Booz Allen (BAH) Stock Up 2.2% Despite Q2 Earnings Miss

Booz Allen Hamilton Holding Corp. BAH reported mixed second-quarter fiscal 2024 results, with revenues beating the Zacks Consensus Estimate but earnings missing the same.

Quarterly adjusted earnings per share (EPS) of $1.29 missed the consensus estimate by 1.5% and fell 3.7% on a year-over-year basis.

Strong 2023 guidance might have impressed investors as the stock climbed 2.2% since the date of earnings release on Oct 27. BAH currently projects revenue growth in the range of 11-14% compared with the prior view of 7-11%. It expects adjusted EPS in the range of $4.95-$5.10 (prior view: $4.8-$4.95). The current Zacks Consensus Estimate of $5.04 is above the midpoint ($5.025) of this EPS guidance.

Revenues, Backlog & Headcount Increase Y/Y

Total revenues of $2.66 billion beat the Zacks Consensus Estimate by 2.6% and increased 16% on a year-over-year basis. Revenues, excluding billable expenses, were $3.7 billion, up 15.5% year over year.

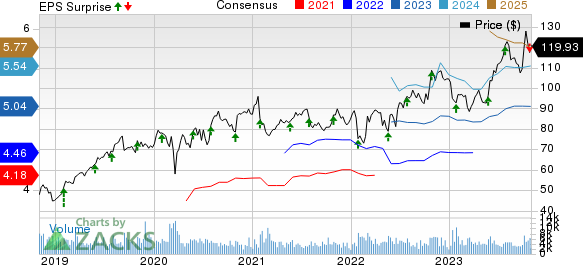

Booz Allen Hamilton Holding Corporation Price, Consensus and EPS Surprise

Booz Allen Hamilton Holding Corporation price-consensus-eps-surprise-chart | Booz Allen Hamilton Holding Corporation Quote

Total backlog increased by 10% from the prior-year figure to $35 billion. This surpassed our estimate of $33.3 billion. Funded backlog of $6.3 billion increased 14.5% year over year. Unfunded backlog declined 2.9% to $10.1 billion.

Priced options were up 16.4% to $18.6 billion. The book-to-bill ratio was 2.41, up from 2.40 a year ago. The headcount of 33,117 improved 10.3% year over year.

EBITDA Margins Rise

Adjusted EBITDA amounted to $290.6 million, up 1.6% year over year. It outshined our projection of $268.6 million. Adjusted EBITDA margin on revenue decreased to 10.9% from 12.4% in the prior year.

Key Balance Sheet & Cash Flow Numbers

Booz Allen exited the quarter with cash and cash equivalents of $557.3 million compared with $209.6 million at the prior-quarter end. Long-term debt (net of current portion) was $3.39 billion compared with $2.76 billion in the prior quarter.

The company used $47.4 million of net cash from operating activities. Capital expenditures were $16.9 million. Free cash flow was $64.3 million.

Fiscal 2024 Outlook

Adjusted EBITDA is now expected in the range of $1,115–$1,145 million compared with its prior view of $1,075 million and $1,105 million. Adjusted EBITDA margin on revenues is still anticipated in the 10-11% band. Net cash provided by operating activities is still projected in the range of $160-$260 million. The company continues to forecast the effective tax rate in the 23-25% band.

Booz Allen currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 (Strong Buy) Rank stocks here.

Recent Earnings Snapshots of Some Service Providers

The Interpublic Group of Companies, Inc. IPG posted third-quarter 2023 results, wherein both earnings and revenues missed the Zacks Consensus Estimate.

IPG’s adjusted earnings of 70 cents per share lagged the consensus estimate by 6.7%. The bottom line, however, climbed 11.1% on a year-over-year basis. Net revenues of $2.31 billion fell short of the consensus estimate by 3.3%. In the year-ago quarter, IPG’s net revenues were $2.3 billion. Total revenues of $2.68 billion increased 1.5% year over year.

Equifax Inc. EFX reported lower-than-expected third-quarter 2023 results. Adjusted earnings (excluding 45 cents from non-recurring items) were $1.76 per share, missing the Zacks Consensus Estimate by 1.1%. Yet, the metric rose 1.7% from a year ago.

EFX’s total revenues of $1.32 billion missed the consensus estimate by 0.7%. Nonetheless, the figure gained 6% from a year ago on a reported basis and 6.5% on a local-currency basis.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Interpublic Group of Companies, Inc. (The) (IPG) : Free Stock Analysis Report

Equifax, Inc. (EFX) : Free Stock Analysis Report

Booz Allen Hamilton Holding Corporation (BAH) : Free Stock Analysis Report