Boise Cascade Co: A Strong Contender in the Building Materials Industry with a GF Score of 86

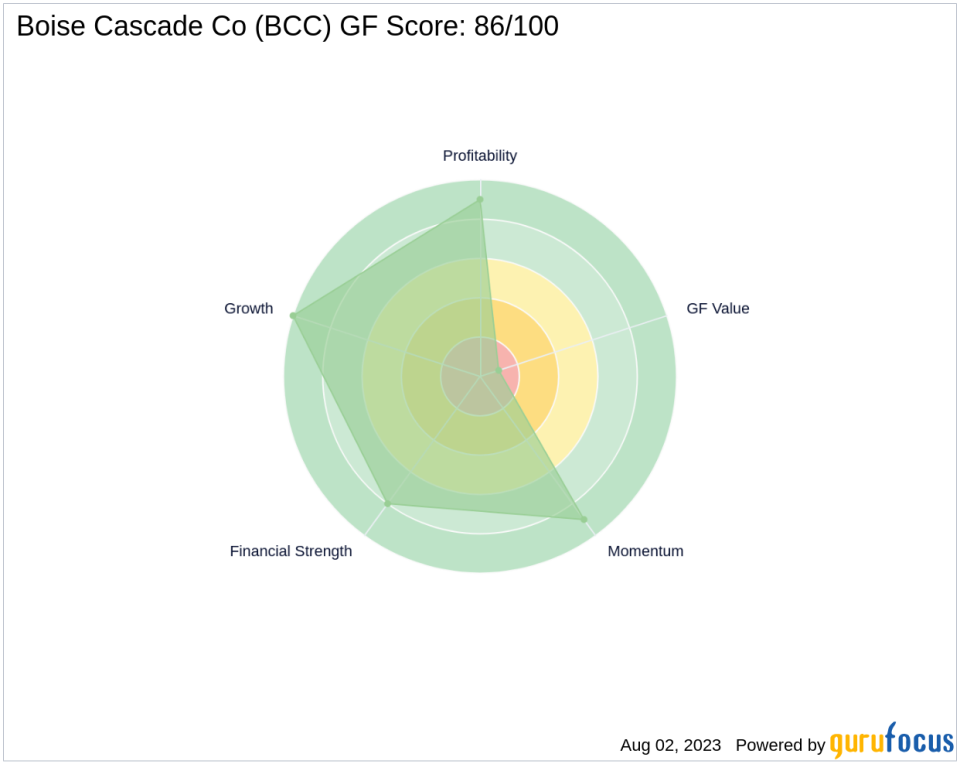

Boise Cascade Co (NYSE:BCC), a prominent player in the Building Materials industry, is currently trading at $109.98 with a market cap of $4.35 billion. The stock has seen a gain of 3.01% today and a significant increase of 23.15% over the past four weeks. According to GuruFocus, BCC has a GF Score of 86 out of 100, indicating good outperformance potential. The GF Score is a comprehensive ranking system that evaluates a company's financial strength, profitability, growth, value, and momentum, providing investors with a holistic view of the company's performance.

Financial Strength Analysis

Boise Cascade Co has a Financial Strength Rank of 8/10, indicating a robust financial situation. The company's interest coverage is 30.25, suggesting it can comfortably meet its interest obligations. Furthermore, its debt to revenue ratio is a low 0.07, and its Altman Z score is 6.03, both of which further underscore its financial stability.

Profitability Rank Analysis

The company's Profitability Rank is 9/10, reflecting its high profitability. Its Operating Margin is 10.82%, and its Piotroski F-Score is 6 out of 9, indicating a healthy financial situation. The company has also demonstrated consistent profitability over the past 10 years and has a Predictability Rank of 3 stars out of 5.

Growth Rank Analysis

Boise Cascade Co has a perfect Growth Rank of 10/10, reflecting its strong growth potential. The company's 5-year revenue growth rate is 14.10%, and its 3-year revenue growth rate is 21.20%. Additionally, its 5-year EBITDA growth rate is an impressive 50.20%, indicating robust operational growth.

GF Value Rank Analysis

The company's GF Value Rank is 1/10, suggesting that the stock is significantly overvalued. This rank is determined by the price-to-GF-Value ratio, a proprietary metric calculated based on historical multiples and an adjustment factor based on a company's past returns and growth.

Momentum Rank Analysis

Boise Cascade Co has a Momentum Rank of 9/10, indicating strong momentum in its stock price. This rank is determined using the standardized momentum ratio and other momentum indicators.

Competitor Analysis

When compared to its competitors in the Building Materials industry, Boise Cascade Co holds a strong position. Summit Materials Inc (NYSE:SUM) has a GF Score of 71, Tecnoglass Inc (NYSE:TGLS) has a GF Score of 78, and United States Lime & Minerals Inc (NASDAQ:USLM) has a GF Score of 82. You can find more details about these competitors here.

Conclusion

In conclusion, Boise Cascade Co's overall GF Score of 86 suggests good outperformance potential. The company's strong financial strength, high profitability, robust growth, and strong momentum make it an attractive investment option. However, investors should be cautious of its current overvaluation. As always, potential investors should conduct their own thorough research before making investment decisions.

This article first appeared on GuruFocus.