BlueLinx Holdings Inc (BXC) Reports Mixed 2023 Financial Results Amid Market Challenges

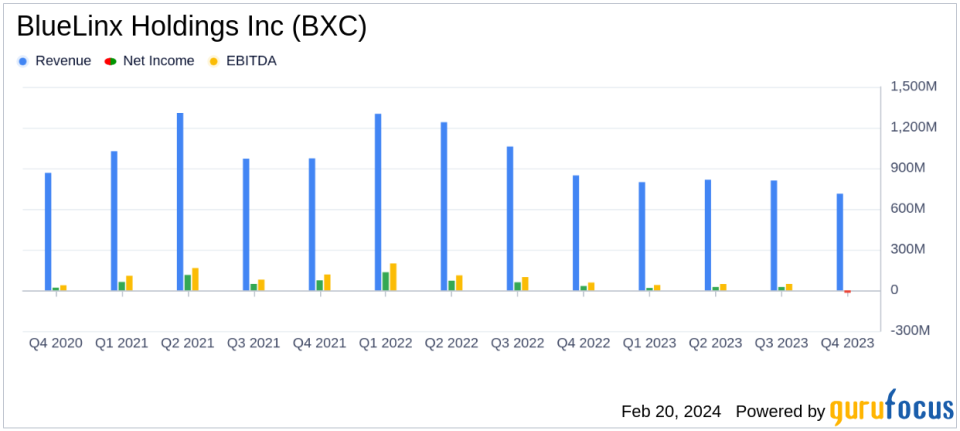

Net Sales: Decreased by 16.0% in Q4 and 29.5% for the full year 2023.

Gross Profit: Dropped by 21.6% in Q4, with a gross margin of 16.6%.

Net Income: Reported a net loss of $18 million in Q4 due to a one-time pension plan charge.

Adjusted EBITDA: $36 million in Q4, representing 5.1% of net sales.

Free Cash Flow: Generated $67 million in Q4 and $279 million for the full year.

Liquidity and Debt: Strong liquidity at $868 million and low net leverage ratio of 0.3x.

Share Repurchases: Completed $42 million in share repurchases, reducing shares outstanding by 6%.

On February 20, 2024, BlueLinx Holdings Inc (NYSE:BXC) released its 8-K filing, detailing the financial results for the fourth quarter and full year ended December 30, 2023. The company, a leading U.S. wholesale distributor of building products, faced a challenging market environment, which was reflected in its mixed financial performance.

For the fourth quarter, BlueLinx reported net sales of $713 million, a decrease of 16.0% compared to the same period last year. The company's gross profit for the quarter was $118 million, with a gross margin of 16.6%. Notably, the specialty products segment, which includes engineered wood, siding, and millwork, continued to drive performance, accounting for 70% of net sales and 80% of gross profit for the year.

However, the company posted a net loss of $18 million, or $2.08 per share, primarily due to a one-time $30.4 million charge related to the exit of a defined benefit pension plan. Excluding this charge, the adjusted net income was $26 million, or $2.94 per adjusted diluted earnings per share. Adjusted EBITDA for the quarter was $36 million, or 5.1% of net sales.

For the full year 2023, net sales were $3.1 billion, a decrease of 29.5% year-over-year. The gross profit for the year was $527 million, with a gross margin of 16.8%. The company achieved a net income of $49 million, or $5.39 per diluted earnings per share, and an adjusted net income of $103 million, or $11.41 per adjusted diluted earnings per share. Adjusted EBITDA for the year was $183 million, or 5.8% of net sales.

BlueLinx generated significant free cash flow, with $67 million in the fourth quarter and $279 million for the full year. The company also maintained strong liquidity, with $868 million available, including $522 million in cash and cash equivalents. The net debt stood at $64 million, resulting in a net leverage ratio of 0.3x.

In 2023, BlueLinx repurchased $42 million of its shares, reducing the number of shares outstanding by 6%. The company's President and CEO, Shyam Reddy, highlighted the strong margin performance and significant free cash flow, emphasizing the company's ability to generate solid results and manage working capital effectively amidst market uncertainties.

BlueLinx's financial achievements are particularly important for a company in the industrial distribution industry, where managing inventory and capital effectively is crucial for maintaining profitability and liquidity. The company's focus on specialty products and disciplined inventory management has helped it navigate a challenging market environment.

Investors and value seekers may find BlueLinx's ability to generate free cash flow and maintain a strong balance sheet appealing, especially given the company's proactive share repurchase program and low net leverage ratio. These factors, combined with the company's strategic focus on high-margin specialty products, position BlueLinx to potentially capitalize on market opportunities as conditions improve.

For more detailed financial information and to participate in the upcoming conference call, investors are encouraged to review the full 8-K filing and visit the Investor Relations section of the BlueLinx website.

Explore the complete 8-K earnings release (here) from BlueLinx Holdings Inc for further details.

This article first appeared on GuruFocus.