Boot Barn (BOOT) Q2 Earnings Beat Estimates, Decline Y/Y

Boot Barn Holdings, Inc. BOOT posted second-quarter fiscal 2024 results, wherein earnings beat the Zacks Consensus Estimate, while revenues missed the same. Although the top line rose year over year, the bottom line declined.

The company's fiscal second-quarter results demonstrated merchandise margin expansion and earnings achievement. BOOT opened 10 stores in the quarter and remains optimistic about the performance of new stores across the country.

Exclusive brand penetration increased more than 600 basis points, underscoring the strong consumer appeal for the company's brands. Despite the decline in retail store same-store sales, average store sales volumes remained notably high. The quarter witnessed a sequential decline in same-store sales, attributed to a soft consumer demand. Nevertheless, the company is well-prepared with its inventory levels and expense structure as it enters the holiday season.

Boot Barn Holdings, Inc. Price, Consensus and EPS Surprise

Boot Barn Holdings, Inc. price-consensus-eps-surprise-chart | Boot Barn Holdings, Inc. Quote

Q2 in Detail

Boot Barn Holdings’ earnings of 91 cents a share decreased from the $1.06 per share reported in the year-ago quarter. However, the metric beat the Zacks Consensus Estimate of 88 cents.

Revenues of $374.5 million increased 6.5% year over year but missed the Zacks Consensus Estimate of $378 million. The rise in net sales was primarily driven by incremental sales generated from newly opened stores in the last year, although this growth was somewhat tempered by the decline in consolidated same-store sales. Consolidated same-store sales witnessed a 4.8% decrease, with retail store same-store sales declining 3.8% and e-commerce same-store sales dropping 11.7%.

The Zacks Consensus Estimate for same-store sales was a decline of 3.4% year over year.

Gross profit of $133.9 million increased from the $129.1 million reported in the year-ago quarter. The rise in gross profit can be primarily attributed to increased sales. The gross margin came in at 35.8%, down 90 basis points (bps) from the year-ago quarter.

However, the decrease in the gross margin was primarily influenced by a 140-bps deleverage in buying, occupancy, and distribution center costs. This deleverage was primarily due to the impacts of occupancy costs associated with 50 new stores and operating costs related to the new Kansas City distribution center. These were partly mitigated by a 50-bps expansion in the merchandise margin rate.

Selling, general and administrative expenses increased to $95.3 million from the $84.9 million reported in the prior-year quarter. As a percentage of revenues, the metric was 25.5%, up 130 bps year over year mainly due to the higher store payroll and store-related expenses.

Income from operations declined from $44.2 million in the second quarter of fiscal 2023 to $38.6 million in the quarter under review. The operating margin was 10.3% compared with the 12.6% reported in the year-ago quarter.

Image Source: Zacks Investment Research

Other Financial Details

Boot Barn Holdings ended the quarter with cash and cash equivalents of $38.7 million. Notably, the company had not drawn any funds from its $250-million revolving credit facility. Management anticipates capital expenditure between $95 million and $105 million.

Guidance

For the third quarter of fiscal 2024, the company estimates net sales of $522-$535 million, indicating year-over-year growth of 1.4-4%.

It also expects a decline in same-store sales of 8-10.5%, with retail store same-store sales expected to decrease 7-9.5% and e-commerce same-store sales declining 12.5-15.5%. Gross profit is projected to be $197.8-$204.2 million.

In fiscal 2024, the company anticipates opening 52 stores. It now expects total revenues between $1.677 billion and $1.702 billion for the fiscal year, indicating year-over-year growth of 1.2-2.7%.

The company also expects a decline in same-store sales of 5% to 6.5%%, with retail store same-store sales expected to decrease 4-5.5% and e-commerce same-store sales declining 11-13%.

Gross profit is projected to be in the band of $618.5-$630.7 million. Selling, general and administrative expenses are estimated to be in the range of $419.6-$420.8 million. Earnings are projected to be $4.75-$5.00 per share.

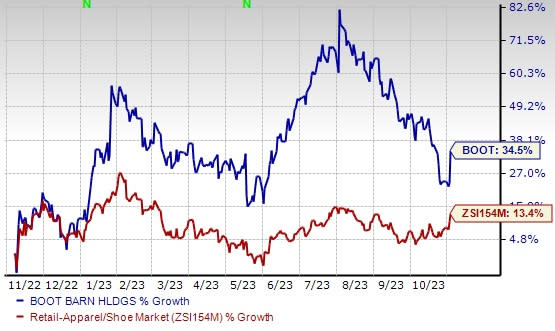

In the past one year, shares of this Zacks Rank #3 (Hold) company have rallied 34.5% against the industry’s growth of 13.4%.

3 Promising Stocks

A few better-ranked stocks in the same space are Deckers Outdoor Corporation DECK, American Eagle Outfitters Inc. AEO and Abercrombie & Fitch Co. ANF.

Deckers Outdoor is a leading designer, producer and brand manager of innovative, niche footwear and accessories. The company sports a Zacks Rank #1 (Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Deckers Outdoors’ current fiscal-year earnings and sales indicates growth of 20.2% and 11.1% from the year-ago period’s reported figures. DECK has a trailing four-quarter average earnings surprise of 26.3%.

American Eagle is a specialty retailer of casual apparel, accessories and footwear. It sports a Zacks Rank #1 at present.

The Zacks Consensus Estimate for American Eagle’s current fiscal-year earnings and sales indicates growth of 35.1% and 2.3% from the year-ago period’s reported figures. AEO has a trailing four-quarter average earnings surprise of 43.2%.

Abercrombie & Fitch is a specialty retailer of premium, high-quality casual apparel. The company currently has a Zacks Rank #2 (Buy). ANF delivered a significant earnings surprise in the last reported quarter.

The Zacks Consensus Estimate for Abercrombie & Fitch’s current fiscal-year sales implies growth of 10.1% from the previous year’s reported number. ANF has a trailing four-quarter average earnings surprise of 724.8%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Abercrombie & Fitch Company (ANF) : Free Stock Analysis Report

American Eagle Outfitters, Inc. (AEO) : Free Stock Analysis Report

Deckers Outdoor Corporation (DECK) : Free Stock Analysis Report

Boot Barn Holdings, Inc. (BOOT) : Free Stock Analysis Report