Boise Cascade (BCC) Buys Brockway-Smith, Fortifies BMD Unit

Boise Cascade Company BCC completed the acquisition of Brockway-Smith Company (BROSCO). In mid-year, the company intended to acquire this leading wholesale distributor of doors and millwork and its two full-scale distribution centers.

BROSCO's strong reputation, expansive manufacturing capacity and loyal customer base in the Northeast align well with BCC's growth strategy. The acquisition also enhances its Building Materials Distribution (BMD) segments’ position by adding valuable offerings, including interior and exterior doors, windows, moldings and composite products, reinforcing the company's presence in the millwork sector.

Shares of this Zacks Rank #3 (Hold) company gained by 0.76% in the after-hour trading session on Oct 2.

Image Source: Zacks Investment Research

Although the company’s revenues witnessed a tough year-over-year comparison due to a decline in total U.S. housing starts and single-family housing starts, it reported sequentially higher revenues in second-quarter 2023. The company has been benefiting from solid demand across its businesses. Its focus on growth initiatives in distribution and engineered wood products businesses and acquisitions bodes well.

During second-quarter 2023, the BMD segments’ gross margin expanded by 110 basis points to 15% compared with 13.9% reported in the year-ago quarter, driven by stable commodity prices. BMD's sales remained strong in third-quarter 2023, with daily average sales being in line with second-quarter levels. Owing to this, the company expects to report strong financial results in the third quarter.

BCC continues to expand its BMD segment organically with the recent commencement of the Kansas City door shop and the expected completion and start-up of the Marion, OH, greenfield expansion project by the end of this year. In the first half of 2023, the company allocated $49 million toward the expansion of this segment.

The company remains optimistic in this regard and anticipates expansions to drive growth. For 2023, the company expects capital expenditures in the range of $120-$140 million.

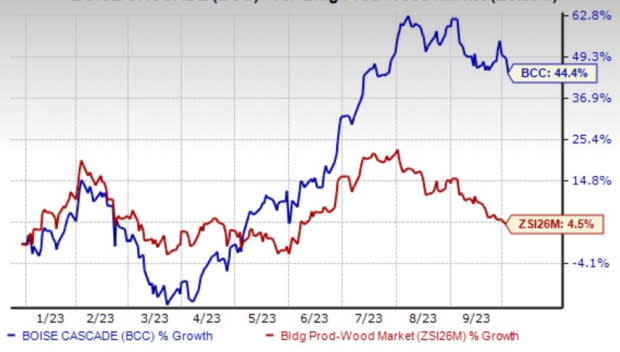

Shares of BCC have increased 44.4% so far this year compared with the Zacks Building Products - Wood industry’s 4.5% growth.

Key Picks

Louisiana-Pacific Corporation LPX is a leading manufacturer of sustainable, quality engineered wood building materials, structural framing products and exterior siding for residential, industrial and light commercial construction.

Louisiana-Pacific, a Zacks Rank #2 (Buy) company, has seen an upward revision of 2023 earnings to $3.41 per share from $3.08 in the past 60 days. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Enviva Inc. EVA makes and sells utility-grade wood pellets. The company has been gaining from a very constructive pricing environment for wood pellets, both for the near term and for long-term contracted deliveries. This is helping EVA boost margins, with the continued expectation of further improvements in the near term. Productivity improvements across its manufacturing facilities, improving supply chain conditions and the constructive pricing environment, particularly in Europe, bode well for future growth.

This Zacks Rank #2 stock’s 2023 earnings moved 15 cents upward in the past 60 days.

Trex Company, Inc. TREX manufactures and distributes wood and plastic composite products as well as related accessories, mainly for residential decking and railing applications. Despite soft demand owing to softening economic conditions and more resilient repair and remodeling, the sector has been driving growth. Trex’s, a Zacks Rank #2 company, tiered product strategy — which supports consumers’ decision-making by providing a range of product aesthetics — is encouraging. Its focus on automation, modernization, energy efficiency and raw material processing is expected to be a major tailwind.

TREX has seen an upward estimate revision for 2023 earnings to $1.79 per share from $1.69 in the past 60 days.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Louisiana-Pacific Corporation (LPX) : Free Stock Analysis Report

Trex Company, Inc. (TREX) : Free Stock Analysis Report

Boise Cascade, L.L.C. (BCC) : Free Stock Analysis Report

Enviva Inc. (EVA) : Free Stock Analysis Report