Boise Cascade (BCC) to Report Q2 Earnings: What's in Store?

Boise Cascade Company BCC is scheduled to report second-quarter 2023 results on Jul 31, after market close.

In the last reported quarter, the company’s earnings and sales topped the Zacks Consensus Estimate by 34.3% and 7.8%, respectively. However, the bottom and the top lines declined 68.1% and 34% year over year.

Boise Cascade’s earnings topped the consensus mark in three of the last four quarters and missed on one occasion, the average surprise being 19%.

Trend in Estimate Revision

The Zacks Consensus Estimate for second-quarter 2023 earnings per share has increased to $2.54 from $2.26 over the past 30 days. The estimated figure indicates a 53.7% decline from the prior year quarter’s reported value.

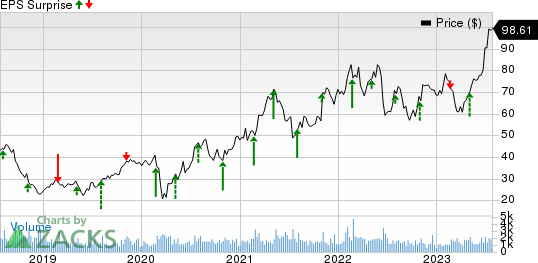

Boise Cascade, L.L.C. Price and EPS Surprise

Boise Cascade, L.L.C. price-eps-surprise | Boise Cascade, L.L.C. Quote

For sales, the consensus mark is pegged at $1.62 billion, suggesting a decline of 28.7% from the prior-year quarter’s reported figure.

Key Factors to Consider

The demand for Boise Cascade’s products is dependent on new residential construction, residential repair-and-remodeling activity and light commercial construction. Hence, the U.S. housing market softness, given the increased mortgage rates and economic uncertainties, is quite likely to have put pressure on Boise Cascade’s second-quarter 2023 results on a year-over-year basis. Meanwhile, favorable backdrop for repair and remodel (R&R) activities, owing to the age of U.S. housing stock and elevated levels of homeowner equity, are expected to have partly offset the above-mentioned headwinds. However, moderation of renovation spending and economic uncertainty are likely to remain causes of concerns.

Lower sales volume, due to a decline in housing starts, along with lower prices, are quite likely to have resulted in the dismal year-over-year performance of the Building Materials Distribution (BMD) segment (which accounted 89.3% for first-quarter 2023 total sales).

Also, lower plywood sales prices and lower engineered wood products or EWP sales volumes are expected to have impacted the company’s Wood segment. Yet, lower OSB and lumber costs are likely to partly offset the negatives.

Despite tough comparison on a year-over-year basis, the company is expected to witness sequential sales growth, given the improving housing market trend.

Furthermore, the company’s organic growth initiatives for its BMD segment, strategic growth investments in the operating segments, accretive buyouts and EWP capacity expansion are likely to have offset the aforementioned risks to some extent.

Meanwhile, Boise Cascade’s margins are likely to have been affected by the ongoing inflationary pressures, lower commodity products margins and lower sales volumes across product lines. Also, per unit conversion costs and wage inflation have been concerns for the company’s bottom line. Despite these headwinds, BCC is expected to witness sequential earnings growth backed by reduced selling and distribution expenses, lower freight costs and other related operating costs.

What the Zacks Model Unveils

Our proven model conclusively predicts an earnings beat for Boise Cascade for the quarter to be reported. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. This is exactly the case here, as you will see below.

Earnings ESP: BCC has an Earnings ESP of +2.36%. You can uncover the best stocks before they’re reported with our Earnings ESP Filter.

Zacks Rank: The company currently sports a Zacks Rank of 1.

Other Stocks With Favorable Combination

Here are some other companies in the Zacks Construction sector, which according to our model, also have the right combination of elements to post an earnings beat for their respective quarters to be reported.

Trex Company, Inc. TREX has an Earnings ESP of +3.28% and a Zacks Rank of 2. You can see the complete list of today’s Zacks #1 Rank stocks here.

TREX is expected to register a 31.7% decrease in earnings for the to-be-reported quarter. Notably, the company reported better-than-expected earnings in three of the last four quarters and missed on one occasion, the average surprise being 7.3%.

AECOM ACM has an Earnings ESP of +1.05% and a Zacks Rank of 2.

ACM’s earnings for the to-be-reported quarter are expected to increase 10.5%. The company reported better-than-expected earnings the trailing four quarters, the average surprise being 4.8%.

Meritage Homes Corporation MTH has an Earnings ESP of +0.98% and a Zacks Rank of 2.

MTH’s earnings for the to-be-reported quarter are expected to decline 48.5%. The company reported better-than-expected earnings in the last four quarters, the average surprise being 17.3%.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

AECOM (ACM) : Free Stock Analysis Report

Meritage Homes Corporation (MTH) : Free Stock Analysis Report

Trex Company, Inc. (TREX) : Free Stock Analysis Report

Boise Cascade, L.L.C. (BCC) : Free Stock Analysis Report