Boot Barn Holdings (BOOT) to Post Q2 Results: A Peek Into Comps

Market watchers are eagerly awaiting Boot Barn Holdings, Inc.’s BOOT second-quarter fiscal 2024 earnings results, scheduled to be reported on Nov 2 before market open. This time too, investors’ focus will center around comparable store sales, the key metric to gauge the company’s performance.

Insights Into Comparable Sales

Before delving into the second quarter, let's revisit the first quarter.

In the first quarter, Boot Barn Holdings reported a 2.9% decline in consolidated same-store sales. This decline was a result of a 1.8% decrease in retail store same-store sales and a more substantial 10.8% drop in e-commerce same-store sales.

While the numbers may seem challenging at first glance, the company noted a sequential improvement throughout the quarter in its retail store same-store sales. This improvement was driven by a rise in the average transactions per store, indicating that customers were returning to stores.

From a merchandise category perspective, several categories demonstrated a sequential improvement in the first quarter. Men's western boots and apparel achieved low-single-digit positive comps. Even categories that experienced declines, such as ladies' boots and apparel, showed a sequential improvement from the year-end despite cycling strong double-digit comps.

Boot Barn Holdings has been successfully navigating through the challenging environment, courtesy of merchandising strategies, omnichannel capabilities and better expense management. This, combined with the expansion of the store base and exclusive brand penetration, has helped it gain market share and, in turn, revenues.

In response to the decline in e-commerce operations, Boot Barn Holdings is proactively optimizing its strategies. Through the implementation of AI-driven solutions, the company aims to enhance customer experiences, foster brand loyalty and sustain sales growth in a challenging environment.

For the second quarter, Boot Barn Holdings guided total sales at the high end of the guidance range of $372 million-$379 million. However, same-store sales are anticipated to decline in the band of 3.5%-5.5%. Within this projection, retail store same-store sales are anticipated to decline in the range of 2.5% to 4.5%, while e-commerce same-store sales are set to decrease between 9% and 11%.

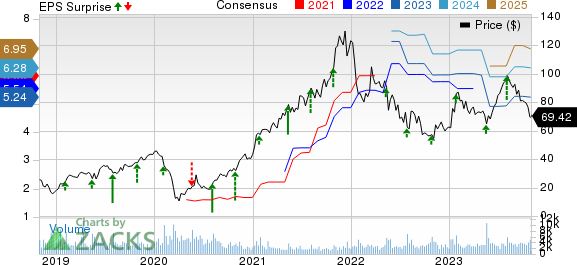

Boot Barn Holdings, Inc. Price, Consensus and EPS Surprise

Boot Barn Holdings, Inc. price-consensus-eps-surprise-chart | Boot Barn Holdings, Inc. Quote

How Are Estimates Shaping Up?

The Zacks Consensus Estimate for its quarterly revenues is pegged at $376.2 million, indicating an improvement of 7% from the year-ago figure. The consensus mark for earnings per share is pegged at 88 cents. This figure signals a 17% decline from the year-ago period.

Our proven model doesn’t conclusively predict an earnings beat for Boot Barn Holdings this time. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. However, that’s not the case here.

Although Boot Barn Holdings currently has a Zacks Rank #3, its Earnings ESP of -1.95% makes the surprise prediction difficult. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Stocks Poised to Beat Earnings Estimates

Here are some companies worth considering as our model shows that these have the right combination of elements to beat on earnings this season:

Build-A-Bear Workshop BBW currently has an Earnings ESP of +0.66% and carries a Zacks Rank #2. The Zacks Consensus Estimate for third-quarter fiscal 2023 earnings per share is pegged at 51 cents, flat year over year. You can see the complete list of today’s Zacks #1 Rank stocks here.

Build-A-Bear Workshop’s top line is expected to ascend year over year. The Zacks Consensus Estimate for quarterly revenues is pegged at $107.6 million, which indicates an increase of 3% from the figure reported in the prior-year quarter. BBW has a trailing four-quarter earnings surprise of 21.6%, on average.

Urban Outfitters URBN currently has an Earnings ESP of +0.69% and a Zacks Rank #3. The Zacks Consensus Estimate for third-quarter fiscal 2024 earnings per share is pegged at 80 cents, up from 40 cents reported in the year-ago period.

Urban Outfitters’ top line is expected to ascend year over year. The Zacks Consensus Estimate for quarterly revenues is pegged at $1.26 billion, which indicates an increase of 7.1% from the figure reported in the prior-year quarter. URBN has a trailing four-quarter earnings surprise of 19.2%, on average.

Ulta Beauty ULTA currently has an Earnings ESP of +2.19% and a Zacks Rank of 3. The company is likely to register a decrease in the bottom line when it reports third-quarter fiscal 2023 numbers. The Zacks Consensus Estimate for quarterly earnings per share of $4.98 suggests a decline of 6.7% from the year-ago reported number.

Ulta Beauty’s top line is expected to ascend year over year. The Zacks Consensus Estimate for quarterly revenues is pegged at $2.48 billion, which suggests an increase of 6.1% from the prior-year quarter. ULTA has a trailing four-quarter earnings surprise of 12.9%, on average.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Urban Outfitters, Inc. (URBN) : Free Stock Analysis Report

Ulta Beauty Inc. (ULTA) : Free Stock Analysis Report

Boot Barn Holdings, Inc. (BOOT) : Free Stock Analysis Report

Build-A-Bear Workshop, Inc. (BBW) : Free Stock Analysis Report