Booking Holdings Inc (BKNG) Reports Mixed 2023 Results and Initiates Dividend

Gross Travel Bookings: Increased by 24% year-over-year to $150.6 billion for the full year 2023.

Room Nights Booked: Grew by 17% for the full year, surpassing 1 billion room nights.

Total Revenues: Rose by 25% to $21.4 billion for the full year 2023.

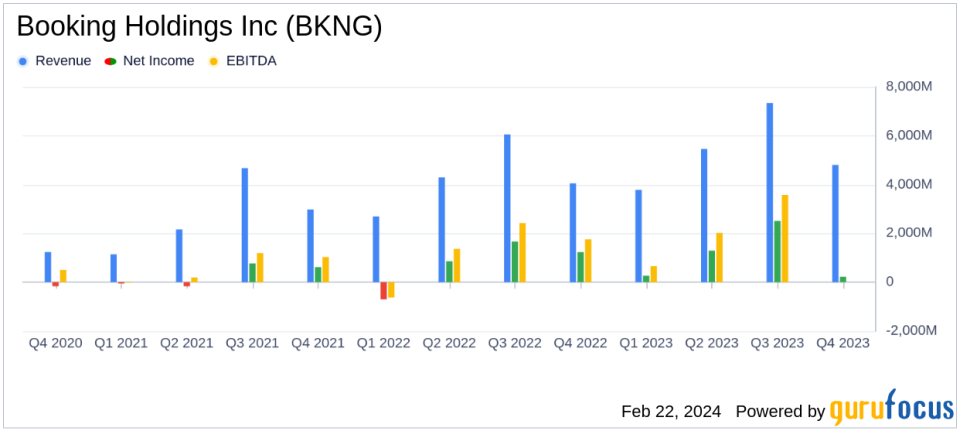

Net Income: Decreased by 82% to $222 million in Q4; however, full-year net income increased by 40% to $4.3 billion.

Adjusted EBITDA: Increased by 34% to $7.1 billion for the full year 2023.

Dividend Announcement: BKNG initiates a quarterly cash dividend of $8.75 per share.

This Powerful Chart Made Peter Lynch 29% A Year For 13 Years

How to calculate the intrinsic value of a stock?

On February 22, 2024, Booking Holdings Inc (NASDAQ:BKNG) released its 8-K filing, detailing its financial performance for the fourth quarter and full year of 2023. The world's largest online travel agency by sales, which operates popular brands such as Booking.com, Agoda, and OpenTable, reported a significant increase in gross travel bookings and room nights booked, indicating a robust demand for travel services. However, the company faced a sharp decline in net income for the fourth quarter, primarily due to losses related to the Netherlands pension fund matter and a draft decision by the Spanish competition authority.

Financial Highlights and Challenges

Booking Holdings Inc (NASDAQ:BKNG) achieved a milestone with over 1 billion room nights booked in 2023, reflecting the strong recovery in the travel industry. The company's total revenues for the year increased by 25% to $21.4 billion, driven by a 24% increase in gross travel bookings to $150.6 billion. Adjusted EBITDA also saw a healthy growth of 34%, reaching $7.1 billion. However, the fourth quarter net income plummeted by 82% to $222 million, with a decrease in net income per diluted common share by 80% to $6.28. This decline was attributed to specific non-recurring losses that were excluded from non-GAAP net income and Adjusted EBITDA.

Importance of Financial Achievements

The travel and leisure industry, which is highly competitive and sensitive to economic fluctuations, benefits from the financial resilience demonstrated by Booking Holdings Inc (NASDAQ:BKNG). The company's ability to generate increased revenue and adjusted EBITDA is crucial for sustaining investments in technology and marketing, which are vital for maintaining its market-leading position. The initiation of a quarterly dividend also signals confidence in the company's cash flow generation and long-term financial health, making it an attractive proposition for value investors.

Key Financial Metrics

Booking Holdings Inc (NASDAQ:BKNG) reported several key financial metrics that are important for evaluating the company's performance:

"We are pleased to report a strong close to 2023 with fourth quarter room nights growing 9% year-over-year or 11% when excluding business associated with Israel, which was significantly impacted by the war. For the full year, we reached a significant milestone with over 1 billion room nights booked on our platforms, and we achieved record levels of gross bookings, revenue, and operating income," said Glenn Fogel, Chief Executive Officer of Booking Holdings.

These metrics, including room nights booked, gross travel bookings, and adjusted EBITDA, are critical indicators of the company's operational efficiency and market penetration. The growth in these areas suggests that Booking Holdings Inc (NASDAQ:BKNG) is effectively capitalizing on the rebound in travel demand post-pandemic.

Analysis of Performance

While Booking Holdings Inc (NASDAQ:BKNG) has shown impressive growth in key areas, the significant decrease in net income for the fourth quarter raises concerns. The losses related to legal and regulatory matters highlight the potential risks associated with international operations. However, the company's robust full-year performance, including a substantial increase in net income and the initiation of a dividend, suggests a strong underlying business capable of weathering short-term challenges.

Booking Holdings Inc (NASDAQ:BKNG) remains a dominant player in the online travel industry, with a diverse portfolio of brands and a global presence. As the company continues to navigate the complexities of the travel market and regulatory environment, its financial agility and strategic initiatives will be key to sustaining growth and delivering value to shareholders.

For more detailed financial information and the full earnings report, please refer to the 8-K filing.

Explore the complete 8-K earnings release (here) from Booking Holdings Inc for further details.

This article first appeared on GuruFocus.