeglogene autotemcel (lovo-cel), under the brand name Lyfgenia, for the treatment of sickle cell disease (SCD) in patients aged 12 years and older with a history of vaso-occlusive events.

This was primarily because of the boxed warning of hematologic malignancy issued with Lyfgenia’s label. Some patients developed blood cancer when being treated with Lyfgenia.

Hence, bluebird will need to monitor patients closely for evidence of malignancy through complete blood counts, at least every six months, and integration site analysis at months six, 12 and as warranted.

Moreover, the FDA concurrently approved Vertex Pharmaceuticals VRTX and CRISPR Therapeutics’ CRSP exagamglogene autotemcel, a CRISPR/Cas9 genome-edited cell therapy, for the treatment of SCD in patients aged 12 years and older with recurrent vaso-occlusive crises.

Exagamglogene autotemcel was approved under the brand name Casgevy, making it the first FDA-approved treatment to utilize a type of novel genome editing technology.

Approval of another gene therapy for the same indication will make it challenging for bluebird to gain market shares.

Also, BLUE has priced Lyfgenia at $3.1 million per dose. Vertex and CRISPR's gene therapy will cost $2.2 million each for every dose.

bluebird also did not receive a Rare Pediatric Disease Priority Review Voucher (PRV) as part of the review. Management had expected to receive the same as it had earlier received two PRVs under an FDA program intended to encourage the development of treatments for rare pediatric diseases.

Zacks Rank

bluebird currently has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Vertex Pharmaceuticals Incorporated (VRTX) : Free Stock Analysis Report

Hercules Capital, Inc. (HTGC) : Free Stock Analysis Report

bluebird bio, Inc. (BLUE) : Free Stock Analysis Report

CRISPR Therapeutics AG (CRSP) : Free Stock Analysis Report