BOK Financial Corp (BOKF) Announces Mixed Q4 Results Amid Economic Headwinds

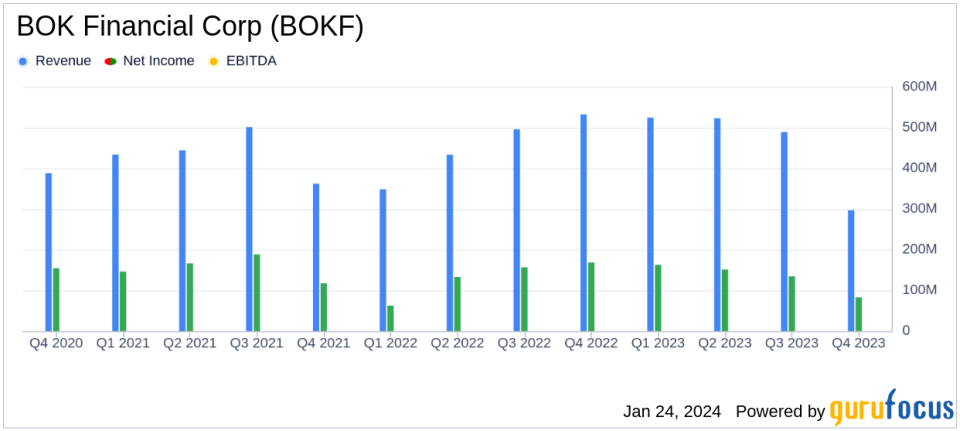

Annual Earnings: BOKF reported annual earnings of $531 million, or $8.02 per diluted share.

Quarterly Earnings: Quarterly earnings were $83 million, or $1.26 per diluted share, including a 52 cent per share reduction due to the FDIC special assessment.

Net Interest Revenue: Decreased by $4.2 million from the previous quarter to $296.7 million.

Operating Expense: Increased by $59.8 million to $384.1 million, largely due to the FDIC special assessment.

Loan Growth: Period-end loans grew by $181 million to $23.9 billion, driven by commercial loans and multifamily property loans.

Deposits: Period-end deposits increased by $367 million to $34.0 billion.

Capital Ratios: The company's common equity Tier 1 capital ratio remained stable at 12.06 percent.

On January 24, 2024, BOK Financial Corp (NASDAQ:BOKF) released its 8-K filing, revealing a complex fourth quarter influenced by several non-recurring items. BOKF, a leading financial institution headquartered in Oklahoma, operates across a diverse range of financial services including commercial and consumer banking, wealth management, and funds management. The company's commercial banking segment, which includes lending and treasury services, remains its primary revenue driver.

President and CEO Stacy Kymes commented on the resilience of BOKF's business model, which allowed the company to navigate economic stress and capitalize on growth opportunities, particularly in core commercial and industrial loans. Despite the challenges faced in the fourth quarter, Kymes highlighted the company's strong core results as a solid foundation for the upcoming year.

"Our disciplined risk management...resulted in strong levels of capital and liquidity at a critical time. We took advantage of this position to thoughtfully grow when others were pulling back," said Kymes.

Financial Performance and Challenges

BOKF's net income for the fourth quarter of 2023 was $82.6 million, or $1.26 per diluted share, compared to $134.5 million, or $2.04 per diluted share, for the third quarter of 2023. The decrease was partly due to a special FDIC assessment, which reduced earnings per share by 52 cents. Net interest revenue saw a slight decrease, attributed to deposit repricing activities and a shift in liability mix. The company's net interest margin also contracted slightly to 2.64 percent.

Operating expenses rose significantly, driven by increases in personnel costs and the aforementioned FDIC special assessment. However, BOKF also reported a $31.0 million pre-tax gain from the sale of its insurance brokerage and consulting business, BOKF Insurance, which contributed positively to the quarter's results.

Loan growth remained a highlight, with period-end loans increasing to $23.9 billion, supported by commercial and multifamily property loans. Deposits also grew, reflecting the company's ability to attract and retain customer funds. Despite these positive aspects, the company faced headwinds such as losses on available for sale securities and an increased effective tax rate due to the acceleration of tax expense from exiting certain investments.

Analysis of Key Financial Metrics

Key financial metrics for BOKF include a stable loan to deposit ratio of 70 percent and a tangible common equity ratio of 8.29 percent, which reflects the company's strong capital position. The common equity Tier 1 capital ratio remained unchanged at 12.06 percent, indicating a robust capital buffer.

Looking ahead, BOKF's strategic positioning and diversified business model suggest resilience in the face of economic uncertainty. The company's focus on disciplined risk management and capital strength positions it to continue its growth trajectory and navigate potential market fluctuations.

Value investors may find BOKF's commitment to shareholder value and its ability to leverage a strong capital position for thoughtful growth particularly appealing. The company's performance, despite the challenges presented in the fourth quarter, demonstrates its potential for sustained profitability and stability.

For a more detailed analysis of BOK Financial Corp's earnings and to stay updated on the company's performance, visit GuruFocus.com.

Explore the complete 8-K earnings release (here) from BOK Financial Corp for further details.

This article first appeared on GuruFocus.