Boeing: Time to Sharpen the Relationship Skills, Says JPMorgan

March 2022 will mark an unwelcome milestone for Boeing (BA). It will be the beginning of the fourth year since the 737 MAX was grounded.

The MAX is now back in action, but in the interim, the A&D giant has lurched from one crisis to another. The company almost went bankrupt during the height of the pandemic last year, and the halt on 787 deliveries due to a growing list of manufacturing defects – as noted in a recently circulated FAA memo - has kept BA in the headlines.

The issues have played their part in keeping the share price depressed, with the stock down 10% year-to-date.

While J.P. Morgan’s Seth Seifman acknowledges the company faces “no shortage of challenges,” the analyst believes there is “potential to make progress in 2022.”

However, to do so, Boeing needs to start delivering some planes, which among other things, requires the company to start fixing relationships.

“The 787 headlines of recent weeks are disappointing but the underlying message most concerning to us is that Boeing has yet to establish a sufficiently constructive working relationship with the FAA or the members of Congress who oversee that agency,” said the analyst.

This is not only an issue for Boeing - suppliers, customers, and investors are all impacted too.

Seifman says it is clear Boeing “had not been building 787s to spec and will change.” But the process on how to address this and how “both sides can agree that the issues are resolved” still lacks coherence. “This lack of clarity is perhaps not surprising for those of us on the outside,” says the analyst, “Sometimes, however, it seems unclear to Boeing and the FAA too.”

The scene gets murkier still with the lawmakers chiming in. A recent Senate report criticized the FAA for its “oversight” of Boeing, which only serves to highlight the fact that 3 years after the MAX crashes, Boeing, the FAA, and Congress are “still adjusting the ground rules for how they will interact.”

While Boeing’s need for resolution is obvious, Seifman notes that the company is a “national asset that needs to be globally competitive,” and it is therefore in everyone’s best interests that “constructive working relationships” are forged.

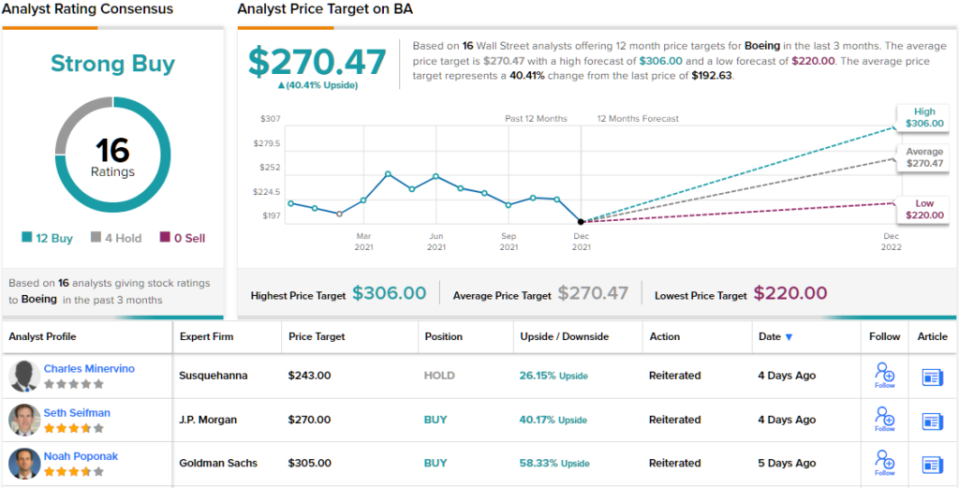

Meanwhile, the analyst rates BA shares an Overweight (i.e., Buy), backed by a $270 price target. This figure suggests room for one-year gains of 40%. (To watch Seifman’s track record, click here)

Seifman’s target is in-line with the Street’s overall objective and so is his rating; the analyst consensus rates the stock a Strong Buy, based on 12 Buys vs. 4 Holds. (See BA stock analysis on TipRanks)

See what top Wall Street analysts say about your stocks >>

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.