Boise Cascade (BCC) Hits 52-Week High: What's Driving It?

Boise Cascade Company BCC reached a new 52-week high of $120.76 on Dec 15. The stock pulled back to end the trading session at $117.31, down 1.6% from the previous day’s closing price of $119.24.

On Dec 14, 2023, the Goldman Sachs Group increased its price target on Boise Cascade from $100 to $114, which boosted investors’ sentiments. Also, the recent decision of the Federal Reserve to maintain a steady interest benchmark between 5.25% and 5.5% bodes well for the overall housing industry as well as related industry.

Furthermore, the company’s strong and flexible balance sheet positions it to facilitate reinvestment and growth strategies while also rewarding its shareholders. This was witnessed from Boise Cascade’s special dividend announcement on Oct 26, 2023. Per the announcement, the company paid a special dividend of $5 per share on Dec 15, 2023, to shareholders of record on Dec 1.

Stock Performance

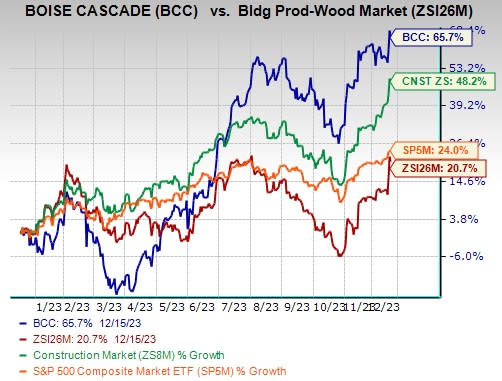

This Zacks Rank #3 (Hold) stock has surged 65.7% in the past year, outperforming the Zacks Building Products - Wood industry’s 20.7% growth, the Zacks Construction sector’s increase of 48.2% and S&P 500 Index’s rise of 24%.

Image Source: Zacks Investment Research

Earnings estimates for 2023 have moved up to $12.13 per share from $11.80 per share in the past 60 days. Despite the macroeconomic uncertainties, the stock portrays a positive trend, indicating robust fundamentals and elevating the expectation of outperformance in the near term on the back of evolving new residential construction demand.

Let’s delve deeper into the factors that are substantiating BCC’s growth potential and recent run.

Increase in Single-Family Housing Starts: In the current market scenario, due to the low availability of already existing houses along with high mortgage rates, the demand for housing construction has increased. This has sparked the demand for single-family housing, which is benefiting Boise Cascade. During the third quarter of 2023, the company witnessed a 7% year-over-year increase in single-family housing starts, benefiting its top line as it is the key demand driver for its sales. For 2024, the company has optimistic views about its market position as the near-term demand for new residential construction is evolving.

Strategic Buyouts: Boise Cascade has been focusing on its acquisition strategies to strengthen its distribution facilities and product portfolio. On Oct 2, 2023, the company acquired Brockway-Smith Company (“BROSCO”), a leading wholesale distributor specializing in doors and millwork, through cash on hand transaction of $168 million. This acquisition included BROSCO’s two full-scale distribution centers in Hatfield, MA and Portland, ME. This inclusion in BCC’s Building Materials Distribution (“BMD”) segment will enhance and expand its product offering to its customer base in the Northeast.

Furthermore, on May 9, 2023, the company’s BMD segment acquired a five-acre site in Birmingham, AL. This acquisition will assist the company in fulfilling the growing demand for its engineered wood products along with specialty building products and commodities.

Impressive Earnings Surprise History: Boise Cascade showcases an impressive earnings surprise history. The company reported an earnings beat in 18 of the trailing 21 quarters, thus solidifying its growth trends. Furthermore, in third-quarter 2023, earnings topped the Zacks Consensus Estimate by 3.2%. The company also delivered a trailing four-quarter earnings surprise of 20.31%, on average.

Key Picks

Here are some better-ranked stocks from the same sector.

EMCOR Group, Inc. EME presently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

It has a trailing four-quarter earnings surprise of 25%, on average. Shares of EME have increased 47.4% in the past year. The Zacks Consensus Estimate for EME’s 2023 sales and earnings per share (EPS) indicates an improvement of 12% and 52.8%, respectively, from the prior-year levels.

M-tron Industries, Inc. MPTI currently sports a Zacks Rank of 1. MPTI delivered a trailing four-quarter earnings surprise of 35.6%, on average. It has surged 219.8% in the past year.

The Zacks Consensus Estimate for MPTI’s 2023 sales and EPS indicates growth of 30.6% and 156.7%, respectively, from the previous year.

Willdan Group, Inc. WLDN currently sports a Zacks Rank of 1. WLDN delivered a trailing four-quarter earnings surprise of a whopping 850.6%, on average. The stock has gained 13.5% in the past year.

The Zacks Consensus Estimate for WLDN’s 2023 sales and EPS indicates growth of 14.1% and 47.7%, respectively, from a year ago.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

EMCOR Group, Inc. (EME) : Free Stock Analysis Report

Willdan Group, Inc. (WLDN) : Free Stock Analysis Report

Boise Cascade, L.L.C. (BCC) : Free Stock Analysis Report

M-tron Industries, Inc. (MPTI) : Free Stock Analysis Report