Booking Holdings (BKNG) Q2 Earnings Beat, Revenues Rise Y/Y

Booking Holdings Inc. BKNG reported non-GAAP earnings of $37.62 per share for second-quarter 2023, beating the Zacks Consensus Estimate by 30.4%. The figure jumped 97% from the year-ago quarter.

Revenues of $5.5 billion surpassed the Zacks Consensus Estimate of $5.1 billion. The top line improved 27% year over year on a reported basis and 28% on a constant-currency (cc) basis.

Improving travel demand and booking trends from the year-ago quarter were tailwinds.

Booking Holdings witnessed growth of 24% in rental cars on a year-over-year basis and 58.3% year-over-year growth in the airline tickets unit in the reported quarter.

Booked room night numbers, amounting to 268 million in the second quarter, surged 8.8% from the prior-year quarter’s level.

The company witnessed strong growth across its agency, merchant and advertising and other businesses in the reported quarter.

The company has gained 41% in the year-to-date period, outperforming the industry’s growth of 36.2%.

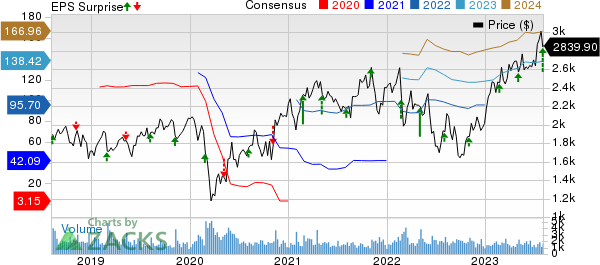

Booking Holdings Inc. Price, Consensus and EPS Surprise

Booking Holdings Inc. price-consensus-eps-surprise-chart | Booking Holdings Inc. Quote

Top Line in Detail

Agency revenues were $2.43 billion (44.5% of total revenues), up 5.6% year over year.

Merchant revenues were $2.77 billion (50.7% of total revenues), up 58.4% on a year-over-year basis.

Advertising & Other revenues were $263 million (4.8% of total revenues), which increased by 7.8% from the year-ago quarter.

Bookings

Booking Holdings’ overall gross bookings totaled $39.7 billion, which increased by 15% on a reported basis and 16% on a cc basis from the year-ago quarter’s respective readings.

Total gross bookings surpassed the Zacks Consensus Estimate of $38.5 billion.

Merchant bookings were $21.12 billion, up 39.9% from the prior-year quarter’s level. The figure topped the consensus mark of $18.7 billion.

Agency bookings were $18.6 billion, down 4.5% from the prior-year quarter’s level. The figure came below the consensus mark of $19.8 billion.

Operating Results

Adjusted EBITDA in the reported quarter was $1.8 billion, which improved 64% year over year.

Adjusted EBITDA margin was 32.6%, which expanded 730 basis points (bps) from the prior-year quarter’s level.

Per management, operating expenses were $3.8 billion, up 15% on a year-over-year basis. As a percentage of revenues, the figure contracted 730 bps from the year-ago quarter’s figure.

Booking Holdings generated an operating margin of 30.6%, which expanded 730 bps year over year.

Balance Sheet

As of Jun 30, 2023, cash and cash equivalents were $14.6 billion, up from $14.1 billion as of Mar 31, 2023. Short-term investments were $640 million, up from $359 million at the end of the previous quarter.

Account receivables amounted to $2.8 billion in the reported quarter compared with $2.05 billion in the prior quarter.

At the end of the second quarter, Booking Holdings had $13.2 billion of long-term debt, up from $11.3 billion at the end of the first quarter.

Zacks Rank & Stocks to Consider

Currently, Booking Holdings carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the retail-wholesale sector are BJ’s Restaurants BJRI, Domino’s Pizza DPZ and Lithia Motors LAD. While BJ’s Restaurants and Domino’s Pizza sport a Zacks Rank #1 (Strong Buy), Lithia Motors carries a Zacks Rank #2 (Buy).

You can see the complete list of today’s Zacks #1 Rank stocks here.

BJ’s Restaurants has gained 37.3% on a year-to-date basis. The long-term earnings growth rate for BJRI is currently projected at 15%.

Domino’s Pizza has gained 15.9% on a year-to-date basis. The long-term earnings growth rate for DPZ is currently projected at 12.97%.

Lithia Motors has gained 47.6% on a year-to-date basis. The long-term earnings growth rate for LAD is currently projected at 3%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

BJ's Restaurants, Inc. (BJRI) : Free Stock Analysis Report

Domino's Pizza Inc (DPZ) : Free Stock Analysis Report

Lithia Motors, Inc. (LAD) : Free Stock Analysis Report

Booking Holdings Inc. (BKNG) : Free Stock Analysis Report